Concept explainers

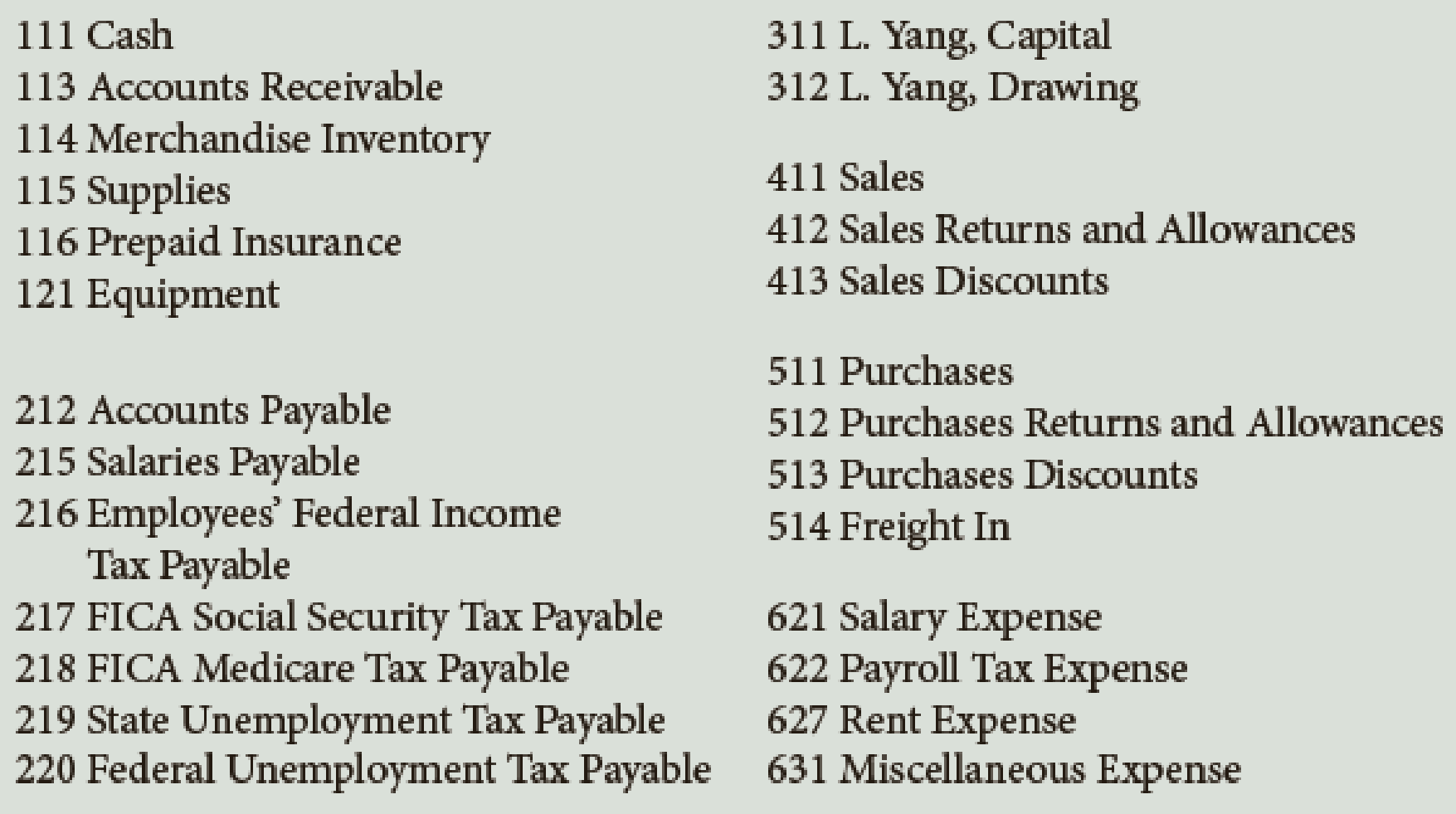

The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer.

Jan. 2 Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, $850.

2 L. Yang, the owner, invested an additional $4,500 in the business.

4 Bought merchandise on account from Valentine and Company, invoice no. A694, $2,830; terms 2/10, n/30; dated January 2.

4 Received check from Velez Appliance for $980 in payment of invoice for $1,000 less discount.

4 Sold merchandise on account to L. Parrish, invoice no. 6483, $755.

6 Received check from Peck, Inc., $637, in payment of $650 invoice less discount.

7 Issued Ck. No. 6982, $588, to Frost and Son, in payment of invoice no. C127 for $600 less discount.

7 Bought supplies on account from Dudley Office Supply, invoice no. 190B, $93.54; terms net 30 days.

7 Sold merchandise on account to Ewing and Charles, invoice no. 6484, $1,115.

9 Issued credit memo no. 43 to L. Parrish, $47, for merchandise returned.

11 Cash sales for January 1 through January 10, $4,454.87.

11 Issued Ck. No. 6983, $2,773.40, to Valentine and Company, in payment of $2,830 invoice less discount.

14 Sold merchandise on account to Velez Appliance, invoice no. 6485, $2,100.

14 Received check from L. Parrish, $693.84, in payment of $755 invoice, less return of $47 and less discount.

Jan. 19 Bought merchandise on account from Crawford Products, invoice no. 7281, $3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, $142 (total $3,842).

21 Issued Ck. No. 6984, $245, to A. Bautista for miscellaneous expenses not recorded previously.

21 Cash sales for January 11 through January 20, $3,689.

23 Received credit memo no. 163, $87, from Crawford Products for merchandise returned.

29 Sold merchandise on account to Bradford Supply, invoice no. 6486, $1,697.20.

29 Issued Ck. No. 6985 to Western Freight, $64, for freight charges on merchandise purchased January 4.

31 Cash sales for January 21 through January 31, $3,862.

31 Issued Ck. No. 6986, $65, to M. Pineda for miscellaneous expenses not recorded previously.

31 Recorded payroll entry from the payroll register: total salaries, $5,899.95; employees’ federal income tax withheld, $795; FICA Social Security tax withheld, $365.80, FICA Medicare tax withheld, $85.50.

31 Recorded the payroll taxes: FICA Social Security tax, $365.80; FICA Medicare tax, $85.50; state

31 Issued Ck. No. 6987, $4,653.65, for salaries for the month.

31 L. Yang, the owner, withdrew $1,000 for personal use, Ck. No. 6988.

Required

- 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used.

- 2.

Post daily all entries involving customer accounts to the accounts receivable ledger. - 3. Post daily all entries involving creditor accounts to the accounts payable ledger.

- 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owner’s name in the Capital and Drawing accounts.

- 5. Add the columns of the special journals and prove the equality of the debit and credit totals.

- 6. Post the appropriate totals of the special journals to the general ledger.

- 7. Prepare a

trial balance . - 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

1.

Journalize the transactions using types of journals.

Explanation of Solution

Sales Journal: Sales journal is one form of special journal book, which records all the sales transactions that are sold to customers on credit. In a single column sales journal, debit aspect of accounts receivable and credit aspect of inventory are recorded, and then posted to individual subsidiary customer account.

Purchase Journal: Purchase journal records all the merchandise purchase on credit. In a single column purchase journal, debit aspect of inventory and credit aspect of accounts payable are recorded, and then posted to individual subsidiary supplier account.

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

Cash payments journal: Cash payments journal refers to the journal that is used to record the all transaction which is involve the cash payments. For example, the business paid cash to employees (salary paid to employees). Cash payments journal is used to record merchandise purchases made in cash and payments of accounts payable. It also records all other cash payments to various purposes. To include all these transactions, companies use multi-column cash payments journal.

General journal is a record of financial transaction. The transactions are recorded in the journal prior to posting them to the accounts in the general ledger.

Journalize the transactions using the types of journals.

- Sales Journal

| Sales Journal | Page no: 91 | ||||

| Date | Invoice No. | Customer Name | Post Ref. | Accounts Receivable Dr. | |

| Sales Cr.($) | |||||

| 20__ | |||||

| Jan. | 4 | 6483 | Mr. P | ✓ | 755 |

| 7 | 6484 | Mr. E&C | ✓ | 1,115 | |

| 14 | 6485 | Mr. V | ✓ | 2,100 | |

| 29 | 6486 | Mr. B | ✓ | 1,697 | |

| 31 | Total | $5,667 | |||

| (113) (411) | |||||

Table (1)

- Purchase Journal

| Purchase Journal | Page no:74 | ||||||||

| Date | Customer name | Invoice no. | Invoice date | Terms. | Post Ref. | Accounts Payable | Freight in | Purchases | |

| Credit ($) | Debit ($) | Debit ($) | |||||||

| 20__ | |||||||||

| Jan. | 4 | V Company | A691 | 2-Jan | 2/10,n/30 | ✓ | 2,830 | 2,830 | |

| 18 | C Company | 7281D | 16-Jan | 2/10,n/60 | ✓ | 3,842 | 142 | 3,700 | |

| 31 | Totals | 6,672 | 142 | 6,530 | |||||

| (212) | (514) | (511) | |||||||

Table (2)

- Cash receipts journal

| Cash Receipts Journal | Page:56 | |||||||

| Date | Accounts Credited | Post ref. | Cash | Sales Discount | Accounts Receivable | Sales | Other Accounts | |

| debit($) | debit($) | credit($) | credit($) | Credit($) | ||||

| 20__ | ||||||||

| Jan | 2 | Mr. Y, Capital | 311 | 4,500 | 4,500 | |||

| 4 | V company | 980 | 20 | 1,000 | ||||

| 6 | P company | 637 | 13 | 650 | ||||

| 11 | 4,455 | 4,455 | ||||||

| 14 | Mr. P | 693 | 14.16 | 708 | ||||

| 21 | 3,689 | 3,689 | ||||||

| 31 | 3,862 | 3,862 | ||||||

| 31 | Totals | 18,816.71 | 47.16 | 2,358 | 12,005.87 | 4,500 | ||

| (111) | (413) | (113) | (411) | (X) | ||||

Table (3)

- Cash payment journal

| Cash payments journal | Page:63 | |||||||

| Date | CK no | Account Debited | Post ref. | Other accounts | Accounts payable | Purchases discounts | Cash | |

| debit($) | debit($) | credit($) | credit($) | |||||

| 20__ | ||||||||

| Jan | 2 | 6981 | Rent expense | 627 | 850 | 850 | ||

| 7 | 6982 | F company | ✓ | 600 | 12 | 588 | ||

| 11 | 6983 | V Company | ✓ | 2,830 | 57 | 2,773.4 | ||

| 21 | 6984 | Miscellaneous expense | 631 | 245 | 245 | |||

| 29 | 6985 | Freight in | 514 | 64 | 64 | |||

| 31 | 6986 | Miscellaneous expense | 631 | 65 | 65 | |||

| 31 | 6987 | Salaries payable | 215 | 4,653 | 4,653.65 | |||

| 31 | 6988 | Mr. Y drawing | 312 | 1,000 | 1,000 | |||

| 31 | Totals | 6,887.65 | 3,430 | 68.6 | 10,239.05 | |||

| (X) | (212) | (513) | (111) | |||||

Table (4)

- General journal

| General journal | Page:100 | ||||

| Date | Description | Post ref. | Debit ($) | Credit($) | |

| 20___ | |||||

| Jan. | 7 | Supplies | 115 | 93.54 | |

| Accounts payable, D company | 212/ | 93.54 | |||

| (Record purchase of supplies from D company | |||||

| invoice no. 1906B, terms net 30) | |||||

| 9 | Sales returns and allowances | 412 | 47 | ||

| Accounts receivable, Mr. L | 113/ | 47 | |||

| (Record issued credit memo no.43) | |||||

| 23 | Accounts payable, C company | 212/ | 87 | ||

| Purchase returns and allowances | 512 | 87 | |||

| (Received credit memo for return of | |||||

| merchandise memo no:163) | |||||

| 31 | Salaries expense | 621 | 5,899.95 | ||

| Employee's federal income tax payable | 216 | 795 | |||

| FICA social security tax payable | 217 | 365 | |||

| FCIA Medicare tax payable | 218 | 85 | |||

| Salaries payable | 215 | 4,653.65 | |||

| (Record salaries paid for the month) | |||||

| 31 | Payroll tax expense | 622 | 805.3 | ||

| FICA social security tax payable | 217 | 365.8 | |||

| Medicare tax payable | 218 | 85.5 | |||

| State unemployment tax payable | 219 | 318.6 | |||

| Federal unemployment tax payable | 220 | 35.4 | |||

| ( Record employer's share of FCIA taxes and | |||||

| employer's state and federal unemployment | |||||

| taxes for the month) | |||||

Table (5)

2.

Record the entries from customer accounts to the accounts receivable ledger.

Explanation of Solution

Account receivable: The amount of money to be received by a company for the sale of goods and services to the customers is referred to as account receivable.

| Accounts Receivable Ledger | ||||||

| Name: B company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 29 | S91 | 1,697 | 1,697.2 | ||

| Name: E and C company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 7 | S91 | 1,115 | 1,115 | ||

| Name: Mr. P | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 4 | S91 | 755 | 755 | ||

| 9 | J119 | 47 | 708 | |||

| 14 | CR56 | 708 | ||||

| Name: P company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 1 | Balance | ✓ | 650 | ||

| 6 | CR38 | 650 | 0 | |||

| Name: V company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 1 | Balance | ✓ | 1,000 | ||

| 4 | CR56 | 1,000 | 0 | |||

| 14 | S91 | 2,100 | 2,100 | |||

Table (6)

3.

Record the entries from creditor accounts to the accounts payable ledger.

Explanation of Solution

Account payable: The amount of money to be paid by a company for the purchase of goods and services from the seller is referred to as account payable.

Record the entries from creditor accounts to the accounts payable ledger.

| Accounts payable ledger | ||||||

| Name: C company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 19 | P74 | 3,842 | 3,842 | ||

| 23 | J119 | 87 | 3,755 | |||

| Name: D company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 7 | J119 | 93.54 | 93.54 | ||

| Name: F and sons | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 1 | Balance | 600 | |||

| 7 | CP63 | 600 | 0 | |||

| Name: V company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| Jan | 4 | P74 | 2,830 | 2,830 | ||

| 11 | CP63 | 2,830 | 0 | |||

Table (7)

4.

Post the prepared journals and other accounts column to general ledger.

Explanation of Solution

Posting of transaction: The process of transferring the journalized transactions into the accounts of the ledger is known as posting of transaction.

Post the prepared journals to the general ledger:

| General ledger | |||||||

| Account: Cash | Account No:111 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 8,740 | |||

| 31 | CR56 | 18,816.71 | 27,556.71 | ||||

| 31 | CP63 | 10,239.05 | 17,317.66 | ||||

| Account: Accounts receivable | Account No:113 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 1,650 | |||

| 9 | J119 | 47 | 1,603 | ||||

| 31 | S91 | 5,667.20 | 7,270.2 | ||||

| 31 | CR56 | 2,358.00 | 4,912 | ||||

| Account: Merchandise inventory | Account No:114 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 20,584 | |||

| Account: Supplies | Account No:115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 592 | |||

| 7 | J119 | 93.54 | 685.54 | ||||

| Account: Prepaid insurance | Account No:116 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 390 | |||

| Account: Equipment | Account No:121 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 3,644 | |||

| Account: Accounts payable | Account No:212 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | Balance | ✓ | 600 | |||

| 7 | J119 | 93.54 | 693.54 | ||||

| 23 | J119 | 87 | 606.54 | ||||

| 31 | P74 | 6,672 | 7,278.54 | ||||

| 31 | CP63 | 3,430 | 3,848.54 | ||||

| Account: Salaries payable | Account No:215 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 4,653.65 | 4,653.65 | |||

| 31 | CP63 | 4,653.65 | |||||

| Account: Employees federal income tax payable | Account No:216 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 795 | 795 | |||

| Account: FICA social security tax payable | Account No:217 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 365.8 | 365.8 | |||

| 31 | J119 | 365.8 | 731.6 | ||||

| Account: FICA Medicare payable | Account No:218 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 85.5 | 85.5 | |||

| 31 | J119 | 85.5 | 171 | ||||

| Account: State Unemployment tax payable | Account No:219 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 318.6 | 318.6 | |||

| Account: Federal unemployment tax payable | Account No:220 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 35.4 | 35.4 | |||

| Account: Mr. Y Capital | Account No:311 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 1 | Balance | ✓ | 35,000 | |||

| 2 | CR56 | 4,500 | 39,500 | ||||

| Account: Mr. Y Drawing | Account No:312 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | CP63 | 1,000 | 1,000 | |||

| Account: Sales | Account No:411 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | S91 | 5,667 | 5,667.2 | |||

| 31 | CR56 | 12,005.9 | 17,673.07 | ||||

| Account: Sales return and allowance | Account No:412 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 9 | J119 | 47 | 47 | |||

| Account: Sales discounts | Account No:413 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | CR56 | 47 | 47 | |||

| Account: Purchases | Account No:511 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | P74 | 6,530 | 6,530 | |||

| Account: Purchases returns and allowances | Account No:512 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 23 | J119 | 87 | 87 | |||

| Account: Purchase discounts | Account No:513 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | CP63 | 68.6 | 68.6 | |||

| Account: Freight in | Account No:514 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 29 | CP63 | 64 | 64 | |||

| 31 | P74 | 142 | 206 | ||||

| Account: Salary expense | Account No:621 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 5,899.95 | 5,899.95 | |||

| Account: Payroll tax expense | Account No:622 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 31 | J119 | 805.3 | 805.3 | |||

| Account: Rent expense | Account No:627 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 2 | CP63 | 850 | 850 | |||

| Account: Miscellaneous expense | Account No:631 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Jan | 21 | CP63 | 245 | 245 | |||

| 31 | CP63 | 65 | 310 | ||||

Table (8)

5.

Report the equality of debit and credit totals in special journal column.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Equality of debit and credit column in purchase journal:

| EQUALITY OF DEBITS AND CREDITS | |||

| DEBITS ($) | CREDITS ($) | ||

| 142 | 6,672 | ||

| 6,530 | |||

| 6,672 | 6,672 | ||

Table (9)

Equality of debit and credit column in Cash receipt journal:

| EQUALITY OF DEBITS AND CREDITS | |||

| DEBITS ($) | CREDITS ($) | ||

| 47.16 | 4,500 | ||

| 18,816.71 | 2,358 | ||

| 12,005.87 | |||

| 18,816.87 | 18,863.87 | ||

Table (10)

Equality of debit and credit column in Cash payment journal:

| EQUALITY OF DEBITS AND CREDITS | |||

| DEBITS ($) | CREDITS ($) | ||

| 6,877.65 | 68.6 | ||

| 3,430.00 | 10,239.05 | ||

| 10,307.65 | 10,307.65 | ||

Table (11)

2, 3, 4, and 6.

Post the appropriate special journal to the general ledger.

Explanation of Solution

General ledger: General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements.

7.

Prepare a trail balance of Y Company.

Explanation of Solution

Prepare a trail balance of Y Company.

| Y company | ||

| Trail balance | ||

| January 31, 20__ | ||

| Account Name | Debit ($) | Credit($) |

| Cash | 17,317.66 | |

| Accounts receivable | 4,912.2 | |

| Merchandise inventory | 20,584 | |

| Supplies | 685.54 | |

| Prepaid insurance | 390 | |

| Equipment | 3,644 | |

| Accounts payable | 3,848.54 | |

| Employee's federal income tax payable | 795 | |

| FICA social security tax payable | 731.6 | |

| FICA Medicare tax payable | 171 | |

| State unemployment tax payable | 318.6 | |

| Federal unemployment tax payable | 35.4 | |

| Mr. Y Capital | 39,500 | |

| Mr. Y Drawings | 1,000 | |

| Sales | 17,673.07 | |

| Sales returns and allowances | 47 | |

| Sales discounts | 47.16 | |

| Purchases | 6,530 | |

| Purchases returns and allowances | 87 | |

| Purchases discounts | 68.6 | |

| Freight in | 206 | |

| Salary expense | 5,899.95 | |

| Payroll tax expense | 805.3 | |

| Rent expense | 850 | |

| Miscellaneous expense | 310 | |

| 63,228.81 | 63,228.81 | |

Table (12)

8.

Prepare a schedule for accounts receivable and accounts payable.

Explanation of Solution

Schedule for the accounts receivable:

| Y company | |

| Schedule of accounts receivable | |

| January 31, 20__ | |

| Particulars | Amount($) |

| B company | 1,697.2 |

| E and C company | 1,115 |

| V company | 2,100 |

| Total accounts receivable | 4912.2 |

Table (13)

| H company | |

| Schedule of accounts payable | |

| January 31, 20__ | |

| Particulars | Amount($) |

| C company | 3,755 |

| D company | 93.54 |

| Total accounts payable | 3848.54 |

Table (14)

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Construction Accounting And Financial Management (4th Edition)

Auditing and Assurance Services (16th Edition)

Managerial Accounting (5th Edition)

Intermediate Accounting

Principles of Accounting Volume 2

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach, as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Aging Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts? If using QuickBooks or general ledger, ignore Steps 2, 3, and 4.arrow_forward

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. If using QuickBooks or general ledger, ignore Steps 2, 3, and 4. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Summary Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forward

- Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet Co. purchases 350 aprons (Supplies) at $25 per apron from a supplier, on credit. Terms of the purchase are 3/10, n/30 from the invoice date of January 5. B. On February 18, Melon Construction receives advance cash payment from a client for construction services in the amount of $20,000. Melon had yet to provide construction services as of February 18. C. On March 21, Noonan Smoothies sells 875 smoothies for $4 cash per smoothie. The sales tax rate is 6.5%. D. On June 7, Organic Methods paid a portion of their noncurrent note in the amount of $9,340 cash.arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardPost the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500arrow_forward

- On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage