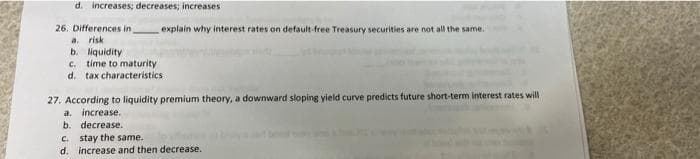

26. Differences in a risk b. liquidity C. time to maturity d. tax characteristics explain why interest rates on default-free Treasury securities are not all the same.

Q: What are the basic risk faced by financial intermediaries? Discuss each throughly

A: The banks, and other financial intermediaries are considered to be very important for the economic…

Q: Discuss FOUR (4) factors Maybank would consider before issuing bonds on the Singapore Exchange's…

A: Exchange rate: It refers to the rate at which the economies exchange with one another. The more the…

Q: Describe the difference between financial markets and financial intermediaries? How can your funds…

A: Monetary business sectors and Financial go-betweens are two channels through which the monetary…

Q: Name anddescribe two markets that are part of the financialsystem in the U.S. economy

A: Bond market and stock market are two major part of the financial system in the U.S. economy.

Q: Which type of short-term loan is secured with Treasury bills as collateral? A. Commercial paper…

A:

Q: Discuss the advantages and disadvantages of options in the financial markets?

A: Advantage: There is a fluctuation in the market. In this situations option can be utilized by the…

Q: 22. In an economy, if uncertainty about the health of banks causes depositors to start withdrawing…

A: Banking crisis: It can be defined as when many people borrow money from the banks but are unable to…

Q: 12 You work for the treasury department of a medium sized bank. You are concerned about…

A: Many investors become concerned during volatile times and begin to question their long-term…

Q: Explain how financial intermediaries reduce a. Adverse selection; and b. Moral hazard.

A: Adverse selection- Adverse selection usually refers to a condition in which sellers have information…

Q: 1. The structure of financial markets is influenced by the problems relating to asymmetric…

A: Asymmetric information refers to a situation in which one party has more information than the other…

Q: II. Read each statement carefully. Identify the following whether it box. BOND STOCK If a company…

A: In an economy, stocks can be defined as a thing that gives individuals ownership in a firm or…

Q: 2. What is the significance role of financial institutions, is and how it operates? of understanding…

A: The business entities that tend to provide services as being intermediaries for various monetary…

Q: Why are non-banking financial companies valuable to the financial system? Elaborate all the…

A: India's financial administration's area is colossal. It doesn't simply contain business banks yet in…

Q: Summarize the effect of : a)an open market purchase of securities by the TCMB b) an open market sale…

A: a. Effects of open market purchase: The reserves of the commercial bank increases Loans and…

Q: An FI has purchased a $201 million cap of 8 percent at a premium of 0.70 percent of face value. A…

A: Income is divided into two parts , one is income and other is saving and the net saving is the…

Q: Impact of covid 19 on financial services sector in SEA Question: Does this crisis present an…

A: Answer=

Q: Consider the relative liquidity of the following assets: Assets 1. A $5 bill 2. A share in a…

A: Liquidity refers to how quickly an asset or security can be converted into cash without affecting…

Q: Explain liquidity preference theory of interest. Write its criticism.

A: The theory of liquidity preference was developed by world renowned economist, John Maynard Keynes.…

Q: Discuss how the concepts of pure security,short selling and no arbitrage profit help establish and…

A: Capital market equilibrium requires that market prices be set so that supply equals demand for each…

Q: 25 - According to the Capital Asset Pricing Model (CAPM), a security with a a) negative alpha is…

A: The capital asset pricing model describes the relationship between risk and expected return…

Q: List and describe thefactors that affect theequilibrium interestrate in the bondmarket

A: Answer - The following factors affect the equilibrium interest rate in the bond market - 1. Supply…

Q: (c) Discuss how the “lemons problem” keep securities market from being effective in channelling…

A: "The Market for Lemons: Quality Uncertainty and the Market Mechanism" is a well-known 1970 paper by…

Q: anks continue to offer new services (such as insurance or securities services), their noninterest…

A: In an economy, banking sector is one of the important sectors because it provides financial services…

Q: 1. One of the consideration in making investments which allows the investor to increase the value of…

A: Investing is the act of assigning resources, usually money, into assets with the desire for earning…

Q: If a bank has $100 million in total assets with $40 million in rate-sensitive assets, and $90…

A: Rate sensitive assets means where banks earn interest income by lending loan amount . Whereas rate…

Q: (b) Discuss the roles of financial intermediaries in solving adverse selection and moral hazard.…

A: Financial intermediaries are described as an institution that reacts as a middleman with regard to…

Q: Discuss the Basic Puzzle in Financial Structure around the Globe. What is Lemon Problem? How the…

A: The basic puzzle in the financial structure around the Globe is the adverse selection in the…

Q: What is Supplies of Liquid Funds? What are Laws Limiting Bank Lending and Risk?

A: Liquid funds are mutual funds that invest in assets having a residual maturity of up to 91 days.…

Q: What are the measurement and important key points of financial instruments - presentation PAS 32?

A: A financial instrument is a contract between two parties or entities that has a monetary value…

Q: 48) During business cycle expansions when income and wealth are rising, the demand for bonds and the…

A: According to the theory of assets demand, Income and wealth has positive impact on demand for bonds.…

Q: 1) What is a mortgage-backed security and what part did these play in the 2008 financial crisis? 2)…

A: Note:- Dear learner you have posted multiple questions, as per our policy we will solve only first…

Q: Explain what is meant by Creation of NPAs as a challenge faced by financial system

A: A non-performing asset widely known as NPAs is a loan or an advance for which the principal amount…

Q: Explain interest rate risk and how it arises from a bank’s perspective with specific reference to…

A: The danger posed by a change in interest rates is known as interest rate risk.

Q: 3) What financial institutions are doing a good job at convincing younger generations to place their…

A: There are many risks in today's time that can be seen, and one of the most risks associated with the…

Q: 1. They serve as coordinators who link the buyers and sellers of financial securities, and sometimes…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Step by step

Solved in 2 steps

- a. Identify and explain the three theories of the term structure of interest rates, including anyrelevant assumptions. b. Using two of the three theories explain why the yield curve may be inverted NEED ANSWER FOR BA9. Assuming that the expectations theory is the correct theory of the term structure, calculate the interest rates in the term structure for maturities of one to five years, and plot the resulting yield curves for the following paths of one- year interest rates over the next five years: a. 5%, 6%, 7%, 6%, 5% b. 5%, 4%, 3%, 4%, 5%. c. How would your yield curves change if people preferred shorter-term bonds over longer- term bonds?Using both the liquidity preference framework and thesupply and demand for bonds framework, show whyinterest rates are procyclical (rising when the economyis expanding and falling during recessions).

- 12. what factors motivate the central bank to require tge two selected Dls to hold minimum amounys of liquid assets?Pls select correct option and explain it. Under the floor system of monetary policy, which interest rate serves as a lower bound on the federal funds rate ? a) The overnight, reverse repo rate b) The overnight repo rate c) IOR d) The discount rateApart from risk component, several marcoeconomics factors such as federal reserve (the fed ) policy, federal budget deficit or surplus, international factors and level of business activity- influence interest rate. A. When the economy is weakening, the feds is likely to decrease in short term interest rate. TRUE OR FALSE?

- Label each of the following statements true, false, or uncertain. Explain briefly.a) The term investment, as used by economists, refers to the purchase of bonds andshares of stock b) The central bank can increase the supply of money by selling bonds in the marketfor c) Bond prices and interest rates always move in opposite directions. d) If government spending and taxes increase by the same amount, the IS curve doesnot shift. e) When banks hold only a fraction of deposits in reserve, banks create money. At theend of this process of money creation, the economy is more liquid in the sense that thereis more of the medium of exchange, and the economy is wealthier than before.35. The liquidity premium theory of the term structure is different from the expectations theoryof the term structure because it includesa.a risk premiumb.default riskC .portfolio of AAA and BBB bond yieldsd.differences between the yields on AAA bonds and BBBExplain the micro factors and macro factors which affect the cost of money? What are the conclusions of Beta stability tests and Tests based on the slope of the SML? (hint: refer to Ch 25 in the textbook) Suppose Asset A has an expected return of 10 percent and a standard deviation of 20 percent. Asset B has an expected return of 16 percent and a standard deviation of 40 percent. If the correlation between A and B is 0.35, what are the expected return and standard deviation for a portfolio comprised of 40 percent Asset A and 60 percent Asset B? 1) Calculate what is called Beta, , from the table below (hint : use excel for calculation for beta) and then 2) make the equation with beta and intercept to calculate the expected return of i asset. (hint; use SML equation in Chapter 25 and rRF=5%, M =9% ) Year M i 1 16% 19% 2 -6% -11% 3 12% 17% 4 14% 19% Calculate the expected return of portfolio and standard deviation of portfolio…

- Draw a negatively sloped yield curve and label it curve 1. On the same diagramdraw a new yield curve labelled curve 2 if the expected rate of inflation both shortand long term falls. Label your axes carefullyA. If the money supply equals 100 and monetary velocity is 5, what is nominal GDP? Explain your answer. B. Suppose monetary velocity is growing at 2 percent, the rate of change of the money supply is 3 percent and real GDP grows at 4 percent. What is the rate of inflation, as measured by the rate of change of the GDP deflator? Explain your answer. C. A zero-coupon bond with a yield to maturity of 4% matures five years from now and will pay out €130. Show how to calculate the current price of this bond. (I don’t need the actual figure for the price)Explain why you would be more or less willing to buylong-term Delta Air Lines bonds under the followingcircumstances:a. The company just released its financial statements, indicating that income decreased and liabilities increased.b. You expect a bull market in stocks (stock prices areexpected to increase).c. You have analyzed your country’s monetary policyand expect interest rates to decrease.d. Brokerage commissions on bonds fall.e. Your income and wealth increased over the last two years