25UMI BOLLIES Financial year 2021 1 200 Financial year 2022 900 Wicketer Machine WTS has elected to diversify its operations by producing sustainable plastic bags. On 1 April 2020, a wicketer machine was purchased to create these plastic bags and was immediately brought into use. The cost of the wicketer machine is as follows: Purchase Price R70 000 R15 000 Installation Staff Training R6 500 The machine has a useful life of 10 years and management's policy is to revalue the machine every two years from the date of purchase. The entity adopts the elimination method for revaluations. The machine is depreciated on a straight-line basis. An independent valuator who is a competent industry expert has determined the fair value of the machine to be R90 000 on the 2nd anniversary of the purchase of the machine. The Financial Director has also approved a policy that the revaluation surplus may be transferred to retained earnings as the asset is used. Required: Q.1.1 Calculate the carrying value of the Fruit Filtration Machine at 30 June 2022.

25UMI BOLLIES Financial year 2021 1 200 Financial year 2022 900 Wicketer Machine WTS has elected to diversify its operations by producing sustainable plastic bags. On 1 April 2020, a wicketer machine was purchased to create these plastic bags and was immediately brought into use. The cost of the wicketer machine is as follows: Purchase Price R70 000 R15 000 Installation Staff Training R6 500 The machine has a useful life of 10 years and management's policy is to revalue the machine every two years from the date of purchase. The entity adopts the elimination method for revaluations. The machine is depreciated on a straight-line basis. An independent valuator who is a competent industry expert has determined the fair value of the machine to be R90 000 on the 2nd anniversary of the purchase of the machine. The Financial Director has also approved a policy that the revaluation surplus may be transferred to retained earnings as the asset is used. Required: Q.1.1 Calculate the carrying value of the Fruit Filtration Machine at 30 June 2022.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 2PB: Strategic initiatives and CSR Blue Skies Inc. is a retail gardening company that is piloting a new...

Related questions

Question

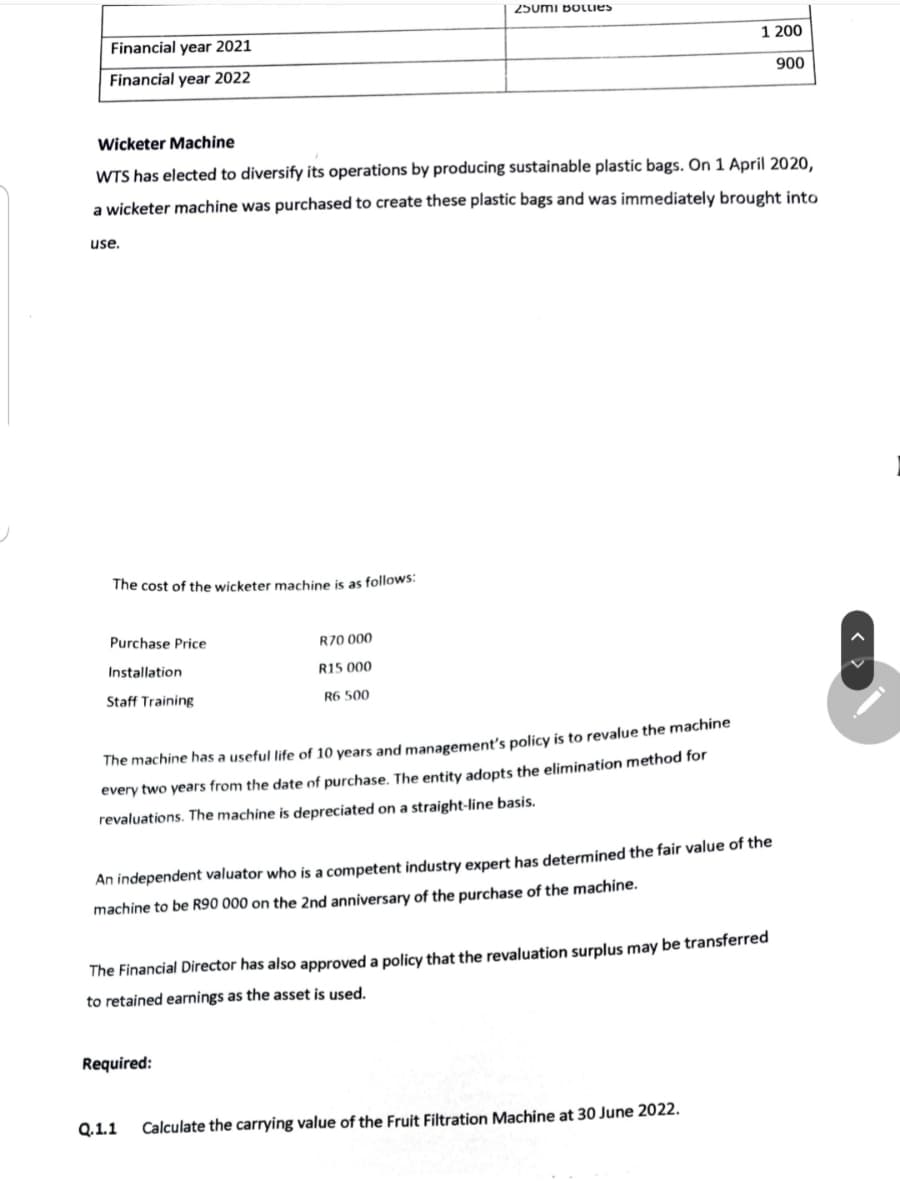

Transcribed Image Text:25UMI BOLlies

Financial year 2021

1 200

Financial year 2022

900

Wicketer Machine

WTS has elected to diversify its operations by producing sustainable plastic bags. On 1 April 2020,

a wicketer machine was purchased to create these plastic bags and was immediately brought into

use.

The cost of the wicketer machine is as follows:

Purchase Price

R70 000

Installation

R15 000

Staff Training

R6 500

The machine has a useful life of 10 years and management's policy is to revalue the machine

every two years from the date of purchase. The entity adopts the elimination method for

revaluations. The machine is depreciated on a straight-line basis.

An independent valuator who is a competent industry expert has determined the fair value of the

machine to be R90 000 on the 2nd anniversary of the purchase of the machine.

The Financial Director has also approved a policy that the revaluation surplus may be transferred

to retained earnings as the asset is used.

Required:

Q.1.1

Calculate the carrying value of the Fruit Filtration Machine at 30 June 2022.

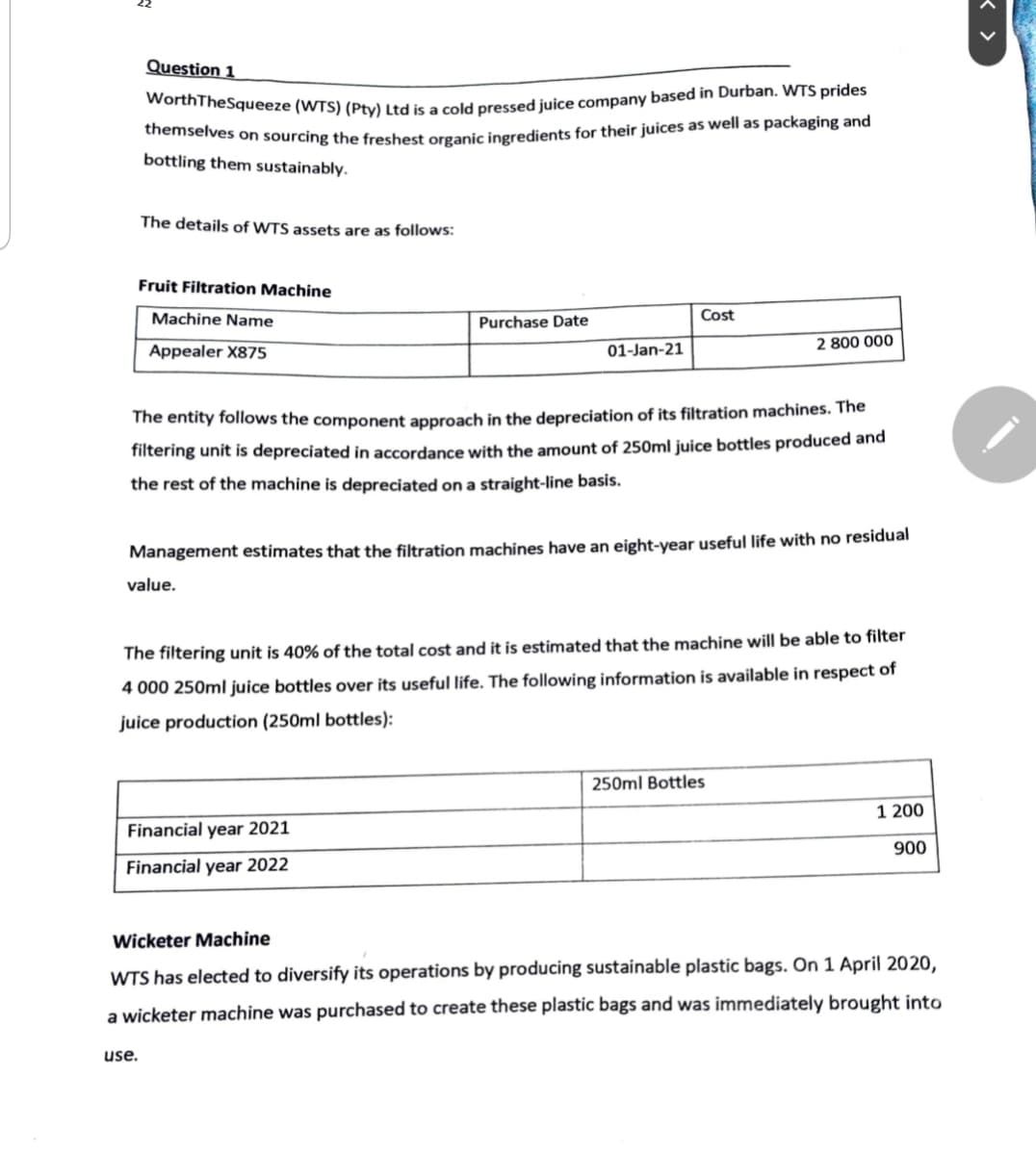

Transcribed Image Text:Question 1

WorthTheSqueeze (WTS) (Pty) Ltd is a cold pressed juice company based in Durban. WTS prides

themselves on sourcing the freshest organic ingredients for their juices as well as packaging and

bottling them sustainably.

The details of WTS assets are as follows:

Fruit Filtration Machine

Machine Name

Cost

Purchase Date

Appealer X875

01-Jan-21

2 800 000

The entity follows the component approach in the depreciation of its filtration machines. The

filtering unit is depreciated in accordance with the amount of 250ml juice bottles produced and

the rest of the machine is depreciated on a straight-line basis.

Management estimates that the filtration machines have an eight-year useful life with no residual

value.

The filtering unit is 40% of the total cost and it is estimated that the machine will be able to filter

4 000 250ml juice bottles over its useful life. The following information is available in respect of

juice production (250ml bottles):

250ml Bottles

Financial year 2021

1 200

900

Financial year 2022

Wicketer Machine

WTS has elected to diversify its operations by producing sustainable plastic bags. On 1 April 2020,

a wicketer machine was purchased to create these plastic bags and was immediately brought into

use.

< >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,