2nl phary sutcln I0.19 Aceoutivg Total Problem 6 A factory uses a job costing system. The following data ar vailable from the books pertaining to job No. A-5: Materials (direct): 14.60 Kg@ Tk. 2.50 Kg. Wages (direct): Department X 18 hours @ Tk.. 3.50 per hour Department Y 32 hours aTk. 3.00 per hour Budget overhead for the year based on normal capacity is as follows Variable overhead: Department X Tk. 5.400 for 9.000 direct labor hours Department Y Tk. 8.000 for 10.000 direct labor hours Fixed overhead: Total budget direct labor hours for whole factory 22,000 Total budget expenditure Tk. 16.500 Required: (i) Compute the factory overhead rate. (ii) Calculate the total cost of job No. A-5 (iii) Estimate the percentage of profit obtained if the price quoted to the eustomer is Tk. 350 (iv) Suppose the actual fixed overhead costs and direct labor hours used in the factory are Tk. 19.000 and 24.000 hours respectively. then what would be the amount of under applied or over applied?

2nl phary sutcln I0.19 Aceoutivg Total Problem 6 A factory uses a job costing system. The following data ar vailable from the books pertaining to job No. A-5: Materials (direct): 14.60 Kg@ Tk. 2.50 Kg. Wages (direct): Department X 18 hours @ Tk.. 3.50 per hour Department Y 32 hours aTk. 3.00 per hour Budget overhead for the year based on normal capacity is as follows Variable overhead: Department X Tk. 5.400 for 9.000 direct labor hours Department Y Tk. 8.000 for 10.000 direct labor hours Fixed overhead: Total budget direct labor hours for whole factory 22,000 Total budget expenditure Tk. 16.500 Required: (i) Compute the factory overhead rate. (ii) Calculate the total cost of job No. A-5 (iii) Estimate the percentage of profit obtained if the price quoted to the eustomer is Tk. 350 (iv) Suppose the actual fixed overhead costs and direct labor hours used in the factory are Tk. 19.000 and 24.000 hours respectively. then what would be the amount of under applied or over applied?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:2nl phary sutcln

I0.19

Aceoutivg

Total

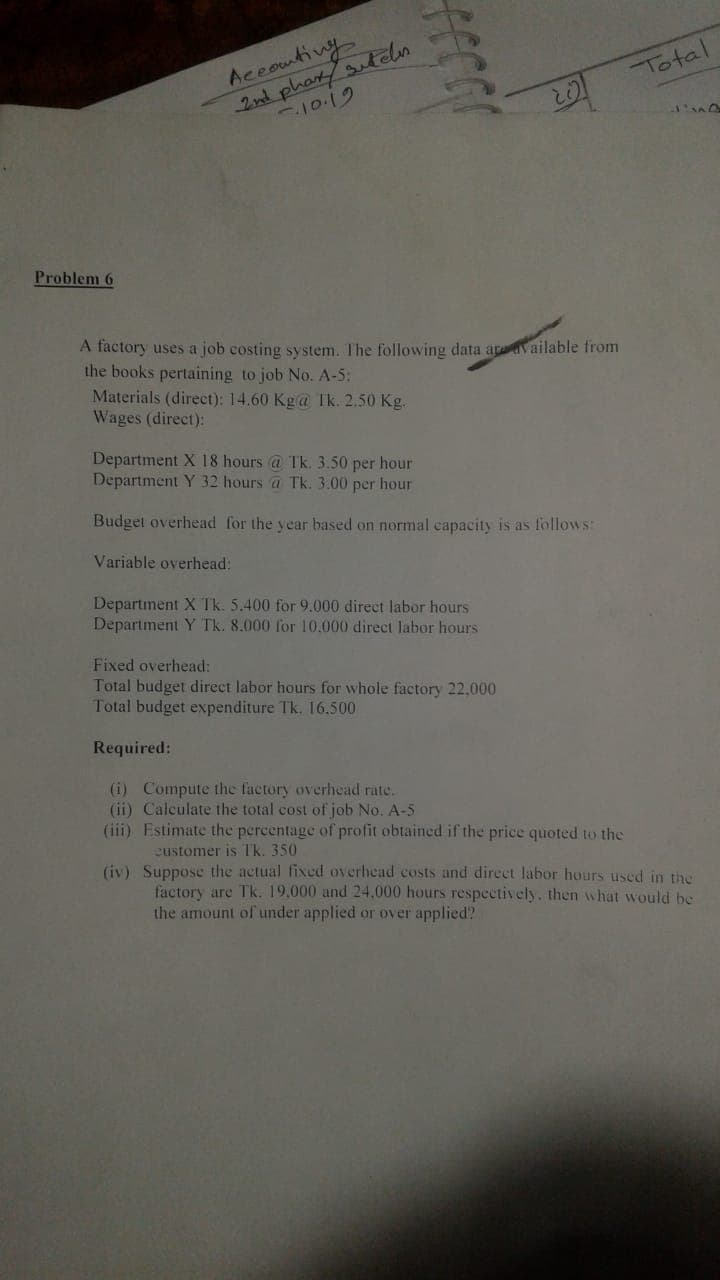

Problem 6

A factory uses a job costing system. The following data ar vailable from

the books pertaining to job No. A-5:

Materials (direct): 14.60 Kg@ Tk. 2.50 Kg.

Wages (direct):

Department X 18 hours @ Tk.. 3.50 per hour

Department Y 32 hours aTk. 3.00 per hour

Budget overhead for the year based on normal capacity is as follows

Variable overhead:

Department X Tk. 5.400 for 9.000 direct labor hours

Department Y Tk. 8.000 for 10.000 direct labor hours

Fixed overhead:

Total budget direct labor hours for whole factory 22,000

Total budget expenditure Tk. 16.500

Required:

(i) Compute the factory overhead rate.

(ii) Calculate the total cost of job No. A-5

(iii) Estimate the percentage of profit obtained if the price quoted to the

eustomer is Tk. 350

(iv) Suppose the actual fixed overhead costs and direct labor hours used in the

factory are Tk. 19.000 and 24.000 hours respectively. then what would be

the amount of under applied or over applied?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education