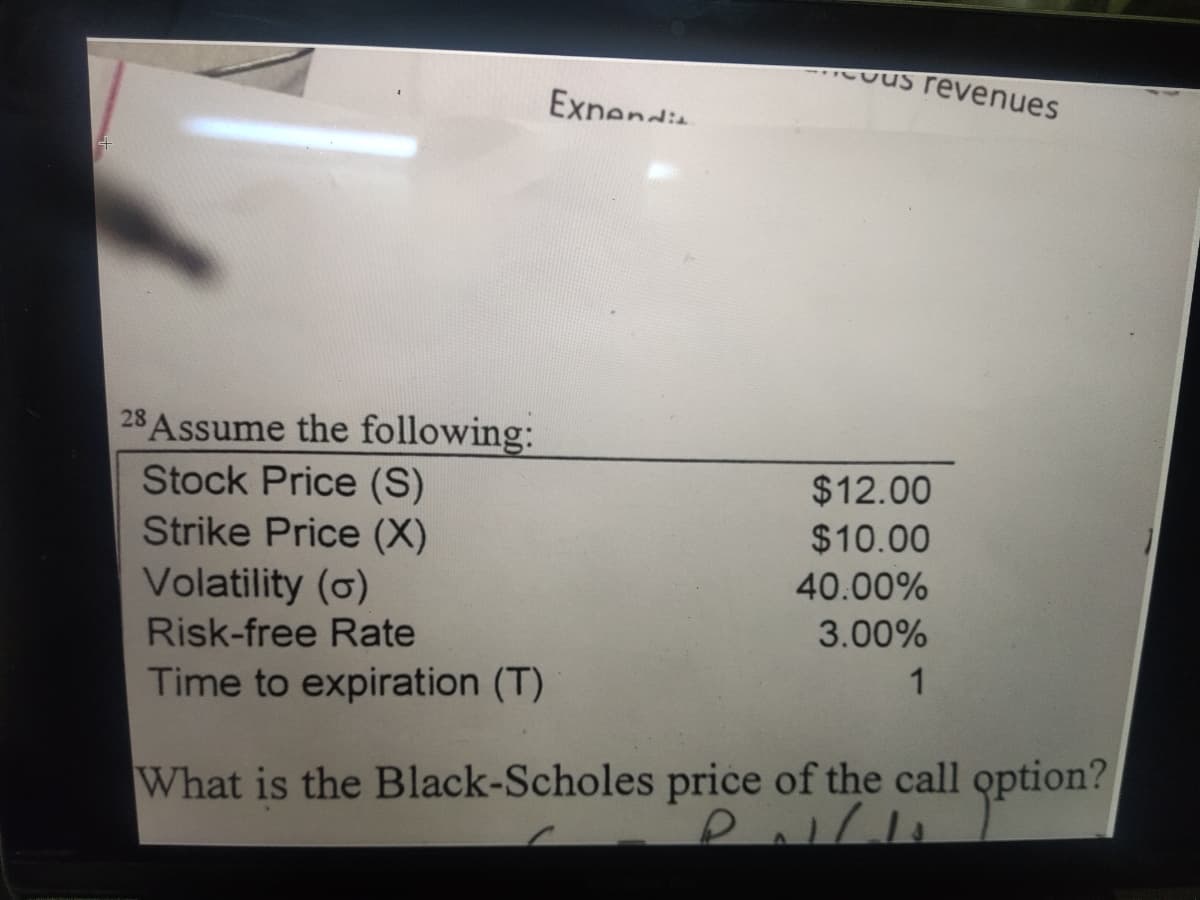

28 Assume the following: Stock Price (S) Strike Price (X) Volatility (6) Risk-free Rate $12.00 $10.00 40.00% 3.00% Time to expiration (T) 1 What is the Black-Scholes price of the call option?

Q: The market price of a security is $52. Its expected rate of return is 12.1%. The risk-free rate is…

A: Dividend = current stock price x expected return = 52 * 12.10% =6.292

Q: c) Assume that using the Security Market Line (SML) the required rate of return (Ra) on stock A is…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Question two The rate of retum on treasury bills (a risk free asset) is 4% p.a. The expected retum…

A: Required rate of return is the actual rate of return received from an investment. It can be same as…

Q: The risk-free rate is 4.15 percent. What is the expected risk premium on this stock given the…

A: Investors have different options to make investments, and the motive behind investments is to…

Q: You're considering purchasing Proctor and Gamble Stock. Suppose the risk-free interest rate is 5.0%…

A: If CAPM hold good, Expected Return on Stock = Risk Free rate + (Market Rate of Return -Risk Free…

Q: The current price of a non-dividend-paying stock is $30. Over the next six months it is expected to…

A: Risk neutral probability to move up for one period P = (e ^(r*T) - d) / (u-d) Where, u =36/30 or 1.2…

Q: 10. Determine the value of a put option using the following information: Risk free rate = 6% Time to…

A: The question is based on the concept of calculation of value for Put option by use of PUT-CALL…

Q: Assume that the risk-free rate is 7.5% and the market risk premium is 5%. What is the required…

A: We need to use CAPM to calculate required rate of return. The equation is rs = Rf +Beta(Rm-Rf) Where…

Q: The market price of a security is $27. Its expected rate of return is 13.1%. The risk-free rate is…

A: Given data; Current market price = $27 current expected return = 13.1% risk free rate = 5% market…

Q: The value of an option is $3.16, its vega is 0.7. What will be the expected price of the option if…

A: Vega of an option will measure the impact of changes in volatility on the price of an option.

Q: Suppose company XYZ's stock is trading at $68.3. You currently hold a call option with a strike…

A: A call option is an instrument which provides its holder an option to buy an underlying asset on a…

Q: . A stock has an initial value of $7, and can go up by 1.2 or down by 0.7, the risk free rate is…

A: PInitial Value is $7 UP move is 1.2 Down move is of 0.7 Total periods 3 Exercise price is 0.13% Risk…

Q: Compute the expected and required return on each stock, determine the appropriate trading strategy

A: Excel Spreadsheet: Excel Workings:

Q: Q2. Calculate Put Gamma, Put Theta, create delta and gamma neutral portfolio from the following…

A: Gamma is a shows how often the option of portfolios need to be adjusted as stock prices changes and…

Q: Assume that the risk-free rate is 7.5% and the market risk premium is 8%. What is the required…

A: The required rate of return can be ascertained by using the Capital Asset Pricing Model (CAPM). The…

Q: 11.2. Below are the expected returns from both stocks based on the probability of economic…

A: Expected return on a stock is the minimum amount of return in the form of profit an investor of a…

Q: You buy a share of stock, write a 1-year call option with X= $65, and buy a 1-year put option with…

A: Risk free interest rate is minimum and guaranteed rate which investor get during the life of the…

Q: Suppose that JPMorgan Chase sells call options on $1.25 million worth of a stock portfolio with beta…

A: Given information in question Sells call option $1.25 million Stock portfolio beta = 1.5 Option…

Q: Problem 6. Find a portfolio of vanilla options written on the same stock that produces the following…

A: Vanilla option-is a call or a put option which enables the holder the right, but not the…

Q: 2. (a) Let the following be observed for the stock price of ZPZ-Bank this day: P = £5.50 (The…

A: Here, To Find: Part a. Fair value of three-month call option =? Part b. Fair value of three-month…

Q: Consider the following information for an individual stock Current share price is $30…

A: TO calculate the price of an European call option C0 = S0* N(d1) - E/ert N(d2) Where, C0 = European…

Q: A stock has a required return of 7%; the risk- free rate is 3.0%; and the market risk premium is 3%.…

A: Following details are given in the question : Required return on stock = 7% Risk free rate = 3%…

