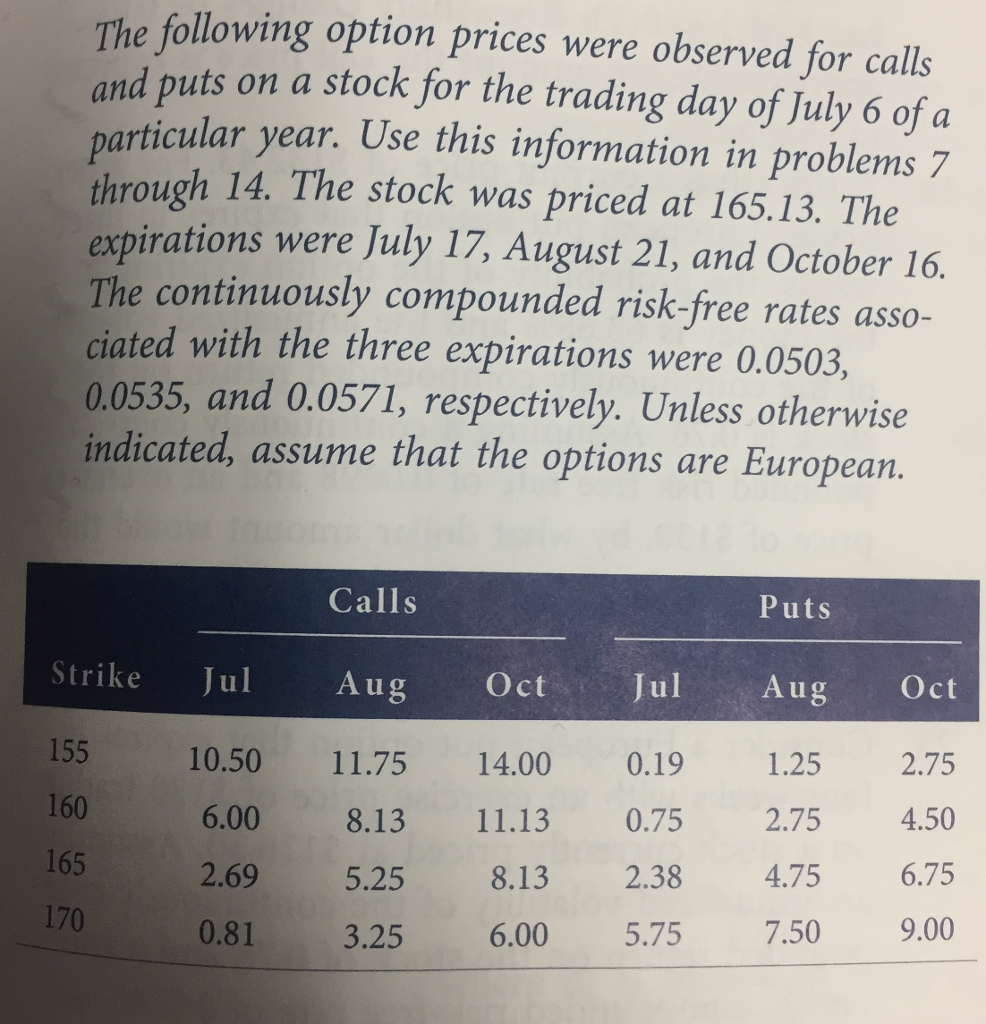

The following option prices were observed for calls and puts on a stock for the trading day of July 6 of particular year. Use this information in problems through 14. The stock was priced at 165.13. The expirations were July 17, August 21, and October 16. The continuously compounded risk-free rates asso- ciated with the three expirations were 0.0503, 0.0535, and 0.0571, respectively. Unless otherwise indicated, assume that the options are European.

The following option prices were observed for calls and puts on a stock for the trading day of July 6 of particular year. Use this information in problems through 14. The stock was priced at 165.13. The expirations were July 17, August 21, and October 16. The continuously compounded risk-free rates asso- ciated with the three expirations were 0.0503, 0.0535, and 0.0571, respectively. Unless otherwise indicated, assume that the options are European.

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 10DQ

Related questions

Question

Let the standard deviation of the continuously compounded return on the stock is 21 percent. Ignore dividends. Respond to the following.

a) What is the theoretical fair value of the October 165 call?

b) Based on your answer in part a, recommend a riskless strategy.

c) If the stock price decreases by $1, how will the option position offset the loss on the stock

Transcribed Image Text:The following option prices were observed for calls

and puts on a stock for the trading day of July 6 of a

particular year. Use this information in problems 7

through 14. The stock was priced at 165.13. The

expirations were July 17, August 21, and October 16.

The continuously compounded risk-free rates asso-

ciated with the three expirations were 0.0503,

0.0535, and 0.0571, respectively. Unless otherwise

indicated, assume that the options are European.

Strike Jul

155

160

165

170

Calls

Aug

10.50 11.75

6.00

2.69

0.81

Oct

14.00

8.13 11.13

5.25

8.13

3.25

6.00

Jul

0.19

0.75

2.38

5.75

Puts

Aug

1.25

2.75

4.75

7.50

Oct

2.75

4.50

6.75

9.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you