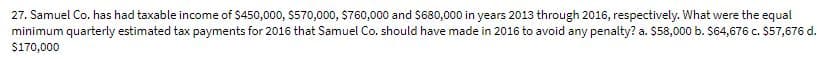

27. Samuel Co. has had taxable income of $450,000, $570,000, $760,000 and $680,000 in years 2013 through 2016, respectively. What were the equal minimum quarterly estimated tax payments for 2016 that Samuel Co. should have made in 2016 to avoid any penalty? a. S$58,000 b. $64,676 c. $57,676 d. $170,000

27. Samuel Co. has had taxable income of $450,000, $570,000, $760,000 and $680,000 in years 2013 through 2016, respectively. What were the equal minimum quarterly estimated tax payments for 2016 that Samuel Co. should have made in 2016 to avoid any penalty? a. S$58,000 b. $64,676 c. $57,676 d. $170,000

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:27. Samuel Co. has had taxable income of $450,000, $570,000, $760,000 and $680,000 in years 2013 through 2016, respectively. What were the equal

minimum quarterly estimated tax payments for 2016 that Samuel Co. should have made in 2016 to avoid any penalty? a. S$58,000 b. $64,676 c. $57,676 d.

$170,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT