41. Imran's financial year ends on 31 December. A machine purchased on 1 January 2015 for $20 000 was sold on 30 June 2017 for $8500. The machine had been depreciated using the straight-line method at 25% per annum on a month by month basis. What was the profit or loss on the disposal of the machine? a. loss $1000 b. loss $1500 c. profit $1000 d. profit $1500

41. Imran's financial year ends on 31 December. A machine purchased on 1 January 2015 for $20 000 was sold on 30 June 2017 for $8500. The machine had been depreciated using the straight-line method at 25% per annum on a month by month basis. What was the profit or loss on the disposal of the machine? a. loss $1000 b. loss $1500 c. profit $1000 d. profit $1500

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 1MCQ: Which of the following statements is true? Under cash-basis accounting, revenues are recorded when a...

Related questions

Question

I Only Want The Correct Option in these MCQs can u please help me

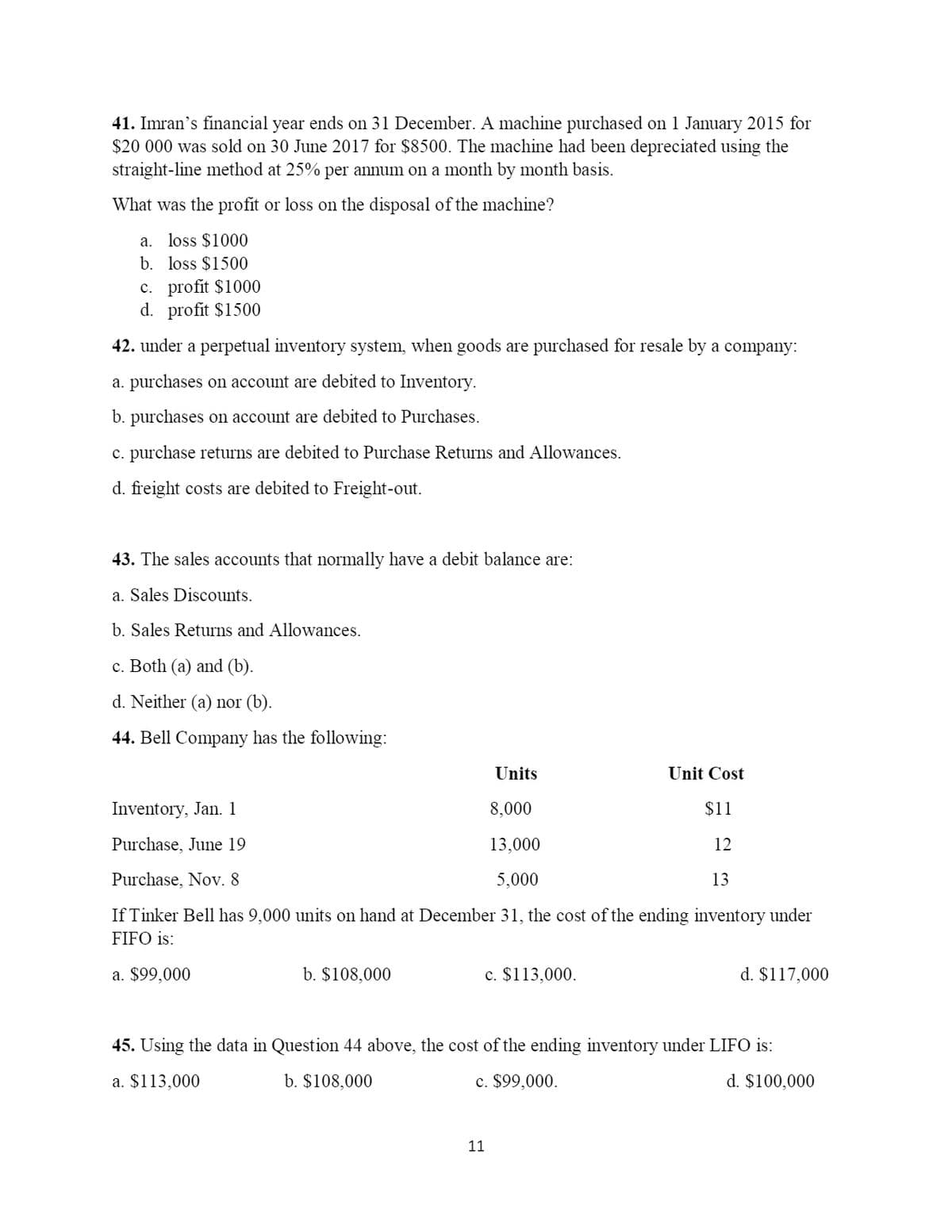

Transcribed Image Text:41. Imran's financial year ends on 31 December. A machine purchased on 1 January 2015 for

$20 000 was sold on 30 June 2017 for $8500. The machine had been depreciated using the

straight-line method at 25% per annum on a month by month basis.

What was the profit or loss on the disposal of the machine?

a. loss $1000

b. loss $1500

c. profit $1000

d. profit $1500

42. under a perpetual inventory system, when goods are purchased for resale by a company:

a. purchases on account are debited to Inventory.

b. purchases on account are debited to Purchases.

c. purchase returns are debited to Purchase Returns and Allowances.

d. freight costs are debited to Freight-out.

43. The sales accounts that normally have a debit balance are:

a. Sales Discounts.

b. Sales Returns and Allowances.

c. Both (a) and (b).

d. Neither (a) nor (b).

44. Bell Company has the following:

Units

Unit Cost

Inventory, Jan. 1

8,000

$1

Purchase, June 19

13,000

12

Purchase, Nov. 8

5,000

13

If Tinker Bell has 9,000 units on hand at December 31, the cost of the ending inventory under

FIFO is:

a. $99,000

b. $108,000

c. $113,000.

d. $117,000

45. Using the data in Question 44 above, the cost of the ending inventory under LIFO is:

a. $113,000

b. $108,000

c. $99,000.

d. $100,000

11

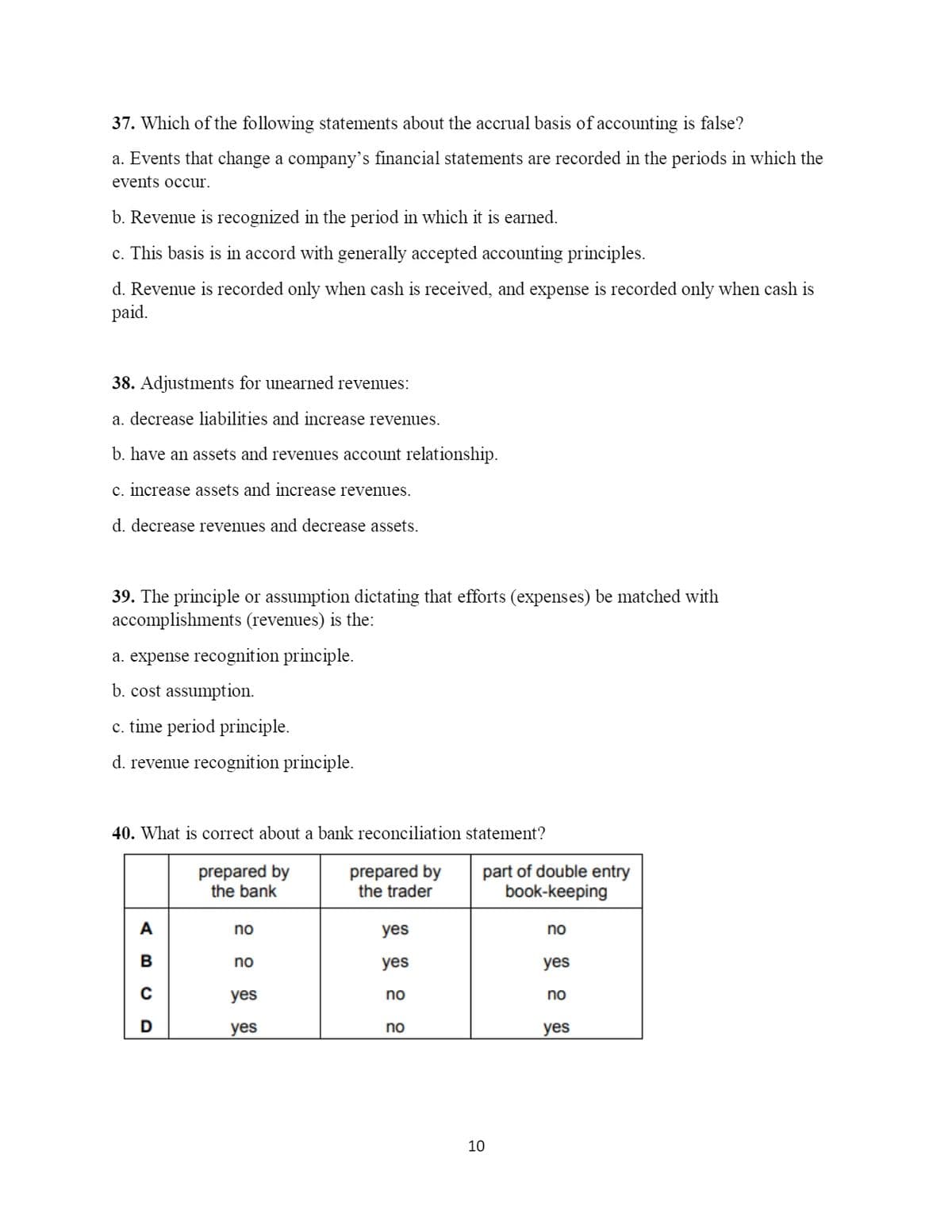

Transcribed Image Text:37. Which of the following statements about the accrual basis of accounting is false?

a. Events that change a company's financial statements are recorded in the periods in which the

events occur.

b. Revenue is recognized in the period in which it is earned.

c. This basis is in accord with generally accepted accounting principles.

d. Revenue is recorded only when cash is received, and expense is recorded only when cash is

paid.

38. Adjustments for unearned revenues:

a. decrease liabilities and increase revenues.

b. have an assets and revenues account relationship.

c. increase assets and increase revenues.

d. decrease revenues and decrease assets.

39. The principle or assumption dictating that efforts (expenses) be matched with

accomplishments (revenues) is the:

a. expense recognition principle.

b. cost assumption.

c. time period principle.

d. revenue recognition principle.

40. What is correct about a bank reconciliation statement?

prepared by

the bank

prepared by

the trader

part of double entry

book-keeping

A

no

yes

no

no

yes

yes

yes

no

no

D

yes

no

yes

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning