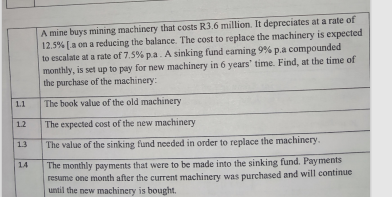

1.1 12 13 14 A mine buys mining machinery that costs R3.6 million. It depreciates at a rate of 12.5% [a on a reducing the balance. The cost to replace the machinery is expected to escalate at a rate of 7.5% pa. A sinking fund earning 9% p.a compounded monthly, is set up to pay for new machinery in 6 years' time. Find, at the time of the purchase of the machinery: The book value of the old machinery The expected cost of the new machinery The value of the sinking fund needed in order to replace the machinery. The monthly payments that were to be made into the sinking fund. Payments resume one month after the current machinery was purchased and will continue until the new machinery is bought.

1.1 12 13 14 A mine buys mining machinery that costs R3.6 million. It depreciates at a rate of 12.5% [a on a reducing the balance. The cost to replace the machinery is expected to escalate at a rate of 7.5% pa. A sinking fund earning 9% p.a compounded monthly, is set up to pay for new machinery in 6 years' time. Find, at the time of the purchase of the machinery: The book value of the old machinery The expected cost of the new machinery The value of the sinking fund needed in order to replace the machinery. The monthly payments that were to be made into the sinking fund. Payments resume one month after the current machinery was purchased and will continue until the new machinery is bought.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 14PROB

Related questions

Question

Answer only first two sub parts

1.1

1.2

Transcribed Image Text:1.1

1.2

1.3

14

A mine buys mining machinery that costs R3.6 million. It depreciates at a rate of

12.5% [a on a reducing the balance. The cost to replace the machinery is expected

to escalate at a rate of 7.5% p.a. A sinking fund earning 9% p.a compounded

monthly, is set up to pay for new machinery in 6 years' time. Find, at the time of

the purchase of the machinery:

The book value of the old machinery

The expected cost of the new machinery

The value of the sinking fund needed in order to replace the machinery.

The monthly payments that were to be made into the sinking fund. Payments

resume one month after the current machinery was purchased and will continue

until the new machinery is bought.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning