28 Required: 1. 2. 3. 4. 5. amount. Purchased a computer on credit for $2,200. Journalise the preceding transactions for Larkspur Furniture using multi-column special journals. Post transaction amounts to ledger accounts and prepare a trial balance. Complete the GST Section of the Business Activity Statement for July. As you are only reporting for one month, you will need to use the quarterly reporting option on the BAS statement. Journalise payment of GST to the ATO on August 1, 2021. A junior accountant is confused about why GST appears on the statement of financial position but not the statement of financial performance. Explain how and why this happens.

28 Required: 1. 2. 3. 4. 5. amount. Purchased a computer on credit for $2,200. Journalise the preceding transactions for Larkspur Furniture using multi-column special journals. Post transaction amounts to ledger accounts and prepare a trial balance. Complete the GST Section of the Business Activity Statement for July. As you are only reporting for one month, you will need to use the quarterly reporting option on the BAS statement. Journalise payment of GST to the ATO on August 1, 2021. A junior accountant is confused about why GST appears on the statement of financial position but not the statement of financial performance. Explain how and why this happens.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

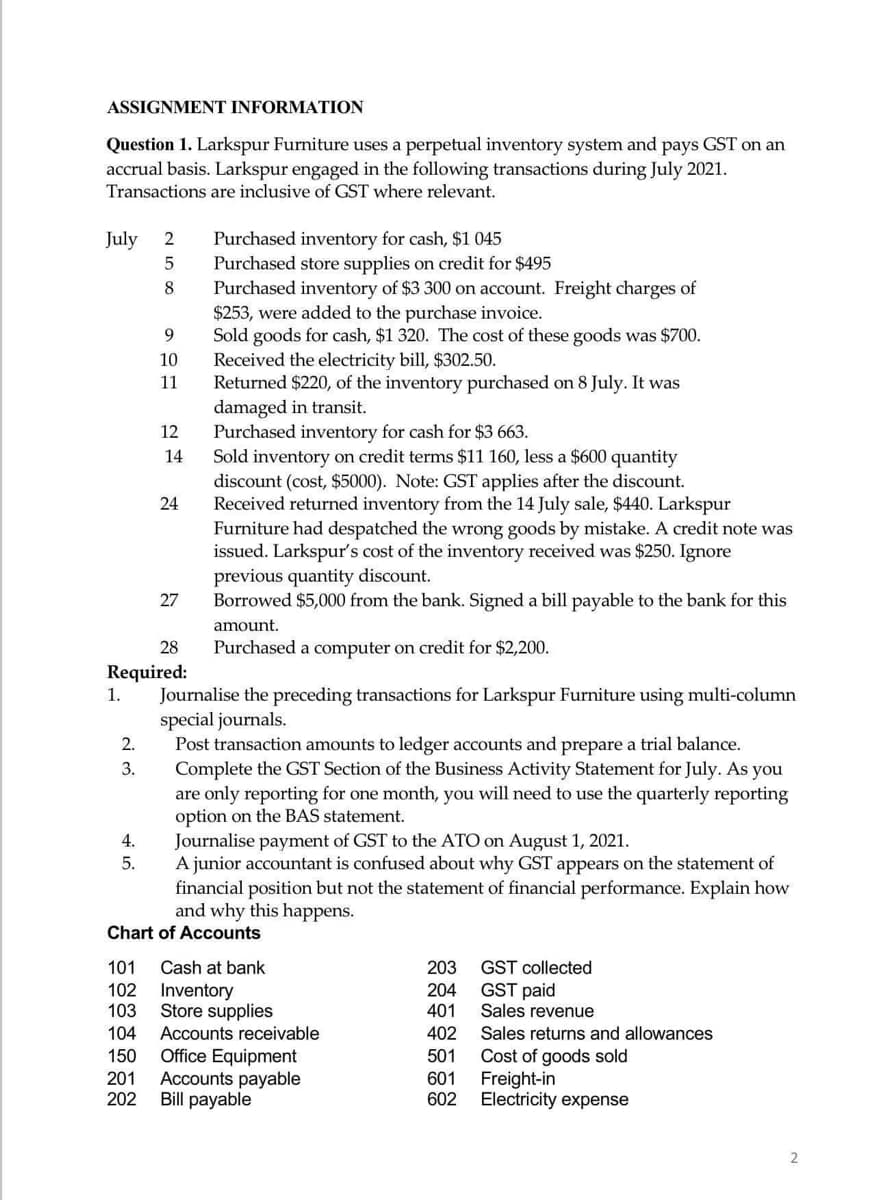

Transcribed Image Text:ASSIGNMENT INFORMATION

Question 1. Larkspur Furniture uses a perpetual inventory system and pays GST on an

accrual basis. Larkspur engaged in the following transactions during July 2021.

Transactions are inclusive of GST where relevant.

July

2.

3.

2

5

8

4.

5.

9

10

11

12

14

24

28

Required:

1.

27

Purchased inventory for cash, $1 045

Purchased store supplies on credit for $495

Purchased inventory of $3 300 on account. Freight charges of

$253, were added to the purchase invoice.

Sold goods for cash, $1 320. The cost of these goods was $700.

Received the electricity bill, $302.50.

Returned $220, of the inventory purchased on 8 July. It was

damaged in transit.

Purchased inventory for cash for $3 663.

Sold inventory on credit terms $11 160, less a $600 quantity

discount (cost, $5000). Note: GST applies after the discount.

Received returned inventory from the 14 July sale, $440. Larkspur

Furniture had despatched the wrong goods by mistake. A credit note was

issued. Larkspur's cost of the inventory received was $250. Ignore

previous quantity discount.

Borrowed $5,000 from the bank. Signed a bill payable to the bank for this

amount.

Purchased a computer on credit for $2,200.

Journalise the preceding transactions for Larkspur Furniture using multi-column

special journals.

Post transaction amounts to ledger accounts and prepare a trial balance.

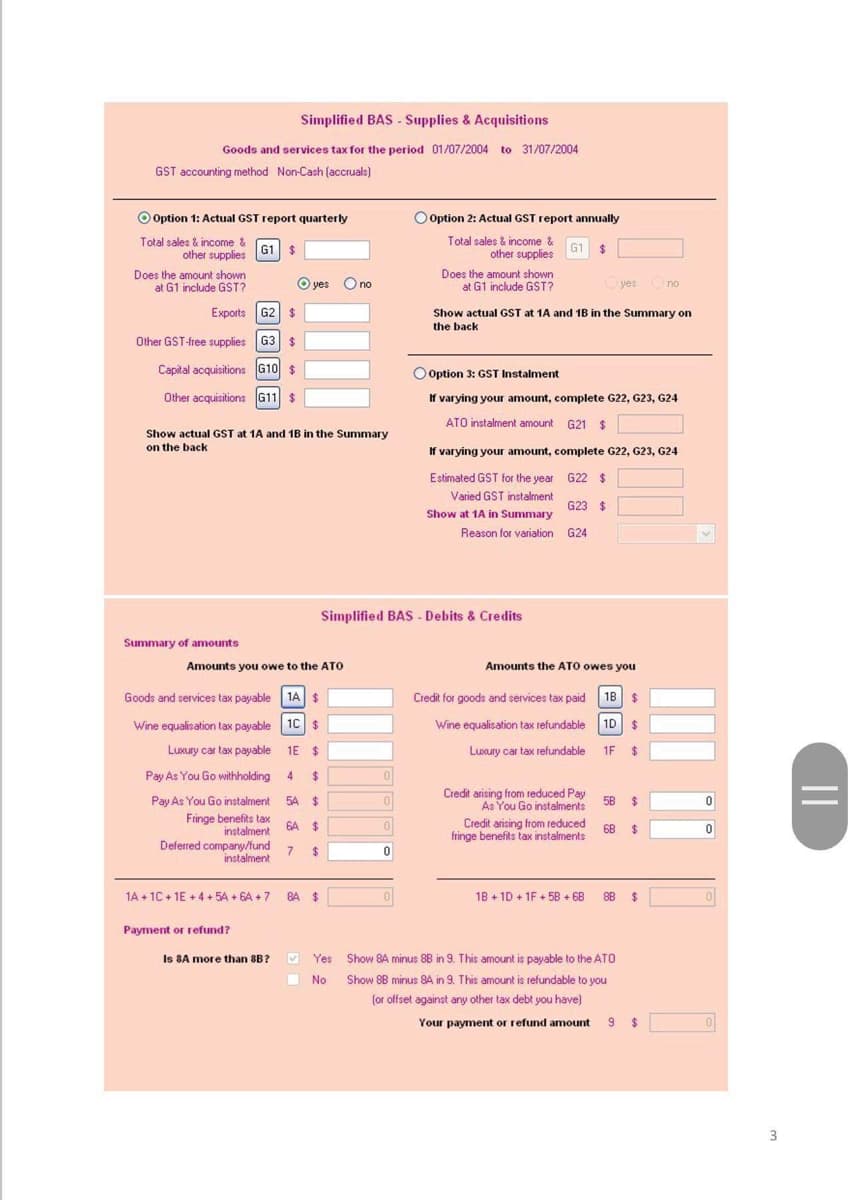

Complete the GST Section of the Business Activity Statement for July. As you

are only reporting for one month, you will need to use the quarterly reporting

option on the BAS statement.

Journalise payment of GST to the ATO on August 1, 2021.

A junior accountant is confused about why GST appears on the statement of

financial position but not the statement of financial performance. Explain how

and why this happens.

Chart of Accounts

101 Cash at bank

102 Inventory

103

104 Accounts receivable

150 Office Equipment

Store supplies

201 Accounts payable

202 Bill payable

203

204

401

402

501

601

602

GST collected

GST paid

Sales revenue

Sales returns and allowances

Cost of goods sold

Freight-in

Electricity expense

2

Transcribed Image Text:Simplified BAS - Supplies & Acquisitions

Goods and services tax for the period 01/07/2004 to 31/07/2004

GST accounting method Non-Cash (accruals)

Option 1: Actual GST report quarterly

Total sales & income &

other supplies

G1 $

Does the amount shown

at G1 include GST?

Exports G2 $

Other GST-free supplies G3 $

Capital acquisitions G10 $

Other acquisitions G11 $

Show actual GST at 1A and 1B in the Summary

on the back

Summary of amounts

O yes O no

Amounts you owe to the ATO

Goods and services tax payable 1A $

Wine equalisation tax payable 1C $

1E $

Luxury car tax payable

Pay As You Go withholding

Pay As You Go instalment

Fringe benefits tax

instalment

Deferred company/fund

instalment

4 $

54 $

6A $

7 $

1A +1C+1E+4+5A +6A +7 84 $

Payment or refund?

Is 8A more than 8B?

BI

Yes

Yes

No

O Option 2: Actual GST report annually

Total sales & income &

other supplies

G1 $

Simplified BAS Debits & Credits

0

0

0

0

Does the amount shown

at G1 include GST?

Show actual GST at 1A and 1B in the Summary on

the back

Option 3: GST Instalment

If varying your amount, complete G22, G23, G24

ATO instalment amount G21 $

If varying your amount, complete G22, G23, G24

Estimated GST for the year G22 $

Varied GST instalment

G23 $

Show at 1A in Summary

Reason for variation

G24

Amounts the ATO owes you

Credit for goods and services tax paid 1B $

Wine equalisation tax refundable 1D $

Luxury car tax refundable

1F $

Credit arising from reduced Pay

As You Go instalments.

Credit arising from reduced

fringe benefits tax instalments

yes no

18+1D +1F +58 +68

5B

$

6B $

Show 84 minus 88 in 9. This amount is payable to the ATO

Show 88 minus 8A in 9. This amount is refundable to you

(or offset against any other tax debt you have)

88 $

Your payment or refund amount 9 $

0

0

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education