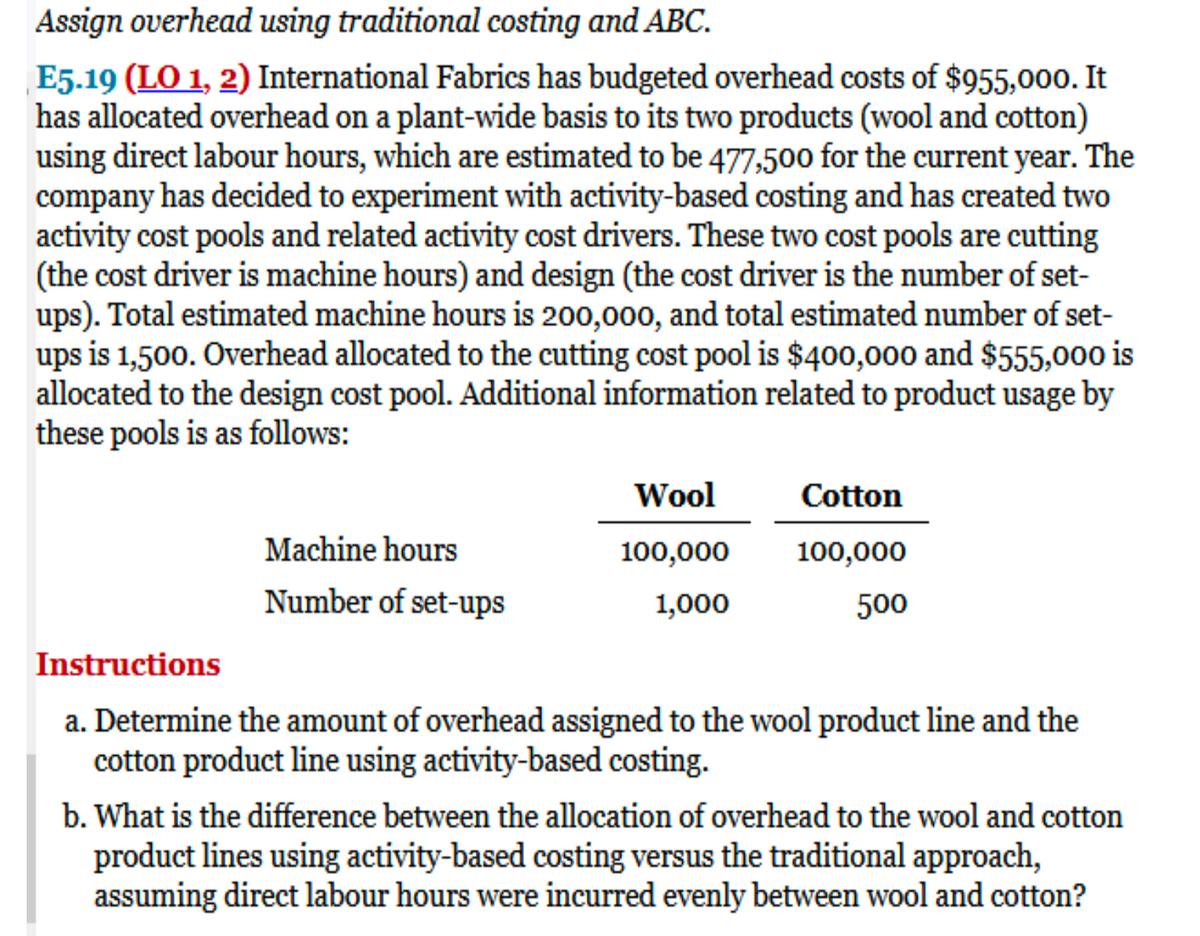

Assign overhead using traditional costing and ABC. E5.19 (LO 1, 2) International Fabrics has budgeted overhead costs of $955,000. It has allocated overhead on a plant-wide basis to its two products (wool and cotton) using direct labour hours, which are estimated to be 477,500 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (the cost driver is machine hours) and design (the cost driver is the number of set- ups). Total estimated machine hours is 200,000, and total estimated number of set- ups is 1,500. Overhead allocated to the cutting cost pool is $400,000 and $555,000 is allocated to the design cost pool. Additional information related to product usage by these pools is as follows: Wool Cotton Machine hours 100,000 100,000 Number of set-ups 1,000 500 Instructions a. Determine the amount of overhead assigned to the wool product line and the cotton product line using activity-based costing. b. What is the difference between the allocation of overhead to the wool and cotton product lines using activity-based costing versus the traditional approach, assuming direct labour hours were incurred evenly between wool and cotton?

Assign overhead using traditional costing and ABC. E5.19 (LO 1, 2) International Fabrics has budgeted overhead costs of $955,000. It has allocated overhead on a plant-wide basis to its two products (wool and cotton) using direct labour hours, which are estimated to be 477,500 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (the cost driver is machine hours) and design (the cost driver is the number of set- ups). Total estimated machine hours is 200,000, and total estimated number of set- ups is 1,500. Overhead allocated to the cutting cost pool is $400,000 and $555,000 is allocated to the design cost pool. Additional information related to product usage by these pools is as follows: Wool Cotton Machine hours 100,000 100,000 Number of set-ups 1,000 500 Instructions a. Determine the amount of overhead assigned to the wool product line and the cotton product line using activity-based costing. b. What is the difference between the allocation of overhead to the wool and cotton product lines using activity-based costing versus the traditional approach, assuming direct labour hours were incurred evenly between wool and cotton?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter18: Activity-based Costing

Section: Chapter Questions

Problem 3CMA: Young Company is beginning operations and is considering three alternatives to allocate...

Related questions

Question

please explain in steps. thanks

Transcribed Image Text:Assign overhead using traditional costing and ABC.

E5.19 (LO 1, 2) International Fabrics has budgeted overhead costs of $955,000. It

has allocated overhead on a plant-wide basis to its two products (wool and cotton)

using direct labour hours, which are estimated to be 477,500 for the current year. The

company has decided to experiment with activity-based costing and has created two

activity cost pools and related activity cost drivers. These two cost pools are cutting

(the cost driver is machine hours) and design (the cost driver is the number of set-

ups). Total estimated machine hours is 200,000, and total estimated number of set-

ups is 1,500. Overhead allocated to the cutting cost pool is $400,000 and $555,000 is

allocated to the design cost pool. Additional information related to product usage by

these pools is as follows:

Wool

Cotton

Machine hours

100,000

100,000

Number of set-ups

1,000

500

Instructions

a. Determine the amount of overhead assigned to the wool product line and the

cotton product line using activity-based costing.

b. What is the difference between the allocation of overhead to the wool and cotton

product lines using activity-based costing versus the traditional approach,

assuming direct labour hours were incurred evenly between wool and cotton?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning