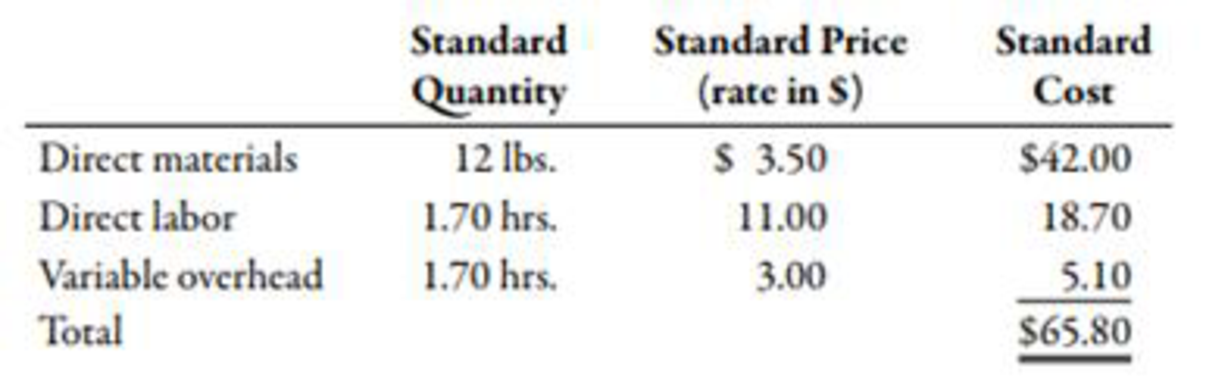

Basuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tear, growth, and other factors, Basuras places about 200,000 new containers each year (about 20% of the total households). Several years ago, Basuras decided to manufacture its own containers as a cost-saving measure. A strategically located plant involved in this type of manufacturing was acquired. To help ensure cost efficiency, a

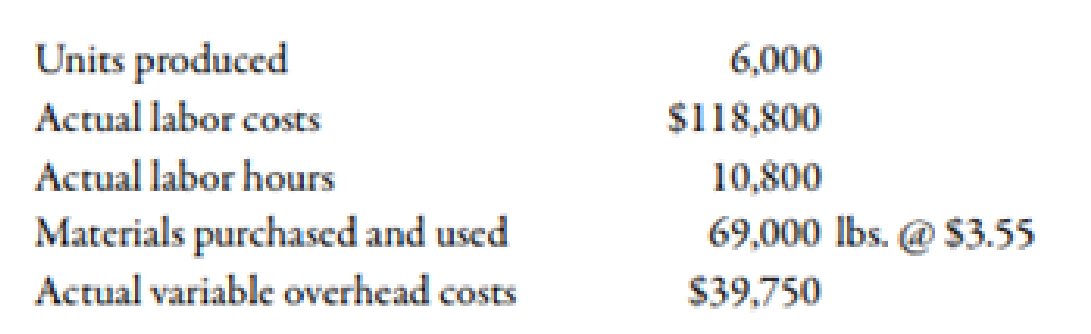

During the first week in January, Basuras had the following actual results:

The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in January. Also, a new manufacturing process was implemented on a trial basis. The new process required a slightly higher level of skilled labor. The higher- quality material has no effect on labor utilization. However, the new manufacturing process was expected to reduce materials usage by 0.25 pound per container.

Required:

- 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assume that the 0.25 pound per container reduction of materials occurred as expected and that the remaining effects are all attributable to the higher-quality material. Would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly.

- 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing process, should it be continued or discontinued? In answering, consider the new process’s materials reduction effect as well. Explain.

- 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new process should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 9,000 and the labor cost was $99,000. Should the new process be adopted? Assume the variances are attributable to the new process. Assuming production of 6,000 units per week, what would be the projected annual savings? (Include the materials reduction effect.)

1.

Calculate the value of material price variance and material usage variance. Identify whether the plant manger could continue to purchase this quality product or purchase the usual quality.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

Use the following formula to calculate material price variance:

Substitute $3.55 for actual price, 69,000 units for actual quantity and $3.50 for standard price in the above formula.

Therefore, the material price variance is $3,450 (U).

Use the following formula to calculate material usage variance with the help of columnar approach:

Substitute $3.50 for standard price, 69,000 units for actual quantity and 72,000 for standard quantity in the above formula.

Therefore, the material usage variance is $10,500 (F).

The new process helps in saving the cost of $5,250

Working Note:

1. Calculation of standard quantity:

2.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the labor variances are attributable to the new manufacturing process should be continued or discontinued.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $118,800 for actual rate and actual hours, 10,800 hours for actual hours and $11 for standard rate in the above formula.

Therefore, the labor rate variance is $0.

Use the following formula to calculate labor efficiency variance:

Substitute $11.00 for standard rate, 10,800 hours for actual hours and 10,200 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $6,600 (U).

The new process helps in material usage in saving the cost of $5,250 and losses the cost in labor variance of $6,600, which giving a net loss of $1,350

Working Note:

1. Calculation of standard hours:

3.

Calculate the value of labor rate variance and labor efficiency variance. Identify whether the new process be adopted or not.

Explanation of Solution

Use the following formula to calculate labor rate variance:

Substitute $99,000 for actual rate and actual hours, 9,000 hours for actual hours and $11 for standard rate in the above formula.

Therefore, the labor rate variance is $0.

Use the following formula to calculate labor efficiency variance:

Substitute $11.00 for standard rate, 9,000 hours for actual hours and 10,200 hours for standard hours in the above formula.

Therefore, the labor efficiency variance is $13,200(F).

The new process helps in material usage in saving the cost of $959,400

Working Note:

1. Calculation of standard hours:

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardQuality Clothing, Inc., produces skorts and jumper uniforms for schoolchildren. In the process of cutting out the cloth pieces for each product, a certain amount of scrap cloth is produced. Quality has been selling this cloth scrap to Jorges Scrap Warehouse for $3.25 per pound. Last year, the company sold 40,000 lb. of scrap, which would be enough to make 10,000 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly in the cutting and stitching processes, but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce the teddy bears $3.85. Fixed costs would increase by $95,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 10,000 teddy bears per year. Finished teddy bears could be sold for $18.00 each. Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell?arrow_forwardIngles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 16 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40 percent of next months sales are in the finished goods inventory. Ingles also purchases sufficient materials to ensure that materials inventory is 60 percent of the following months scheduled production. Ingless sales budget in units for the next quarter is as follows: Ingless ending inventories in units for July 31 are as follows: Required: 1. Calculate the number of tables to be produced during August. 2. Disregarding your response to Requirement 1, assume the required production units for August and September are 2,100 and 1,900, respectively, and the July 31 materials inventory is 4,000 units. Compute the number of table legs to be purchased in August. 3. Assume that Ingles Corporation will produce 2,340 units in September. How many employees will be required for the Assembly Department in September? (Fractional employees are acceptable since employees can be hired on a part-time basis. Assume a 40-hour week and a 4-week month.) (CMA adapted)arrow_forward

- Paladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have increased by 50 percent in each of the past three years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Minnesota factory is at capacity. Beryl Adams, president of Paladin, has examined the situation and developed the following alternatives. 1. Add a permanent second shift at the plant. However, the semiskilled workers who assemble the fax machines are in short supply, and the wage rate of 15 per hour would probably have to be increased across the board to 18 per hour in order to attract sufficient workers from out of town. The total wage increase (including fringe benefits) would amount to 125,000. The heavier use of plant facilities would lead to increased plant maintenance and small tool cost. 2. Open a new plant and locate it in Mexico. Wages (including fringe benefits) would average 3.50 per hour. Investment in plant and equipment would amount to 300,000. 3. Open a new plant and locate it in a foreign trade zone, possibly in Dallas. Wages would be somewhat lower than in Minnesota, but higher than in Mexico. The advantages of postponing tariff payments on parts imported from Asia could amount to 50,000 per year. Required: Advise Beryl of the advantages and disadvantages of each of her alternatives.arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forwardJonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)arrow_forward

- Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardOtero Fibers, Inc., specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. Otero has been in business since 1985 and has been profitable every year since 1993. The company uses a standard cost system and applies overhead on the basis of direct labor hours. Otero has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 10 percent after income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of 30 per blanket are not likely to be considered. In order to prepare the bid for the 800,000 blankets, Andrea Lightner, cost accountant, has gathered the following information about the costs associated with the production of the blankets. Direct machine costs consist of items such as special lubricants, replacement of needles used in stitching, and maintenance costs. These costs are not included in the normal overhead rates. Otero recently developed a new blanket fiber at a cost of 750,000. In an effort to recover this cost, Otero has instituted a policy of adding a 0.50 fee to the cost of each blanket using the new fiber. To date, the company has recovered 125,000. Lightner knows that this fee does not fit within the definition of full cost, as it is not a cost of manufacturing the product. Required: 1. Calculate the minimum price per blanket that Otero Fibers could bid without reducing the companys operating income. 2. Using the full-cost criteria and the maximum allowable return specified, calculate Otero Fibers bid price per blanket. 3. Without prejudice to your answer to Requirement 2, assume that the price per blanket that Otero Fibers calculated using the cost-plus criteria specified is greater than the maximum bid of 30 per blanket allowed. Discuss the factors that Otero Fibers should consider before deciding whether or not to submit a bid at the maximum acceptable price of 30 per blanket. (CMA adapted)arrow_forwardGlobal Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forward

- Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of 160,000 per year and a budgeted variable rate of 65 per hour of professional time. The normal usage of the legal services center is 2,600 hours per year for the Yuma office and 1,400 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year. Required: 1. Determine the amount of legal services support center costs that should be assigned to each office. 2. Since the offices produce services, not tangible products, what purpose is served by allocating the budgeted costs? 3. Now, assume that during the year, the legal services center incurred actual fixed costs of 163,000 and actual variable costs of 272,400. It delivered 4,180 hours of professional time2,580 hours to Yuma and 1,600 hours to Bernalillo. Determine the amount of the legal services centers costs that should be allocated to each office. Explain the purposes of this allocation. 4. Did the costs allocated differ from the costs incurred by the legal services center? If so, why?arrow_forwardZZOOM, Inc., has decided to discontinue manufacturing its Z Best model. Currently, the company has 4,600 partially completed Z Best models on hand. The government has put a recall on a particular part in the Z Best model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these Z Best models to their current state. Reworking each Z Best model will cost $22 for materials and $25 for direct labor. In addition, $9 of variable overhead and $34 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. If ZZOOM completes the Z Best models, it can sell them for $180 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $105 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if ZZOOM should complete the Z Best models or sell them in their current state.arrow_forwardRenslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks. The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division. Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1: Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1 Each division has 1,000,000 of management salary expense that is eligible for the bonus pool. Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion. Required: 1. Determine the 20x1 bonus pool available for the management team at: a. Meyers Service Company b. Wellington Products, Inc. 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at: a. Meyers Service Company b. Wellington Products, Inc. 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems. a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans. b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College