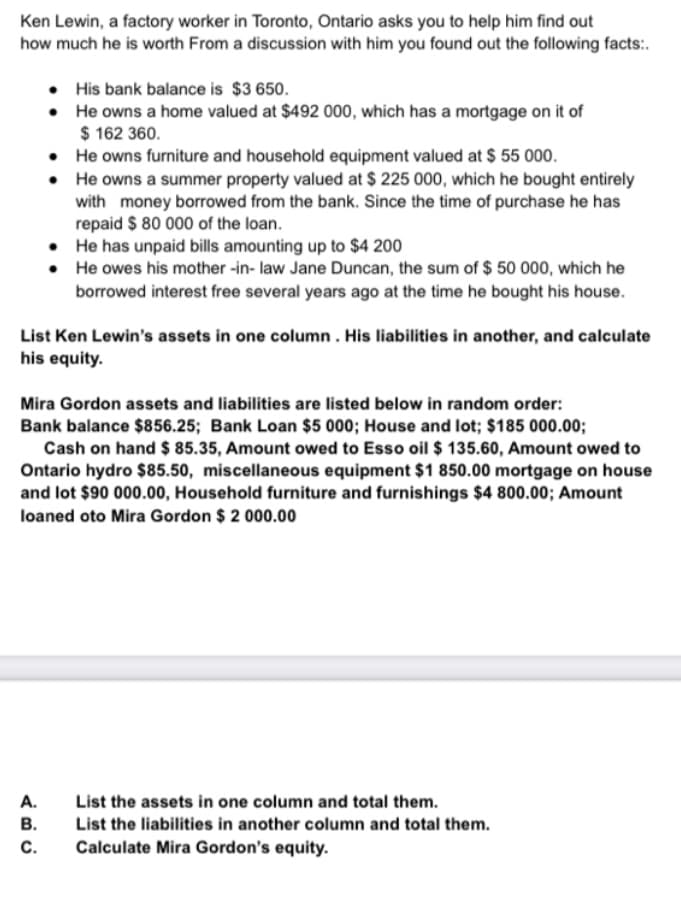

Ken Lewin, a factory worker in Toronto, Ontario asks you to help him find out how much he is worth From a discussion with him you found out the following facts:. His bank balance is $3 650. • He owns a home valued at $492 000, which has a mortgage on it of $ 162 360. He owns furniture and household equipment valued at $ 55 000. • He owns a summer property valued at $ 225 000, which he bought entirely with money borrowed from the bank. Since the time of purchase he has repaid $ 80 000 of the loan. He has unpaid bills amounting up to $4 200 • He owes his mother-in-law Jane Duncan, the sum of $ 50 000, which he borrowed interest free several years ago at the time he bought his house. List Ken Lewin's assets in one column. His liabilities in another, and calculate his equity.

Ken Lewin, a factory worker in Toronto, Ontario asks you to help him find out how much he is worth From a discussion with him you found out the following facts:. His bank balance is $3 650. • He owns a home valued at $492 000, which has a mortgage on it of $ 162 360. He owns furniture and household equipment valued at $ 55 000. • He owns a summer property valued at $ 225 000, which he bought entirely with money borrowed from the bank. Since the time of purchase he has repaid $ 80 000 of the loan. He has unpaid bills amounting up to $4 200 • He owes his mother-in-law Jane Duncan, the sum of $ 50 000, which he borrowed interest free several years ago at the time he bought his house. List Ken Lewin's assets in one column. His liabilities in another, and calculate his equity.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 68P

Related questions

Question

Transcribed Image Text:Ken Lewin, a factory worker in Toronto, Ontario asks you to help him find out

how much he is worth From a discussion with him you found out the following facts:.

•

His bank balance is $3 650.

•

He owns a home valued at $492 000, which has a mortgage on it of

$ 162 360.

•

He owns furniture and household equipment valued at $ 55 000.

•

He owns a summer property valued at $ 225 000, which he bought entirely

with money borrowed from the bank. Since the time of purchase he has

repaid $ 80 000 of the loan.

.

He has unpaid bills amounting up to $4 200

•

He owes his mother-in-law Jane Duncan, the sum of $ 50 000, which he

borrowed interest free several years ago at the time he bought his house.

List Ken Lewin's assets in one column. His liabilities in another, and calculate

his equity.

Mira Gordon assets and liabilities are listed below in random order:

Bank balance $856.25; Bank Loan $5 000; House and lot; $185 000.00;

Cash on hand $ 85.35, Amount owed to Esso oil $ 135.60, Amount owed to

Ontario hydro $85.50, miscellaneous equipment $1 850.00 mortgage on house

and lot $90 000.00, Household furniture and furnishings $4 800.00; Amount

loaned oto Mira Gordon $ 2 000.00

A.

List the assets in one column and total them.

B.

List the liabilities in another column and total them.

Calculate Mira Gordon's equity.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT