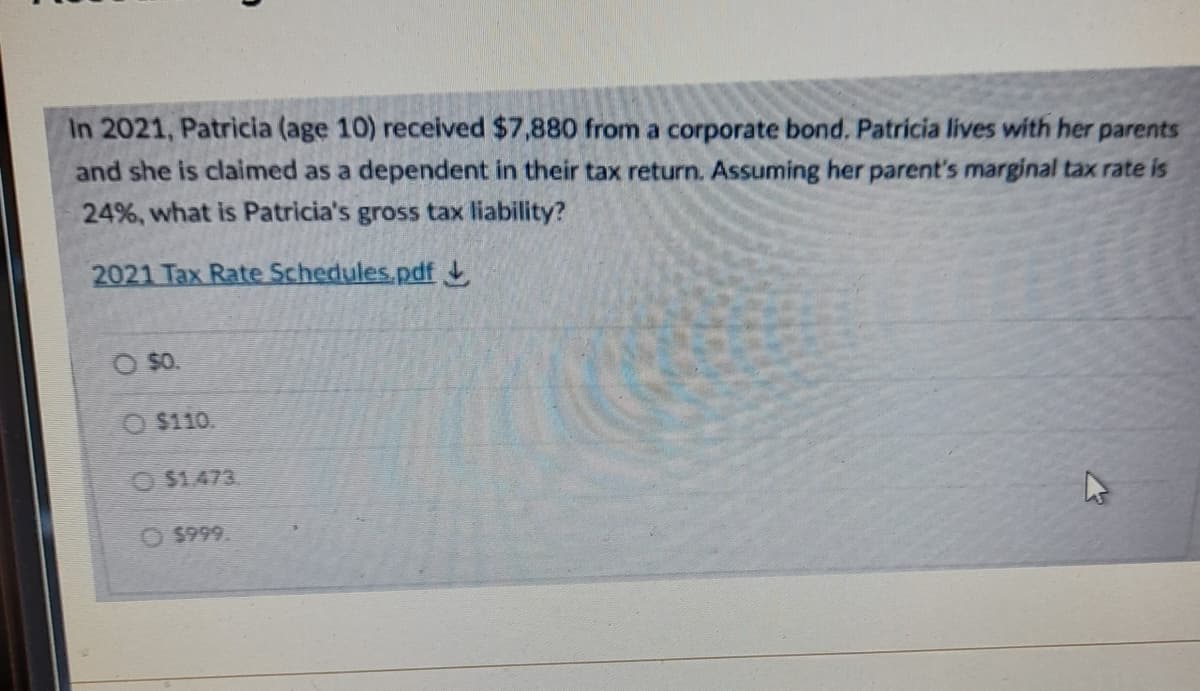

24%, what is Patricia's gross tax liabi

Q: What I can do Activity 2: Direction: Use given the ratio compute the Financial Ratio Analysis. The…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: XYZ Company's policy for the purchases of any asset over the value of $3,000 requires the purchasing…

A: Solution concept There are various internal control put in place by the organization for prevention…

Q: 5 Hello, can someone make a pay off metrix for this? The situation is that an athlete is following…

A: If the athlete chooses to use illegal substances to enhance performance ability, they lose their…

Q: Age Interval Est. Percentage Uncollectible Balance Not due $63,000 2% 1-30 days past due 7,100 31-60…

A: Formula: Estimated uncollectible amount = Balance amount x Estimated percentage Uncollectible

Q: Explain the Threat and Opportunity of Shareholder Activism ?

A: A shareholder activist is a person who is trying to exercise his or her rights as a shareholder in a…

Q: 4. On April 1, 2021, KAKAYANIN Company had 6,000 units of Work in Process in Department B, the…

A: In the context of the given question, firstly we should compute the statement of equivalents…

Q: 7. During March, a company's Department X equivalent unit product costs, computed under the weighted…

A: WIP inventory = Work-in-process inventory The question says that 4000 units are in WIP at March 31.…

Q: Unlimited Doors showed supplies available during the year of $1,700. A count of the supplies on hand…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: Cash balance per bank $4,500 Outstanding checks $200 Deposits in transit $1,000 Credit memo for…

A: Adjusted cash balance = cash balance as per bank - Outstanding checks + deposits in transit + credit…

Q: Pro Forma cash flow statement for a start up company (restaurant) Can you help with a layout of the…

A: Pro Forma Cash Flow Cash Received Cash from Operations Cash Sales xxx Subtotal Cash…

Q: ur Company makes a single product. Only one kind of direct material is used to make this product.…

A: The standard price is the expected price paid for material per unit . The Answer to the above…

Q: The following revenue data were taken from the December 31, 2017, Coca-Cola annual report (10-K):…

A: Intersegment Sales as a % of Total Sales=Intersegment salesTotal sales×100

Q: Under the fair value option for debt investment, entities report all changes in fair value in…

A: Lets understand the basics. Fair value option means a option in which change in fair value in debt…

Q: 10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending…

A: Payroll Payroll is considered to be important in the business which can be timely payment is…

Q: wOsking capít al foy all Yeaxs? Years? As Reported Annual Balance Sheet Report Date Scale 2019 2018…

A: Formula: Working capital = Current Assets - Current liabilities.

Q: Balance Est. Percentage Uncollectible Age Interval Not due $63,000 2% 1-30 days past due 7,100 5%…

A: Formula: Estimated Uncollectibe amount = Balance amount x Estimated Percentage Uncollectible

Q: Ferris Company began January with 8,000 units of its principal product. The cost of each unit is $7.…

A: This question deals with the calculation of inventory and COGS using LIFO basis. In last in first…

Q: Marley's Manufacturing Income Statement Month Ending August 31, 2018 Dept. A Dept. B Sales $22,000…

A: Operating Income in dollars and Operating Income in percentage Sales…

Q: Covariance and Correlation The following table shows the expected returns from six different stocks…

A: Expected Return of each stock. Stock A = (Weight1 * Return1) + Weight 2 * Return 2) + ( Weight3 *…

Q: Bloomington Inc. exchanged land for equipment and $2,600 in cash. The book value and the fair value…

A: There are transactions that companies make between each other to exchange assets. The exchange can…

Q: Valdez Motors Co. makes motorcycles. Management wants to estimate overhead costs to plan its…

A: Lets understand the basics. High low method is used to separate fixed cost and variable cost.…

Q: Give me a formula of sensitivity analysis under of cost volume profit analysis(CVP). Thank youuu:)

A: The sensitivity analysis of the CVP model demonstrates how the model will change when any of its…

Q: An accrual income statement for 2021 reveals: a. Profit from crops and livestock produced in…

A: Income statement refers to one of the statement which states the financial position of the business…

Q: On January 1, 2021, Hosana Co. sold equipment in exchange for a P 850,000, 4 year, 11% note,…

A: Lets understand the basics. Compounded interest means interest on interest. In other words, it is a…

Q: 6. LABAN LANG Company adds materials at the beginning of the process in the AAA Department, which is…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Which of the following is a characteristic of managerial accounting?a. There is an internal focus.b.…

A: Managerial accounting (often referred to as cost accounting or management accounting) seems to be a…

Q: Why is preparation of the government-wide statements considered to be "challenging"?

A: Government accounting seems to be a systematic technique for gathering, categorizing, documenting,…

Q: To measure the financial viability of a proposed business, which is the more powerful measure-…

A: Ratio analysis involves evaluation of various operational aspects of the business such as liquidity,…

Q: ivalent units to be assigned costs are as follows: Direct Materials Conversion ory in process,…

A: Cost of units completed and transferred out of Production Cost of units completed and transferred…

Q: What the answer for 21,24, 21. Not 45,000 24. Not 5.44

A: 21. Needs to find Out Current Liabilities 24. Current Ratio

Q: Direction: Use given the ratio compute the Financial Ratio Analysis. The comparative statement of…

A: Financial ratios are the formulas used by the management to make it easy to understand the financial…

Q: What is the amount of gross taxable compensation income subject to normal tax?

A: As per our protocol we provide solution to the one question only but as you have asked two questions…

Q: The amount of subjectivity involved in establishing fair value estimates can be complex for…

A: GIVEN The amount of subjectivity involved in establishing fair value estimates can be complex for…

Q: TRM Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the…

A: Step 1: Calculate ending Inventory at base price: Year Ending Inventory at current price Prince…

Q: Define selling cost. Give five examples of selling cost.

A: The expenditures paid by the producer to encourage the sale of the item are referred to as selling…

Q: Jennifer has been very successful in operating her business for the last five years. Her financial…

A: Calculation of amount to be invested by Nicole Amount to be invested by Nicole = Firm's capital…

Q: EXO Company is projecting its financial performance for the next year. It plans to set a target…

A: The fixed assets remains constant at every level of production till 100% capacity is being utilized.…

Q: Inc. has developed a balanced scorecard with the following performance metrics:• Total sales•…

A: A balanced scorecard seems to be a strategic management evaluation statistic that assists businesses…

Q: - How much cost would Larry expec laces.) Answer is complete but not ent Total cost 1,070.49

A: a. The expected cost for the month of April is $1,042.41 Explanation: The total cost per month for…

Q: Your Company makes a single product. Only one kind of direct material is used to make this product.…

A: Material Price Variance = (Standard Price - Actual Price) x Actual Quantity

Q: Identify which taxes apply to the following situations and state whether the tax is direct or…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: Jan. Issued 1,000 shares of Common Stock, $2 par for $12 per share. Record the journal entry.

A: The company can raise funds by various methods. Some of them are, by way of issuing common stock,…

Q: Botella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles.The…

A: Calculation of Material Price variance Material price variance = (Standard price per lb. of material…

Q: Problem II Steel Company has the following assets: Co ffee plants 100,000 Harve sted coffee beans…

A: As per IAS 41, 'Biological asset' is a living plant or animal, and 'agricultural produce' is the…

Q: entxies JOUnal Green Company sells goods to Thumb Inc. on account on January 1, 2017.The goods have…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The manufacturer of a product that has a variable cost of $2.50 per unit and total fixed cost of…

A: The break-even point (BEP) appears to be an accounting term that refers to the point where a…

Q: Solomon Fruit Drink Company planned to make 200,000 containers of apple juice. It expected to use…

A: * As per Bartleby policy, in case multiple questions are asked then answer first three only. 1.…

Q: Muscat company purchased office supplies costing OMR2,000 and debited Office Supplies for the full…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: SydMel Ltd commences operations on 1 July 2020. One year later, on 30 June 2021, the entity prepares…

A: The calculation of the deferred tax while taking consider the accounting profit with the adjustment…

Q: AG is preparing the comparative financial statements to be included in the annual report to…

A: The number of weighted shares are calculated using the following formula:- Weighted Number of shares…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Arthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.Marlene, a cash basis taxpayer, invests in Series EE U.S. government savings bonds and bank certificates of deposit (CDs). Determine the tax consequences of the following on her 2019 gross income: a. On September 30, 2019, she cashed in Series EE bonds for 10,000. She purchased the bonds in 2009 for 7,090. The yield to maturity on the bonds was 3.5%. b. On July 1, 2018, she purchased a CD for 10,000. The CD matures on June 30, 2020, and will pay 10,816, thus yielding a 4% annual return. c. On July 1, 2019, she purchased a CD for 10,000. The maturity date on the CD was June 30, 2020, when Marlene would receive 10,300.During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________