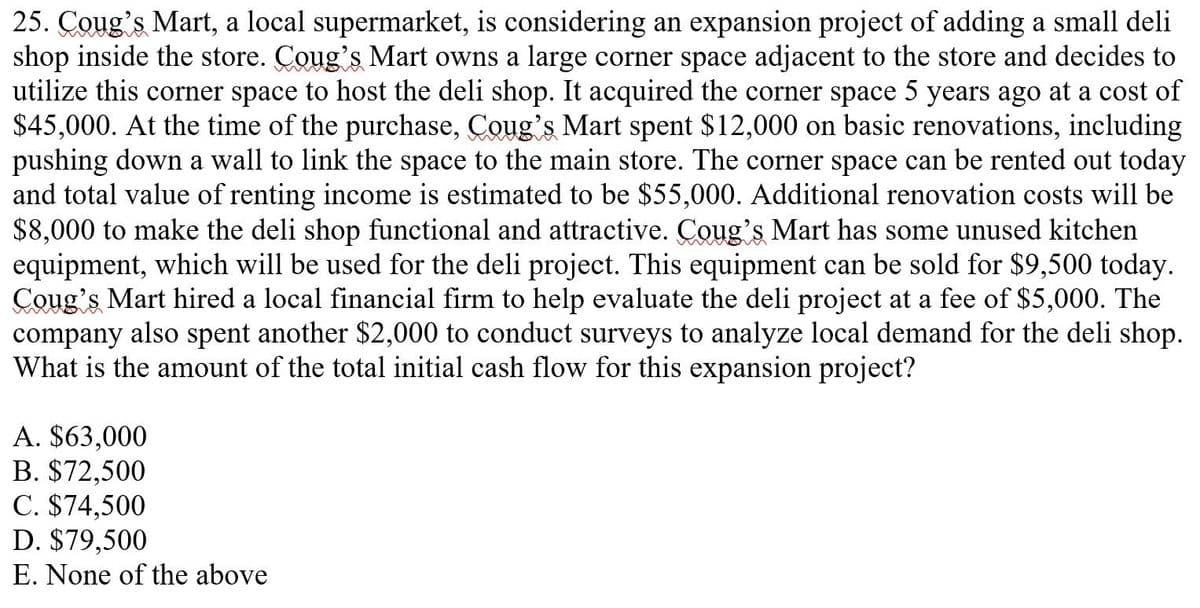

25. Coug's Mart, a local supermarket, is considering an expansion project of adding a small deli shop inside the store. Coug's Mart owns a large corner space adjacent to the store and decides to utilize this corner space to host the deli shop. It acquired the corner space 5 years ago at a cost of $45,000. At the time of the purchase, Coug's Mart spent $12,000 on basic renovations, including pushing down a wall to link the space to the main store. The corner space can be rented out today and total value of renting income is estimated to be $55,000. Additional renovation costs will be $8,000 to make the deli shop functional and attractive. Coug's Mart has some unused kitchen equipment, which will be used for the deli project. This equipment can be sold for $9,500 today. Coug's Mart hired a local financial firm to help evaluate the deli project at a fee of $5,000. The company also spent another $2,000 to conduct surveys to analyze local demand for the deli shop. What is the amount of the total initial cash flow for this expansion project? A. $63,000 B. $72,500 C. $74,500 D. $79,500 E. None of the above

25. Coug's Mart, a local supermarket, is considering an expansion project of adding a small deli shop inside the store. Coug's Mart owns a large corner space adjacent to the store and decides to utilize this corner space to host the deli shop. It acquired the corner space 5 years ago at a cost of $45,000. At the time of the purchase, Coug's Mart spent $12,000 on basic renovations, including pushing down a wall to link the space to the main store. The corner space can be rented out today and total value of renting income is estimated to be $55,000. Additional renovation costs will be $8,000 to make the deli shop functional and attractive. Coug's Mart has some unused kitchen equipment, which will be used for the deli project. This equipment can be sold for $9,500 today. Coug's Mart hired a local financial firm to help evaluate the deli project at a fee of $5,000. The company also spent another $2,000 to conduct surveys to analyze local demand for the deli shop. What is the amount of the total initial cash flow for this expansion project? A. $63,000 B. $72,500 C. $74,500 D. $79,500 E. None of the above

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 24DQ

Related questions

Question

Answer in typing

Transcribed Image Text:25. Coug's Mart, a local supermarket, is considering an expansion project of adding a small deli

shop inside the store. Coug's Mart owns a large corner space adjacent to the store and decides to

utilize this corner space to host the deli shop. It acquired the corner space 5 years ago at a cost of

$45,000. At the time of the purchase, Coug's Mart spent $12,000 on basic renovations, including

pushing down a wall to link the space to the main store. The corner space can be rented out today

and total value of renting income is estimated to be $55,000. Additional renovation costs will be

$8,000 to make the deli shop functional and attractive. Coug's Mart has some unused kitchen

equipment, which will be used for the deli project. This equipment can be sold for $9,500 today.

Coug's Mart hired a local financial firm to help evaluate the deli project at a fee of $5,000. The

company also spent another $2,000 to conduct surveys to analyze local demand for the deli shop.

What is the amount of the total initial cash flow for this expansion project?

A. $63,000

B. $72,500

C. $74,500

D. $79,500

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College