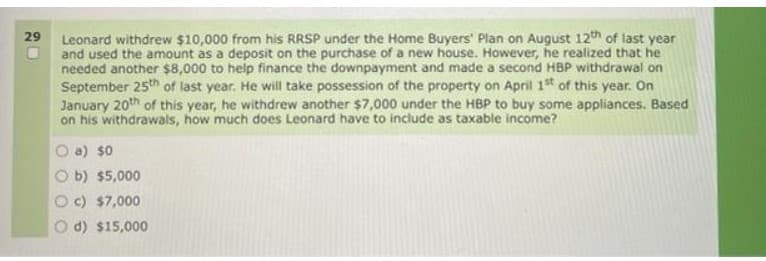

29 Leonard withdrew $10,000 from his RRSP under the Home Buyers' Plan on August 12th of last year and used the amount as a deposit on the purchase of a new house. However, he realized that he needed another $8,000 to help finance the downpayment and made a second HBP withdrawal on September 25th of last year. He will take possession of the property on April 1st of this year. On January 20th of this year, he withdrew another $7,000 under the HBP to buy some appliances. Based on his withdrawals, how much does Leonard have to include as taxable income? a) $0 b) $5,000 c) $7,000 d) $15,000

29 Leonard withdrew $10,000 from his RRSP under the Home Buyers' Plan on August 12th of last year and used the amount as a deposit on the purchase of a new house. However, he realized that he needed another $8,000 to help finance the downpayment and made a second HBP withdrawal on September 25th of last year. He will take possession of the property on April 1st of this year. On January 20th of this year, he withdrew another $7,000 under the HBP to buy some appliances. Based on his withdrawals, how much does Leonard have to include as taxable income? a) $0 b) $5,000 c) $7,000 d) $15,000

Chapter4: Additional Income And The Qualified Business Income Deduction

Section: Chapter Questions

Problem 16MCQ: John owns a second home in Palm Springs, CA. During the year, he rented the house for $5,000 for 56...

Related questions

Question

Transcribed Image Text:29 Leonard withdrew $10,000 from his RRSP under the Home Buyers' Plan on August 12th of last year

and used the amount as a deposit on the purchase of a new house. However, he realized that he

needed another $8,000 to help finance the downpayment and made a second HBP withdrawal on

September 25th of last year. He will take possession of the property on April 1st of this year. On

January 20th of this year, he withdrew another $7,000 under the HBP to buy some appliances. Based

on his withdrawals, how much does Leonard have to include as taxable income?

a) $0

b) $5,000

c) $7,000

d) $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning