2021 2020 Service revenue $523,000 $476,000 385,500 Operating expenses Income tax expense 319,800 34,375 Net income _$ 103,125 $117,150 39,050

Q: The single largest cost item for universities is salaries/wages. The UUS university has asked you to…

A: Here discuss about the control over the reduction in the cost which are associated with the…

Q: wift, LLC purchased equipment (7-year property) for use in its business on October 15, 2021. This…

A: MACRS Depreciation To calculate the tax adjusted basis of the assets first to determine the cost of…

Q: The company has beginning inventory for the year of $50,000, during the year cost of goods sold was…

A: Cost of goods sold = Beginning inventory + Purchases - Ending inventory Purchases = Cost of goods…

Q: Balance per bank.... .$14,500 Balance per company records..... .13,875 Bank service charges.. 75…

A: Introduction: Bank Reconciliation statement: To reconcile the differences between bank book and cash…

Q: TM and SJ, having capital balances of P980,000 and P525,000 respectively, decided to admit GD into…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: a. If Canace Company, with a break-even point at $244,200 of sales, has actual sales of $370,000,…

A: Introduction: Margin of safety: Deduction of Break even sales from the current sales value Derives…

Q: 2010 May 1 Assets: Premises $2,000, Motor Van $450, Fixtures $600, Stock $1,289, debtors: N. Hardy…

A: Introduction:- The act of recording or keeping track of any financial or non-financial action is…

Q: List two circumstances in which obtaining capital allowances on the reducing balance basis is more…

A: Depreciation is the reducing value of an asset, If we buy something from the market or any fixed…

Q: Please prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon…

A: The bank reconciliation statement is prepared to adjust the balances of cash book and pass book with…

Q: On August 1, Rantoul Stores Inc. is considering leasing a building and purchasing the necessary…

A: Differential analysis is a decision-making approach that analyses the net effects of two…

Q: Repair Shop after one year of operation: 1. The the firs A trial balance and additional information…

A: The adjusting entries are the entries related to uncorded revenues expenses etc. These entries are…

Q: or the past quarter follow: Dirt Mountain Racing Bikes Total Bikes Bikes Sales.. Varlable…

A: The contribution margin can be stated on a gross or per-unit basis. It shows the additional money…

Q: United Apparel has the following balances in its stockholders' equity accounts on December 31, 2024:…

A: Total Paid in Capital = Common Stock + Preferred Stock + Additional Paid in Capital Total…

Q: n January 1, 2006, Naruto Company issued its 10% bonds in the face amount of P5,000,000, which…

A: Adjusted unamortized bond premium at year end = Total bond premium - amortized bond premium for the…

Q: On January 1, 2017, Naruto Company issued P4,000,000 face value bonds with a stated rate of 12% and…

A: In the given case bonds are issued at discount. Interest expense to be reported in 2017 will be the…

Q: 1. Acer Computer Services is owned by Pepito Manoloto. Prepare the Balance Sheet of the business.…

A: Since, basic accounting equation is Total assets = Total liabilities + owners equity

Q: 3.3 Cost of Goods Sold Budget Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter…

A: Cost of goods sold means the cost of goods which has been sold out and exclude the cost of ending…

Q: Toole Corporation uses a job order costing system and allocates manufacturing overhead at a rate of…

A: Journal entries are recorded in the books of an entity so as to maintain a proper record of…

Q: Cost of Goods Sold Budget Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic…

A: Total budgeted manufacturing cost=Budgeted direct materials+Budgeted direct labor+Budgeted overhead

Q: Rodgers Company gathered the following reconciling information in preparing its May bank…

A: Introduction: Bank reconciliation statement: To Reconcile the difference between Bank book and cash…

Q: Accounts Payable $12,000 Buildings 70,000 Cash 8,000 Accounts Recelvable 7,000 Seles Tex Payable…

A: Introduction: Current Assets: The assets which can be easily converted in to cash with in 12 months…

Q: On January 1, 2023, Jones Corporation issued $2.982.000, 9%, 5-year bonds with interest payable on…

A: Interest expense on bonds is calculated at the market rate of interest on the issue value of the…

Q: Williams Company sells women’s hats for $12 each. Actual and budgeted sales in units for nine months…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: PV$1 PVA 10 6% 0.558395 7.360087 10 7% 0.508349 7.023582 20 3% 0.553676 14.87747 20 3.5% 0.502566…

A: Bonds- A bond is a fixed-income tool that represents a loan made by a shareholder to a borrower…

Q: Provide a comprehensive discussion on what constitute a legitimate agency shop agreement and close…

A: Here discuss about the details of the legitimate for agency shop agreement and the closed shop…

Q: not wish to commit to a renta d contribute $178,000 per mo , what is the net amount of C

A: The answer has been mentioned below.

Q: The following is a summary of information presented on the financial statements of a company on…

A: Horizontal analysis is the way to calculate the variance from the different year by year to show an…

Q: CALCULAT Cunningham Industries reported actual sales of $2,000,000, and fixed costs of $540,000. The…

A: Formula: Margin of safety in Dollars = Total sales - Break even sales. Deduction of break even sales…

Q: The total of the partners' capital accounts was P770,000 before the recognition of partnership asset…

A: Revaluation of asset means to re-value the worth of the assets as per market price of the same.

Q: Bergman Ltd has the following product information available: Sales price $12 per unit Variable…

A: Contribution margin per unit = $12 - $4 = $8

Q: Q.3.5 Complete the following table by filling in the missing amounts: (6) Mark-up on Cost Price…

A: Profit P is the difference between the cost to make a product CP and the selling price SP. (P = SP -…

Q: On October 1,2018, Bane Company entered into a 6-month, 5,200,000 purchase commitment for a supply…

A: Purchase commitment is the situation, when a buyer o a firm commit to buy from the particular…

Q: Monte's Coffee Company purchased packaging equipment on January 5, 2014, for $90,000. The equipment…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Bart Company purchased equipment on January 1, 2016, at a total cost of $400,000. The equipment has…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: open a Canine Calé where patrons can enjoy delicious baked goo ing the real estate listings, Merry…

A: The answer has been mentioned bwlow.A s

Q: Forever Ready Company expects to operate at 90% of productive capacity during July. The total…

A: Fixed factory overhead cost is irrelevant because it will not increase for additional 2,000…

Q: Ms. Gail Go created a trust in favour of her son, Wilson Go. He appointed Atty. Ramulo as a…

A: Here discuss about the details of the important of Trustee appointed by the Trust and its rights and…

Q: 14.24 David Jurman, Ltd., has received the following orders: Period 1 3 4 6. 10 40 30 40 8 9 Order…

A: The process of determining how much resource will be required to fulfill demand is referred to as…

Q: Cash $13,000; Short-term Debt $21,00o; Buildings and Equipment $420,000; Inventory, $44,000; Notes…

A: Introduction: Assets: The resource having economic value called as Assets. Assets are of two types 1…

Q: Direct Materials Purchases Budget: Direct Labor Budget Crescent Company produces stuffed toy…

A:

Q: A diesel-powered tractor with a cost of $249,520 and an estimated residual value of $7,600 is…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Larkspur Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone…

A: Journal entries are recorded in the books of a business so as to report all the transactions…

Q: Coller Company's most recent contribution format income shown below. Total Per Unit Sales (20,000…

A: Contribution Margin Income Statement if Selling Price Increase by P 1.50 per unit, Fixed Expenses…

Q: How does the length of the time horizon affect the classification of a cost as fixed or variable?…

A: Cost are being classified as variable and fixed normally. It is necessary to bifurcate the cost in…

Q: Cash Flows from Operating Activities-Direct Method The cash flows from operating activities are…

A: The cash flow statement (CFS) is a financial statement that shows how cash equivalents (CCE) enter…

Q: On January 1, 2006, Naruto Company issued its 9% bonds in face amount of P4,000,000, which mature on…

A: The bonds are issued at discount when market rate is higher than the coupon rate of bonds payable.

Q: On January 1, 2021, the start of the current financial year, Tubble Ltd had in issue 36 million…

A: Calculation of bonus shares issued: Existing no of shares = 36 million Bonus shares proportionate =…

Q: 1. a. A company with a MARR policy of 12% is trying to estimate the initial cost of a piece of…

A: MACRS (The Modified Accelerated Cost Recovery System) is depreciation system in US for calculation…

Q: Letecia Company leased an equipment from a lessor on January 1, 2020 under a lease with the…

A: Lease is a contract under which one party agrees to rent out the property to another party at a…

Q: In determining changes to a partner's outside basis, which of the following statements is false?…

A: Changing a partner's outside basis entails the following:- The partnership's stake in each…

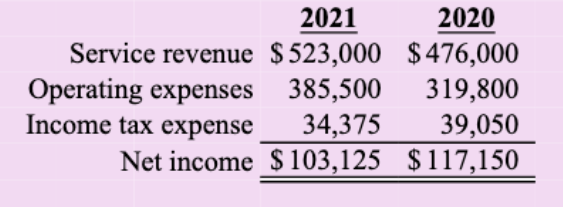

Here is the operating data for Yalis Cleaning, Inc.:

After analyzing the transactions, prepare a vertical analysis schedule for the company for 2021 and 2020 using service revenue as the base amount. Round percentages to two decimal places.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- 1. How much is the net share in the profit or loss of the associate (investment income) in 2021? P480,000 P825,000 P420,000 P135,000 2. How much is the carrying amount of the investment as of December 31, 2021? P7,815,000 P8,025,000 P7,680,000 P7,125,000How much is the total income tax expense recorded for the year ended December 31, 2019? a. P246,000 b. P270,000 c. P540,000 d. P786,000Compute the income tax due in 2021. A. 50,000B. 800,000C. 290,000D. 400,000

- What amount was recognized as actuarial gain on PBO during the year? 100 000 200 000 240 000 0 What is the benefit expense for 2019? 500 000 795 000 295 000 195 000Question The following are the balances extracted from the public Accounts on the consolidated fund from the year ended 31 December 2016. GHS000 Direct Tax 1044460 compensation of employee 808672 Goods and Services 404336 Non-financial Assets 134779 Indirect tax 939556 Grants 28110 Interest Expenses 398138 Social benefits 238882 Other Expenses 159255 Other revenue…Taxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 2022 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 6,000,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 1,000,000 Compute the corporate income tax should be paid in 2022?

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).The following table pertains to C. J. Company: Year Taxable Income Tax Rate 2020 ($1,000,000) 25% 2021 $680,000 25% 2022 $725,000 20% What is income tax expense for 2021? Select one: a. $136,000 b. $80,000 c. $170,000 d. $0

- NOPAT 8250000 EBITDA 17725000 Net Income 5050000 Capital Expenditures 6820000 After tax capital costs 6820000 Tax rate 40%Calculate the interest expense and EVATaxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 how much corporate income tax should paid in 2021? A. 275,000 B. 50,000 C. 25,000 D. 20,000 E. ZeroINCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…