26 The company sold merchandise with a $4,640 cost for $5,800 on credit to KC, Inc., invoice dated January 26. 31 The company paid cash to Lyn Addie for 10 days' work at $125 per day. Feb. 1 The company paid $2,475 cash to Hillside Mall for another three months' rent in advance. 3 The company paid Kansas Corp. for the balance due, net of the cash discount, less the $496 amount in the credit memorandum. 5 The company paid $1200 cash to the local newspaper for an advertising insert in today's paper. 11 The company received the balance due from Alex's Engineering Co. for fees billed on January 11. 15 The company paid $5000 cash in dividends. 23 The company sold merchandise with a $2,660 cost for $3,220 on credit to Delta Co., invoice dated February 23. 26 The company paid cash to Lyn Addie for nine days' work at $125 per day. 27 The company reimbursed Santana Rey for business automobile mileage (1600 miles at $0.32 per mile). Mar. 8 The company purchased $3,730 of computer supplies from Harris Office Products on credit, invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. 11 The company paid $610 cash for minor repairs to the company's computer. 16 The company received $5,260 cash from Dream, Inc., for computing services provided. 19 The company paid the full amount due to Harris Office Products, consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company billed Easy Leasing for $9,047 of computing services provided. 25 The company sold merchandise with a $2,002 cost for $2,800 on credit to Wildcat Services, invoice dated March 25. 30 The company sold merchandise with a $1,048 cost for $2,220 on credit to IFM Company, invoice dated March 30. 31 The company reimbursed Santana Rey for business automobile mileage (400 miles at $0.32 per mile).

26 The company sold merchandise with a $4,640 cost for $5,800 on credit to KC, Inc., invoice dated January 26. 31 The company paid cash to Lyn Addie for 10 days' work at $125 per day. Feb. 1 The company paid $2,475 cash to Hillside Mall for another three months' rent in advance. 3 The company paid Kansas Corp. for the balance due, net of the cash discount, less the $496 amount in the credit memorandum. 5 The company paid $1200 cash to the local newspaper for an advertising insert in today's paper. 11 The company received the balance due from Alex's Engineering Co. for fees billed on January 11. 15 The company paid $5000 cash in dividends. 23 The company sold merchandise with a $2,660 cost for $3,220 on credit to Delta Co., invoice dated February 23. 26 The company paid cash to Lyn Addie for nine days' work at $125 per day. 27 The company reimbursed Santana Rey for business automobile mileage (1600 miles at $0.32 per mile). Mar. 8 The company purchased $3,730 of computer supplies from Harris Office Products on credit, invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. 11 The company paid $610 cash for minor repairs to the company's computer. 16 The company received $5,260 cash from Dream, Inc., for computing services provided. 19 The company paid the full amount due to Harris Office Products, consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company billed Easy Leasing for $9,047 of computing services provided. 25 The company sold merchandise with a $2,002 cost for $2,800 on credit to Wildcat Services, invoice dated March 25. 30 The company sold merchandise with a $1,048 cost for $2,220 on credit to IFM Company, invoice dated March 30. 31 The company reimbursed Santana Rey for business automobile mileage (400 miles at $0.32 per mile).

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PA: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

100%

With the given information prepare

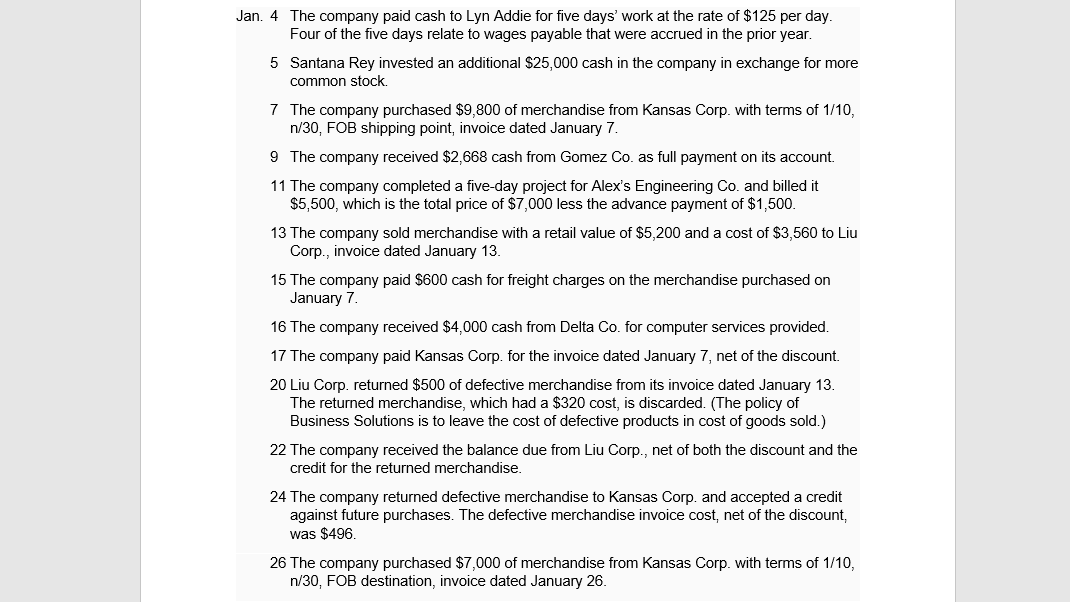

Transcribed Image Text:Jan. 4 The company paid cash to Lyn Addie for five days' work at the rate of $125 per day.

Four of the five days relate to wages payable that were accrued in the prior year.

5 Santana Rey invested an additional $25,000 cash in the company in exchange for more

common stock,

7 The company purchased $9,800 of merchandise from Kansas Corp. with terms of 1/10,

n/30, FOB shipping point, invoice dated January 7.

9 The company received $2,668 cash from Gomez Co. as full payment on its account.

11 The company completed a five-day project for Alex's Engineering Co. and billed it

$5,500, which is the total price of $7,000 less the advance payment of $1,500.

13 The company sold merchandise with a retail value of $5,200 and a cost of $3,560 to Liu

Corp., invoice dated January 13.

15 The company paid $600 cash for freight charges on the merchandise purchased on

January 7.

16 The company received $4,000 cash from Delta Co. for computer services provided.

17 The company paid Kansas Corp. for the invoice dated January 7, net of the discount.

20 Liu Corp. returned $500 of defective merchandise from its invoice dated January 13.

The returned merchandise, which had a $320 cost, is discarded. (The policy of

Business Solutions is to leave the cost of defective products in cost of goods sold.)

22 The company received the balance due from Liu Corp., net of both the discount and the

credit for the returned merchandise.

24 The company returned defective merchandise to Kansas Corp. and accepted a credit

against future purchases. The defective merchandise invoice cost, net of the discount,

was $496.

26 The company purchased

n/30, FOB destination, invoice dated January 26.

,000 of merchandise from Kansas Corp. with terms of 1/10,

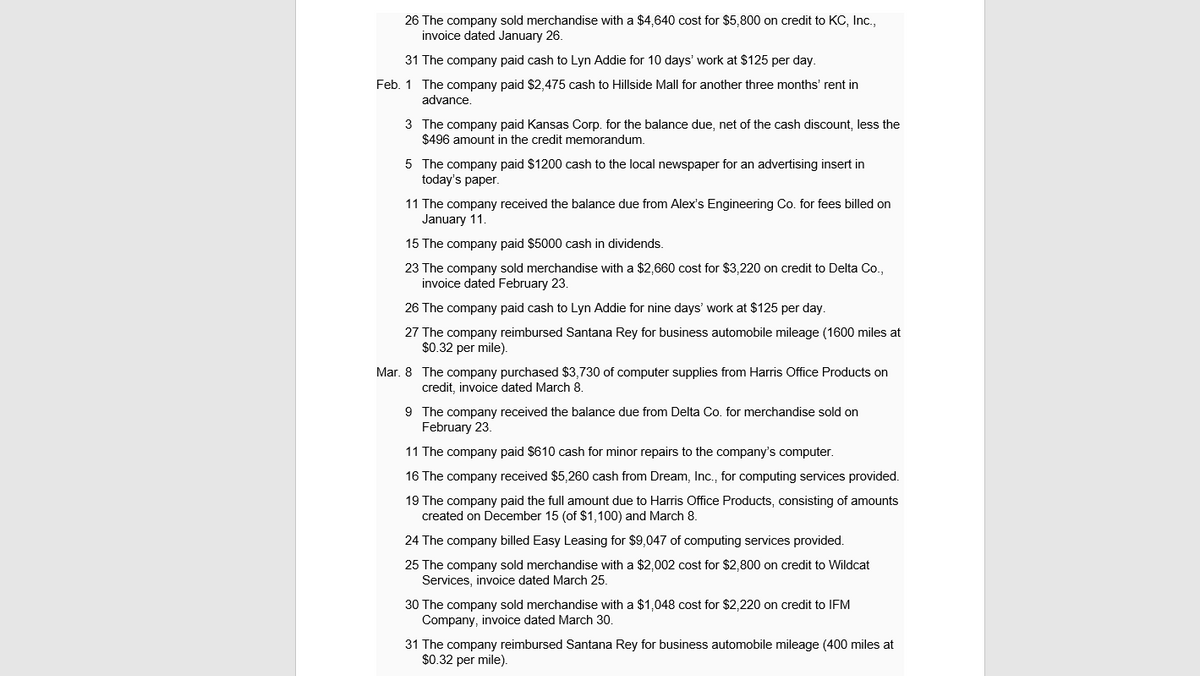

Transcribed Image Text:26 The company sold merchandise with a $4,640 cost for $5,800 on credit to KC, Inc.,

invoice dated January 26.

31 The company paid cash to Lyn Addie for 10 days' work at $125 per day.

Feb. 1 The company paid $2,475 cash to Hillside Mall for another three months' rent in

advance.

3 The company paid Kansas Corp. for the balance due, net of the cash discount, less the

$496 amount in the credit memorandum.

5 The company paid $1200 cash to the local newspaper for an advertising insert in

today's paper.

11 The company received the balance due from Alex's Engineering Co. for fees billed on

January 11

15 The company paid $5000 cash in dividends.

23 The company sold merchandise with a $2,660 cost for $3,220 on credit to Delta Co.,

invoice dated February 23.

26 The company paid cash to Lyn Addie for nine days' work at $125 per day.

27 The company reimbursed Santana Rey for business automobile mileage (1600 miles at

$0.32 per mile).

Mar. 8 The company purchased $3,730 of computer supplies from Harris Office Products on

credit, invoice dated March 8.

9 The company received the balance due from Delta Co. for merchandise sold on

February 23.

11 The company paid $610 cash for minor repairs to the company's computer.

16 The company received $5,260 cash from Dream, Inc., for computing services provided.

19 The company paid the full amount due to Harris Office Products, consisting of amounts

created on December 15 (of $1,100) and March 8.

24 The company billed Easy Leasing for $9,047 of computing services provided.

25 The company sold merchandise with a $2,002 cost for $2,800 on credit to Wildcat

Services, invoice dated March 25.

30 The company sold merchandise with a $1,048 cost for $2,220 on credit to IFM

Company, invoice dated March 30.

31 The company reimbursed Santana Rey for business automobile mileage (400 miles at

$0.32 per mile).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

For the Feb3 transaction how did you get the amount of 6434 for the Cash credit?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage