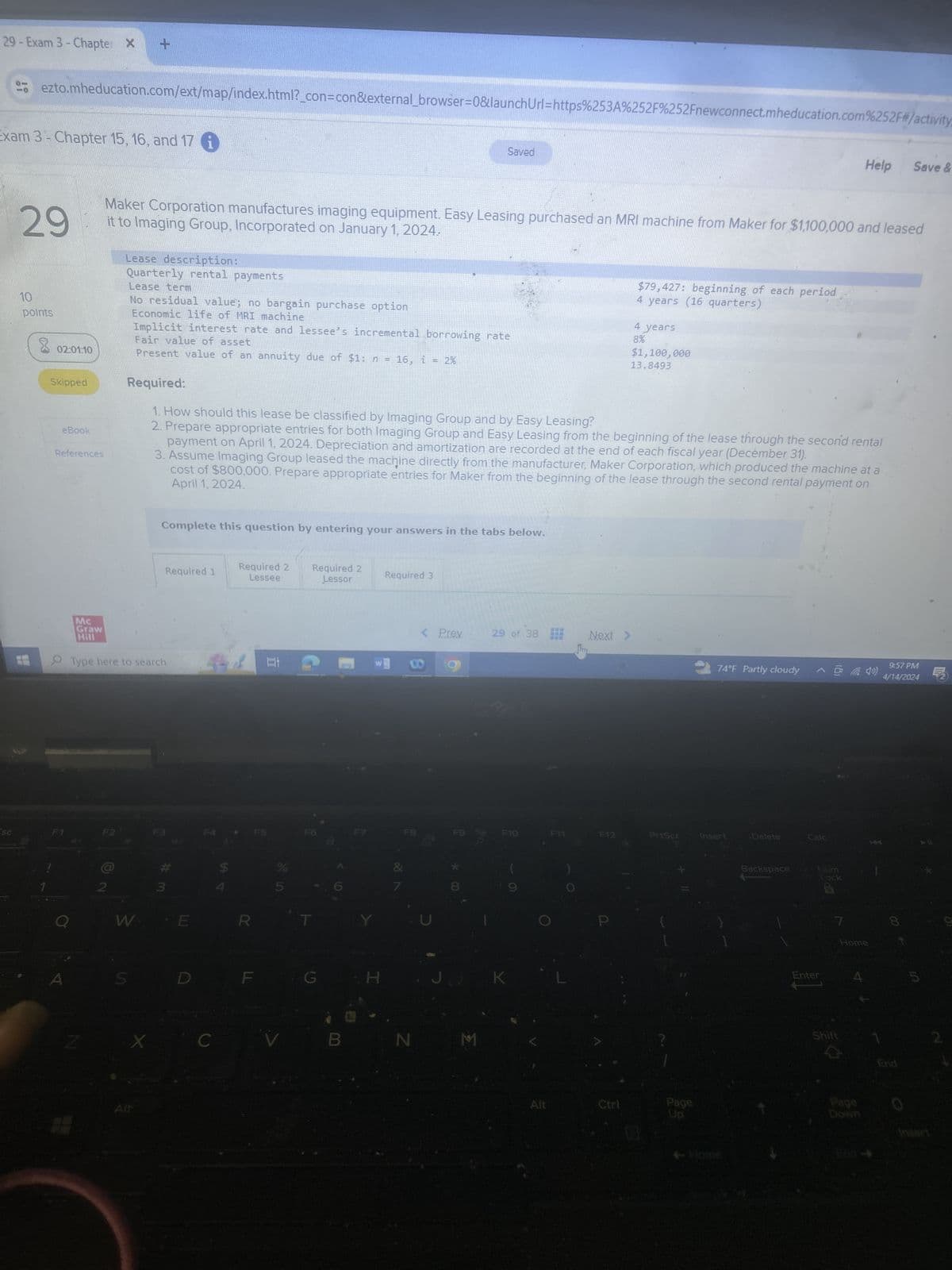

29-Exam 3-Chapter X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity Exam 3 - Chapter 15, 16, and 17 Saved Help Save & 29 10 points 02:01:10 it to Imaging Group, Incorporated on January 1, 2024. Maker Corporation manufactures imaging equipment. Easy Leasing purchased an MRI machine from Maker for $1,100,000 and leased Lease description: Quarterly rental payments Lease term No residual value; no bargain purchase option Economic life of MRI machine Implicit interest rate and lessee's incremental borrowing rate Fair value of asset Present value of an annuity due of $1: n = 16, i = 2% $79,427: beginning of each period 4 years (16 quarters) 4 years 8% $1,100,000 13.8493 SC Skipped Required: eBook References Mc Graw Hill 1. How should this lease be classified by Imaging Group and by Easy Leasing? 2. Prepare appropriate entries for both Imaging Group and Easy Leasing from the beginning of the lease through the second rental payment on April 1, 2024. Depreciation and amortization are recorded at the end of each fiscal year (December 31). 3. Assume Imaging Group leased the machine directly from the manufacturer, Maker Corporation, which produced the machine at a April 1, 2024. cost of $800,000. Prepare appropriate entries for Maker from the beginning of the lease through the second rental payment on Complete this question by entering your answers in the tabs below. Required 1 Required 2 Lessee Required 2 Lessor Required 3 Type here to search F2 a 2 W 3 S Alt E R C 立 F5 F7 W 7 < Prev 29 of 38 Next > 9:57 PM 74°F Partly cloudy 4/14/2024 F10 F11 F12 PrtScr Insert Delete Calc F8 G H K N M Page Alt Ctrl Up Home Backspace tim ock Enter 7 Home 5 Shift 2 End Page

29-Exam 3-Chapter X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity Exam 3 - Chapter 15, 16, and 17 Saved Help Save & 29 10 points 02:01:10 it to Imaging Group, Incorporated on January 1, 2024. Maker Corporation manufactures imaging equipment. Easy Leasing purchased an MRI machine from Maker for $1,100,000 and leased Lease description: Quarterly rental payments Lease term No residual value; no bargain purchase option Economic life of MRI machine Implicit interest rate and lessee's incremental borrowing rate Fair value of asset Present value of an annuity due of $1: n = 16, i = 2% $79,427: beginning of each period 4 years (16 quarters) 4 years 8% $1,100,000 13.8493 SC Skipped Required: eBook References Mc Graw Hill 1. How should this lease be classified by Imaging Group and by Easy Leasing? 2. Prepare appropriate entries for both Imaging Group and Easy Leasing from the beginning of the lease through the second rental payment on April 1, 2024. Depreciation and amortization are recorded at the end of each fiscal year (December 31). 3. Assume Imaging Group leased the machine directly from the manufacturer, Maker Corporation, which produced the machine at a April 1, 2024. cost of $800,000. Prepare appropriate entries for Maker from the beginning of the lease through the second rental payment on Complete this question by entering your answers in the tabs below. Required 1 Required 2 Lessee Required 2 Lessor Required 3 Type here to search F2 a 2 W 3 S Alt E R C 立 F5 F7 W 7 < Prev 29 of 38 Next > 9:57 PM 74°F Partly cloudy 4/14/2024 F10 F11 F12 PrtScr Insert Delete Calc F8 G H K N M Page Alt Ctrl Up Home Backspace tim ock Enter 7 Home 5 Shift 2 End Page

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

Transcribed Image Text:29-Exam 3-Chapter X +

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity

Exam 3 - Chapter 15, 16, and 17

Saved

Help

Save &

29

10

points

02:01:10

it to Imaging Group, Incorporated on January 1, 2024.

Maker Corporation manufactures imaging equipment. Easy Leasing purchased an MRI machine from Maker for $1,100,000 and leased

Lease description:

Quarterly rental payments

Lease term

No residual value; no bargain purchase option

Economic life of MRI machine

Implicit interest rate and lessee's incremental borrowing rate

Fair value of asset

Present value of an annuity due of $1: n = 16, i = 2%

$79,427: beginning of each period

4 years (16 quarters)

4 years

8%

$1,100,000

13.8493

SC

Skipped

Required:

eBook

References

Mc

Graw

Hill

1. How should this lease be classified by Imaging Group and by Easy Leasing?

2. Prepare appropriate entries for both Imaging Group and Easy Leasing from the beginning of the lease through the second rental

payment on April 1, 2024. Depreciation and amortization are recorded at the end of each fiscal year (December 31).

3. Assume Imaging Group leased the machine directly from the manufacturer, Maker Corporation, which produced the machine at a

April 1, 2024.

cost of $800,000. Prepare appropriate entries for Maker from the beginning of the lease through the second rental payment on

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Lessee

Required 2

Lessor

Required 3

Type here to search

F2

a

2

W

3

S

Alt

E

R

C

立

F5

F7

W

7

< Prev

29 of 38

Next >

9:57 PM

74°F Partly cloudy

4/14/2024

F10

F11

F12

PrtScr

Insert

Delete

Calc

F8

G

H

K

N

M

Page

Alt

Ctrl

Up

Home

Backspace

tim

ock

Enter

7

Home

5

Shift

2

End

Page

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you