Q: Assume the market rate of return is 10.1 percent and the risk-free rate of return is 3.2 percent.…

A: The systematic risk of the market (beta) is 1. Therefore the beta of Lexant = 1 - 2%, which is 0.95…

Q: A stock has an expected return of 13.1%, its beta is 1.70, and the risk free premium rate is 2.6%.…

A: In the given question we require to calculate the expected return on market from the following…

Q: Suppose that many stocks are traded in the market and that it is possible to borrow at the risk-free…

A: a. Expected rate of return for the given risk free portfolio is: Weighted average return of stock A…

Q: required

A: Required rate of return = Risk free rate + Market risk premium * Beta

Q: 3.Consider the three stocks in the following table. P t represents price at time t, and Q1…

A: a, b, and c calculation: Formula snip: For better understanding of b’s calculation, the divisor is…

Q: FIN300 Inc's stock has an expected return of 12.25%, a beta of 1.25, and is in equilibrium. If the…

A: Capital Asset Pricing Model (Expected Return) = R* + (Rm-R*)B Where Expected Rate of Return = 12.25%…

Q: Assume the risk-free rate is 3% and the market return is 10%. Stock X Stock Y Stock Z Beta 0.65 0.90…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: A stock has an expected return of 18.00%. The risk-free rate is 1.45% and the market risk premium is…

A: Marker Risk Premium excess return that market offers above risk-free rate. It is compensation to…

Q: Question 2. At current time t a stock paying no income has price 45, the forward price with maturity…

A: Arbitrage refers to purchasing and selling assets (like securities, commodities or currencies in…

Q: The risk free rate of return is 3.4%; the expected return of the market portfolio is 12.2% and the…

A: CAPM return CAPM model is used for describing the relationship between the expected return and the…

Q: A stock has an expected return of 14.00%. The risk-free rate is 2.64% and the market risk premium is…

A: beta : it is the systemtic risk measure of the stock. formula of beta: beta…

Q: d. Consider a stock with a current price of P $27 Suppose that over the next 6 months the stock…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: 3. A stock sells for $110. A call option on the stock has an exercise price of $105 and expires in…

A: Black-Scholes Model Black-Scholes is a pricing model that uses six factors, including, strike price,…

Q: (a) What is meant by the term alpha? (b) Suppose the CAPM holds. A stock has a beta of 0.8. If the…

A: CAPM is a Capital asset pricing model which is used to compute the expected return on the stock by…

Q: Question 4 The risk-free rate of return is 2.7 percent, the inflation rate is 3.1 percent, and the…

A: Expected rate of return = Risk free rate + (Beta x Market risk premium)

Q: If the stock price is 44, the exercise price is 40, the put price is 1.54, and the Black- Scholes…

A: The question is related to Balck Scholes model. The Black Scholes Merton option pricing model values…

Q: The expected risk premium on a stock is equal to the expected return on the stock minus the:…

A: The return that the investors are expected in order to invest in a particular investment is referred…

Q: Stock A's stock has a beta of 1.30, and its required return is 15.75%. Stock B's beta is 0.80. If…

A: Given information: Stock A beta is 1.30 Required return is 15.75% Stock B beta is 0.80 Risk free…

Q: 1) The risk-free rate is 3.7 percent and the expected return on the market is 12.3 percent. Stock A…

A: If the required return (computed using CAPM) is less than the expected return for stock A, the stock…

Q: 22.Consider the following simplified APT model: Factor Expected Risk Premium Market 6.4% Interest…

A:

Step by step

Solved in 3 steps with 2 images

- A non-dividend-paying stock has a current price of 800 ngwee. In any unit of time (t, t + 1) the price of the stock either increases by 25% or decreases by 20%. K1 held in cash between times t and t + 1 receives interest to become K1.04 at time t + 1. The stock price after t time units is denoted by St.Required:I. Calculate the risk-neutral probability measure for the model.II. Calculate the price (at t = 0) of a derivative contract written on the stock with expiry date t = 2 which pays 1,000 ngwee if and only if S2 is not 800 ngwee (and otherwise pays 0).Assume that the risk-free rate is 6.00% and the market risk premium is 6.75%. What is the expected return for the overall stock market (rM) ? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.)The expected risk premium on a stock is equal to the expected return on the stock minus the: Group of answer choices inflation rate. expected market rate of return. standard deviation. risk-free rate. A stock just paid a dividend of P1.50. The expected rate of return is 10.1%, and the constant growth rate is 4.0%. What is the current stock price? Group of answer choices P23.11 P25.57 P24.31 P23.70

- The reward-to-risk ratio for Stock X, in decimal form, is ______. Round your answer to 3 decimal places (example: if your answer is .04567, you should enter .046). Margin of error for correct responses: +/- .002. expected return (implied by market price) Beta Stock X 9.7% 0.87 S&P500 10% ? T-bonds 3% ?Please show step by step work (not in excel): What is the call option premium given the following information? What would happen to the call price if the company initiated and paid a dividend before the expiration of the option? What would happen to the call premium if the expiration of the option expanded beyond the current 9 months? Stock price $36.00 Strike price $30.00 Volatility 16% Dividend Yield 0.00 Time 0.75 Riskfree Rate 2.70%The risk-free rate is 1.13% and the market risk premium is 6.26%. A stock with a β of 0.84 will have an expected return of ____%. Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

- Market Data Risk-Free Rate (Annualized) 0.025 Vokinar Corporation Stock Price $55.00 Dividend Yield 0.03 Standard Deviation 0.45 Exercise Price $50.00 Maturity (Years) 0.25 Required: Using the Black-Scholes option pricing formula and the data above, please calculate the price of the European call and put for this share of stock. (Use cells A3 to B10 from the given information to complete this question.) Vokinar Corporation d1 d2 N(d1) N(d2) Call Price Put PriceQ9 to Q10 below is based on the following information.Current Stock Price (S0) 80Strike/Exercise Price (K) 75Time to Maturity (T) of 1 year 1Risk-free Rate (r) 0.04Volatility 40%N(d1) 0.6777N(d2) 0.5245N(d1) 0.3223N(d2) 0.4755 Q9. Based on the above information and the Black-Scholes-Merton model, which of thefollowing is the correct Delta () of the European Put option?(A) 0.6777 (positive)(B) 0.5245 (positive)(C) -0.6777 (negative)(D) -0.3223 (negative)Answer: _______________ Q10. Based on the above information and the Black-Scholes-Merton model, which ofthe following is closest to the correct no-arbitrage Put Option price?(A) 8.4852(B) 16.4259(C) 11.3392(D) -16.4259Answer: _______________Assume that a $60 strike call has a 2.0% continuous dividend, r = 5%, the stock price is $61.00, and the volatility is 20%. What is the theta of the option as the expiration time declines from 60 to 50 days? Answer to 2 decimal places. Correct Answers Between -0.2 and -0.18

- Assume that a $55 strike call has a 1.5% continuous dividend, r = 0.05 and the stock price is $50.00. If the option has 45 days until expiration, what is the vega, given a shift in volatility from 33.0% to 34.0%? (show details) A) 0.20 B) 0.15 C) 0.10 D) 0.05 Please show calculation work.If Stock I is correctly priced right now, its Beta must be ______ . Round your answer to 2 decimal places (example: if your answer is 1.2357, you should enter 1.24). Margin of error for correct responses: +/- .02. expected return (implied by market price) Beta Stock I 12.5% ?? S&P500 11% T-bonds 4%Let the standard deviation of the continuously compounded return on the stock is 21 percent. Ignore dividends. Respond to the following. a) What is the theoretical fair value of the October 165 call? b) Based on your answer in part a, recommend a riskless strategy. c) If the stock price decreases by $1, how will the option position offset the loss on the stock