26.3X Harvey DaCosta, a sole trader, purchases on 1 November 2015 a new machine for $18,000. His business year end is 31 October but he cannot decide which method of depreciation he should use

26.3X Harvey DaCosta, a sole trader, purchases on 1 November 2015 a new machine for $18,000. His business year end is 31 October but he cannot decide which method of depreciation he should use

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.8E: Depreciation On July 1, 2016, Dexter Corp. buys a computer system for $260,000 in cash. Assume that...

Related questions

Question

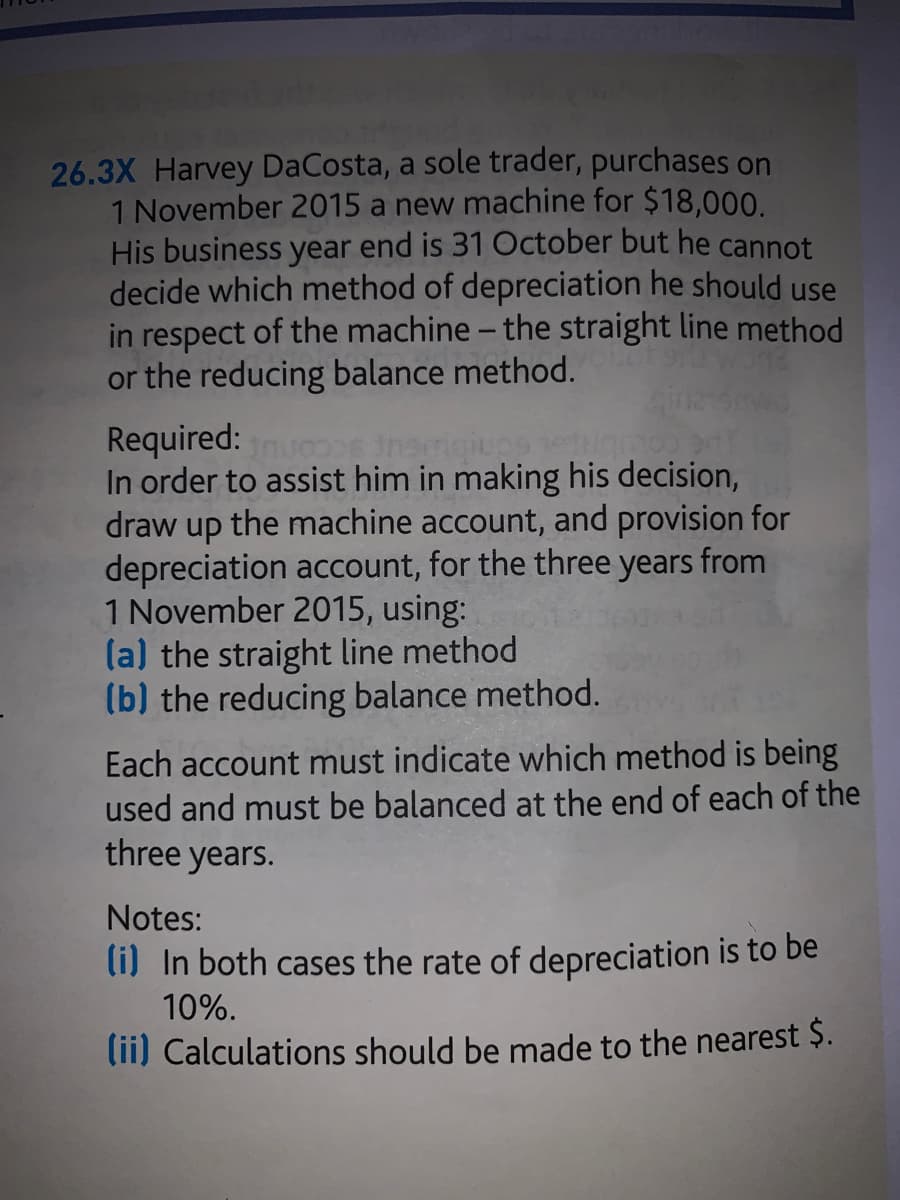

Transcribed Image Text:26.3X Harvey DaCosta, a sole trader, purchases on

1 November 2015 a new machine for $18,000.

His business year end is 31 October but he cannot

decide which method of depreciation he should use

in respect of the machine - the straight line method

or the reducing balance method.

Required:

In order to assist him in making his decision,

draw up the machine account, and provision for

depreciation account, for the three years from

1 November 2015, using:

(a) the straight line method

(b) the reducing balance method.

Each account must indicate which method is being

used and must be balanced at the end of each of the

three years.

Notes:

li) In both cases the rate of depreciation is to be

10%.

lii) Calculations should be made to the nearest $.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning