2$ 16,261.96 e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. 2$ 124,098.0 f. What right-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. $ 124,098

2$ 16,261.96 e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. 2$ 124,098.0 f. What right-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. $ 124,098

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 1P

Related questions

Question

The last two please.

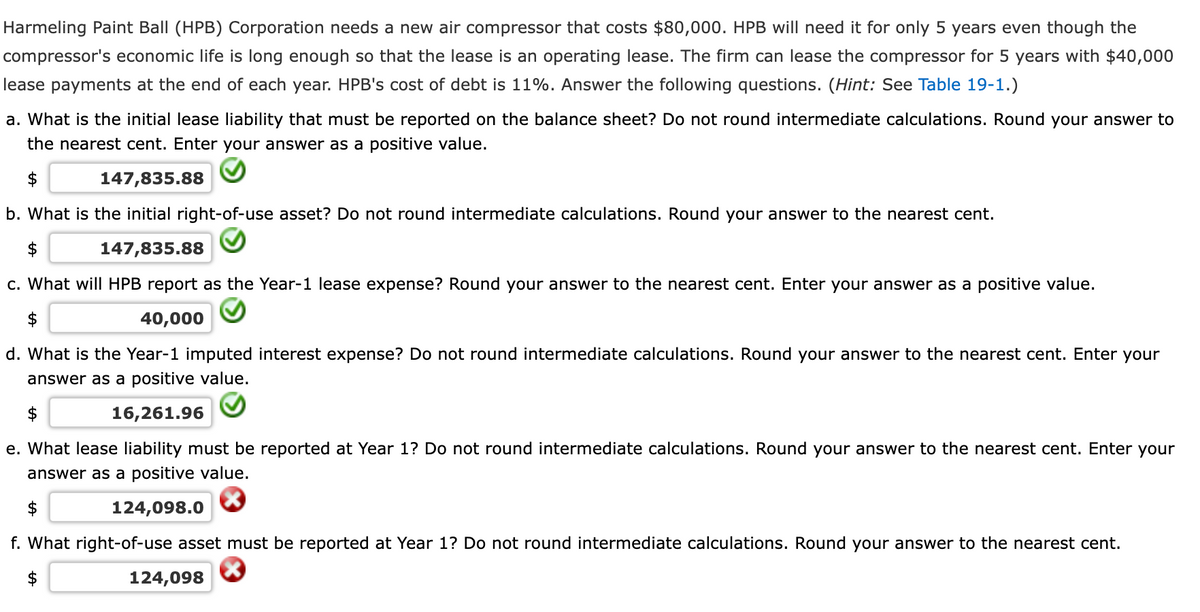

Transcribed Image Text:Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $80,000. HPB will need it for only 5 years even though the

compressor's economic life is long enough so that the lease is an operating lease. The firm can lease the compressor for 5 years with $40,000

lease payments at the end of each year. HPB's cost of debt is 11%. Answer the following questions. (Hint: See Table 19-1.)

a. What is the initial lease liability that must be reported on the balance sheet? Do not round intermediate calculations. Round your answer to

the nearest cent. Enter your answer as a positive value.

$

147,835.88

b. What is the initial right-of-use asset? Do not round intermediate calculations. Round your answer to the nearest cent.

$

147,835.88

c. What will HPB report as the Year-1 lease expense? Round your answer to the nearest cent. Enter your answer as a positive value.

$

40,000

d. What is the Year-1 imputed interest expense? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your

answer as a positive value.

$

16,261.96

e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your

answer as a positive value.

124,098.0

f. What right-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent.

$

124,098

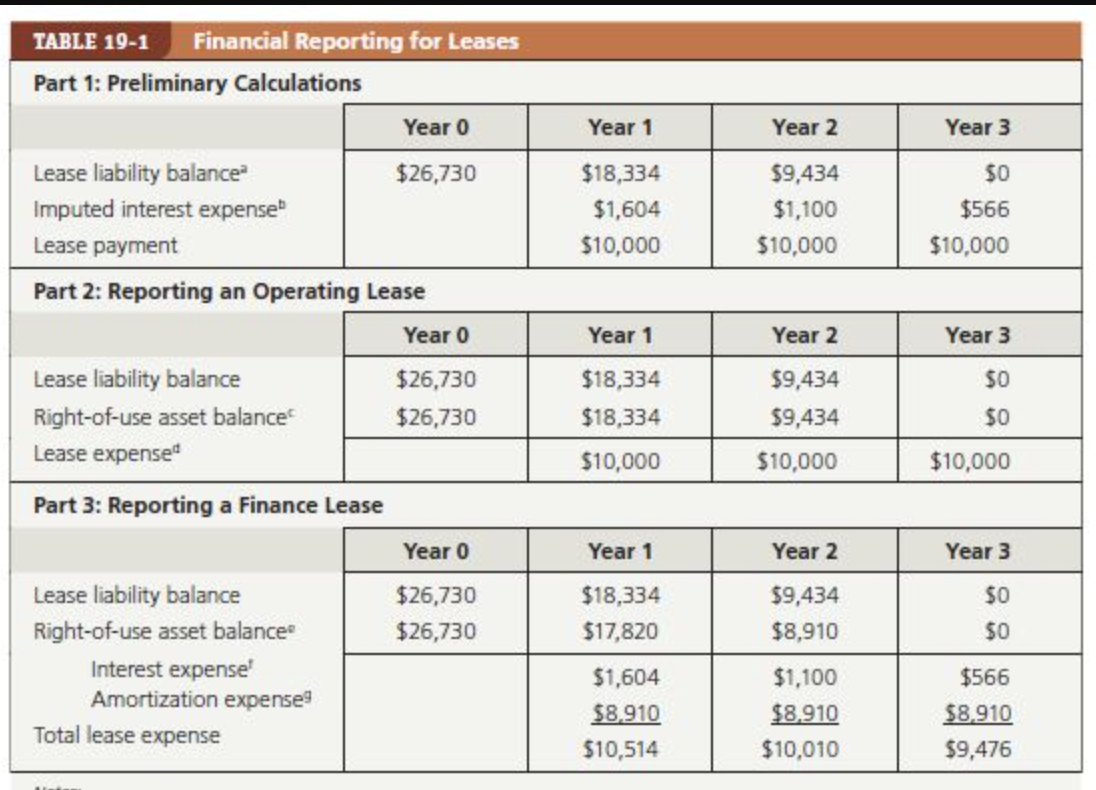

Transcribed Image Text:TABLE 19-1

Financial Reporting for Leases

Part 1: Preliminary Calculations

Year 0

Year 1

Year 2

Year 3

Lease liability balance

$26,730

$18,334

$9,434

$0

Imputed interest expense

$1,604

$1,100

$566

Lease payment

$10,000

$10,000

$10,000

Part 2: Reporting an Operating Lease

Year 0

Year 1

Year 2

Year 3

Lease liability balance

$26,730

$18,334

$9,434

$0

Right-of-use asset balance

$26,730

$18,334

$9,434

$0

Lease expense"

$10,000

0,000

$10,000

Part 3: Reporting a Finance Lease

Year 0

Year 1

Year 2

Year 3

Lease liability balance

$26,730

$18,334

$9,434

$0

Right-of-use asset balance

$26,730

$17,820

$8,910

$0

Interest expense

Amortization expense

$1,604

$1,100

$566

$8.910

$8,910

$8,910

Total lease expense

$10,514

$10,010

$9,476

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College