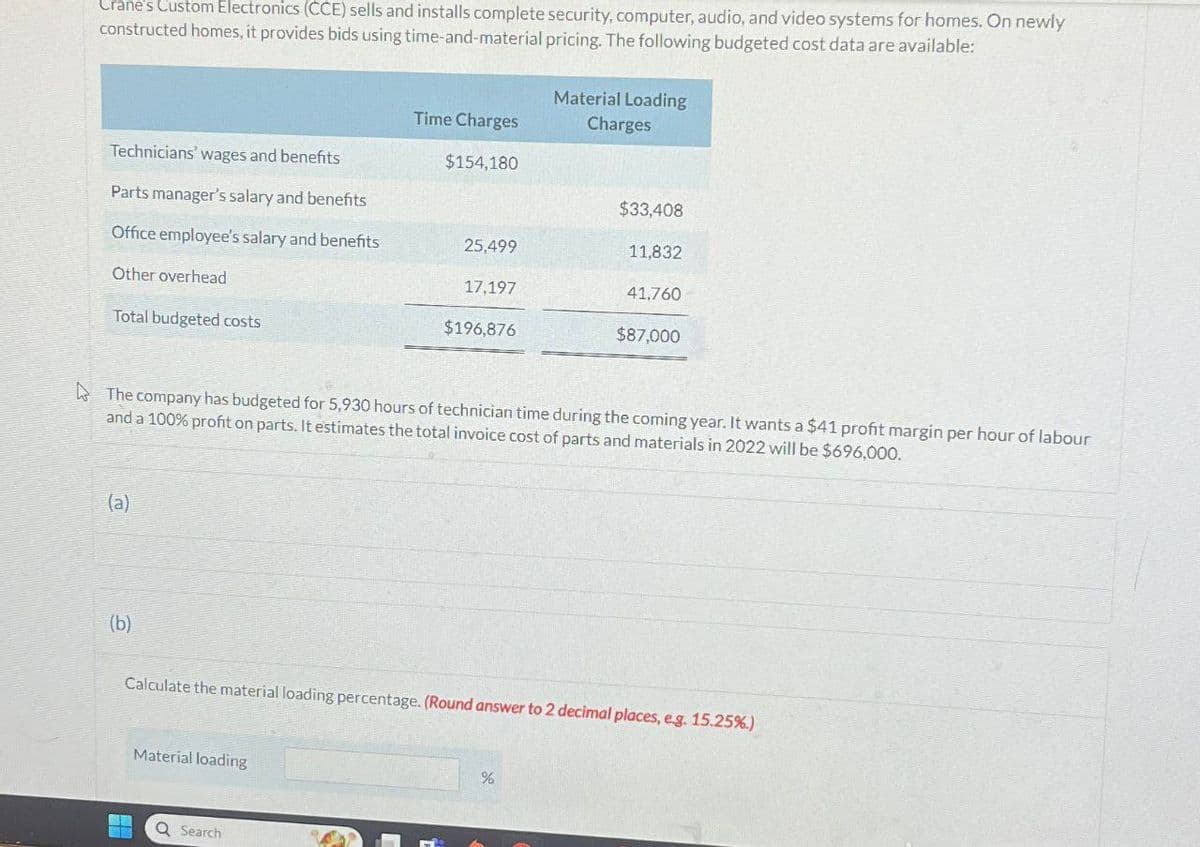

Crane's Custom Electronics (CCE) sells and installs complete security, computer, audio, and video systems for homes. On newly constructed homes, it provides bids using time-and-material pricing. The following budgeted cost data are available: Material Loading Charges Time Charges Technicians' wages and benefits $154,180 Parts manager's salary and benefits $33,408 Office employee's salary and benefits 25,499 11,832 Other overhead 17,197 41,760 Total budgeted costs $196,876 $87,000 The company has budgeted for 5,930 hours of technician time during the coming year. It wants a $41 profit margin per hour of labour and a 100% profit on parts. It estimates the total invoice cost of parts and materials in 2022 will be $696,000. (a) (b) Calculate the material loading percentage. (Round answer to 2 decimal places, e.g. 15.25%.) Material loading Q Search %

Crane's Custom Electronics (CCE) sells and installs complete security, computer, audio, and video systems for homes. On newly constructed homes, it provides bids using time-and-material pricing. The following budgeted cost data are available: Material Loading Charges Time Charges Technicians' wages and benefits $154,180 Parts manager's salary and benefits $33,408 Office employee's salary and benefits 25,499 11,832 Other overhead 17,197 41,760 Total budgeted costs $196,876 $87,000 The company has budgeted for 5,930 hours of technician time during the coming year. It wants a $41 profit margin per hour of labour and a 100% profit on parts. It estimates the total invoice cost of parts and materials in 2022 will be $696,000. (a) (b) Calculate the material loading percentage. (Round answer to 2 decimal places, e.g. 15.25%.) Material loading Q Search %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 6E: Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing...

Related questions

Question

Answer please fast it @@@

Transcribed Image Text:Crane's Custom Electronics (CCE) sells and installs complete security, computer, audio, and video systems for homes. On newly

constructed homes, it provides bids using time-and-material pricing. The following budgeted cost data are available:

Material Loading

Charges

Time Charges

Technicians' wages and benefits

$154,180

Parts manager's salary and benefits

$33,408

Office employee's salary and benefits

25,499

11,832

Other overhead

17,197

41,760

Total budgeted costs

$196,876

$87,000

The company has budgeted for 5,930 hours of technician time during the coming year. It wants a $41 profit margin per hour of labour

and a 100% profit on parts. It estimates the total invoice cost of parts and materials in 2022 will be $696,000.

(a)

(b)

Calculate the material loading percentage. (Round answer to 2 decimal places, e.g. 15.25%.)

Material loading

Q Search

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning