compute for adjusted book balance as on november 30 , adjusted bank receipts for december ; adjusted bank disbursements for December Please show complete solutions.

compute for adjusted book balance as on november 30 , adjusted bank receipts for december ; adjusted bank disbursements for December Please show complete solutions.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash And Marketable Securities

Section: Chapter Questions

Problem 32MCQ

Related questions

Question

compute for adjusted book balance as on november 30 , adjusted bank receipts for december ; adjusted bank disbursements for December

Please show complete solutions.

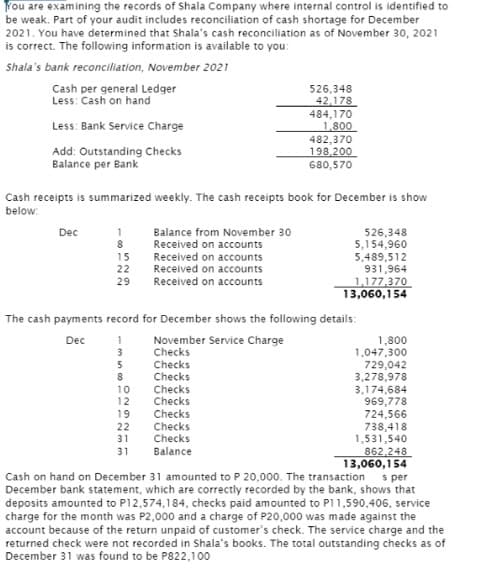

Transcribed Image Text:You are examining the records of Shala Company where internal control is identified to

be weak. Part of your audit includes reconciliation of cash shortage for December

2021. You have determined that Shala's cash reconciliation as of November 30, 2021

is correct. The following information is available to you:

Shala's bank reconciliation, November 2021

Cash per general Ledger

Less: Cash on hand

Less: Bank Service Charge

Add: Outstanding Checks

Balance per Bank

Cash receipts is summarized weekly. The cash receipts book for December is show

below:

Dec

1

8

15

22

29

8

10

12

Balance from November 30

Received on accounts

Received on accounts

Received on accounts

Received on accounts

The cash payments record for December shows the following details:

Dec

1 November Service Charge

3

5

19

22

31

31

526,348

42,178

484,170

1,800

482,370

198,200

680,570

Checks

Checks

Checks

Checks

Checks

Checks

Checks

Checks

Balance

526,348

5,154,960

5,489,512

931,964

1,177,370

13,060,154

1,800

1,047,300

729,042

3,278,978

3,174,684

969,778

724,566

738,418

1,531,540

862,248

13,060,154

s per

Cash on hand on December 31 amounted to P 20,000. The transaction

December bank statement, which are correctly recorded by the bank, shows that

deposits amounted to P12,574,184, checks paid amounted to P11,590,406, service

charge for the month was P2,000 and a charge of P20,000 was made against the

account because of the return unpaid of customer's check. The service charge and the

returned check were not recorded in Shala's books. The total outstanding checks as of

December 31 was found to be P822,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning