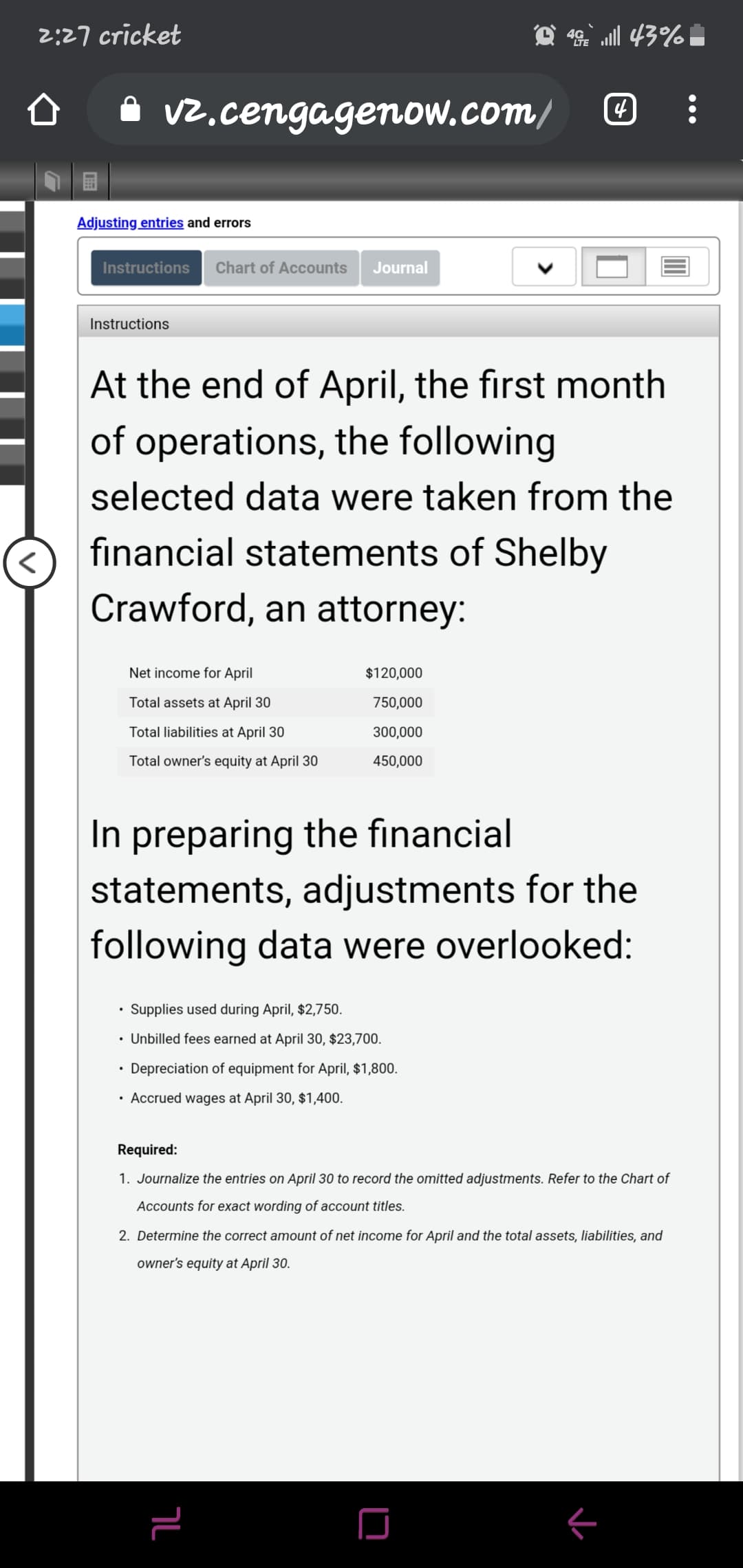

2:27 cricket • v2.cengagenow.com/ Adjusting entries and errors Instructions Chart of Accounts Journal Instructions At the end of April, the first month of operations, the following selected data were taken from the く financial statements of Shelby Crawford, an attorney: Net income for April $120,000 Total assets at April 30 750,000 Total liabilities at April 30 300,000 Total owner's equity at April 30 450,000 In preparing the financial statements, adjustments for the following data were overlooked: • Supplies used during April, $2,750. • Unbilled fees earned at April 30, $23,700. • Depreciation of equipment for April, $1,800. • Accrued wages at April 30, $1,400. Required: 1. Journalize the entries on April 30 to record the omitted adjustments. Refer to the Chart of Accounts for exact wording of account titles. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owner's equity at April 30. Lצ

2:27 cricket • v2.cengagenow.com/ Adjusting entries and errors Instructions Chart of Accounts Journal Instructions At the end of April, the first month of operations, the following selected data were taken from the く financial statements of Shelby Crawford, an attorney: Net income for April $120,000 Total assets at April 30 750,000 Total liabilities at April 30 300,000 Total owner's equity at April 30 450,000 In preparing the financial statements, adjustments for the following data were overlooked: • Supplies used during April, $2,750. • Unbilled fees earned at April 30, $23,700. • Depreciation of equipment for April, $1,800. • Accrued wages at April 30, $1,400. Required: 1. Journalize the entries on April 30 to record the omitted adjustments. Refer to the Chart of Accounts for exact wording of account titles. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owner's equity at April 30. Lצ

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.6APR: Adjusting entries and errors At the end of April, the first month of operations, the following...

Related questions

Question

Transcribed Image Text:2:27 cricket

• v2.cengagenow.com/

Adjusting entries and errors

Instructions Chart of Accounts

Journal

Instructions

At the end of April, the first month

of operations, the following

selected data were taken from the

く

financial statements of Shelby

Crawford, an attorney:

Net income for April

$120,000

Total assets at April 30

750,000

Total liabilities at April 30

300,000

Total owner's equity at April 30

450,000

In preparing the financial

statements, adjustments for the

following data were overlooked:

• Supplies used during April, $2,750.

• Unbilled fees earned at April 30, $23,700.

• Depreciation of equipment for April, $1,800.

• Accrued wages at April 30, $1,400.

Required:

1. Journalize the entries on April 30 to record the omitted adjustments. Refer to the Chart of

Accounts for exact wording of account titles.

2. Determine the correct amount of net income for April and the total assets, liabilities, and

owner's equity at April 30.

Lצ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning