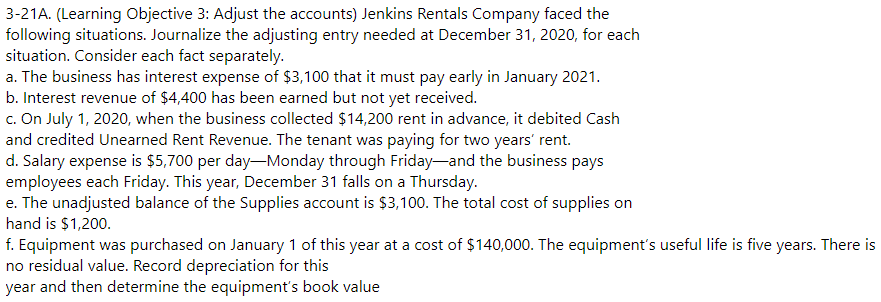

3-21A. (Learning Objective 3: Adjust the accounts) Jenkins Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2020, for each situation. Consider each fact separately. a. The business has interest expense of $3,100 that it must pay early in January 2021. b. Interest revenue of $4,400 has been earned but not yet received. c. On July 1, 2020, when the business collected $14,200 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent. d. Salary expense is $5,700 per day-Monday through Friday-and the business pays employees each Friday. This year, December 31 falls on a Thursday. e. The unadjusted balance of the Supplies account is $3,100. The total cost of supplies on hand is $1,200. f Eguinment was purchased on lanuary 1 of this vear at a cost of S140.000 The eguinment's useful life is

3-21A. (Learning Objective 3: Adjust the accounts) Jenkins Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2020, for each situation. Consider each fact separately. a. The business has interest expense of $3,100 that it must pay early in January 2021. b. Interest revenue of $4,400 has been earned but not yet received. c. On July 1, 2020, when the business collected $14,200 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent. d. Salary expense is $5,700 per day-Monday through Friday-and the business pays employees each Friday. This year, December 31 falls on a Thursday. e. The unadjusted balance of the Supplies account is $3,100. The total cost of supplies on hand is $1,200. f Eguinment was purchased on lanuary 1 of this vear at a cost of S140.000 The eguinment's useful life is

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:3-21A. (Learning Objective 3: Adjust the accounts) Jenkins Rentals Company faced the

following situations. Journalize the adjusting entry needed at December 31, 2020, for each

situation. Consider each fact separately.

a. The business has interest expense of $3,100 that it must pay early in January 2021.

b. Interest revenue of $4,400 has been earned but not yet received.

c. On July 1, 2020, when the business collected $14,200 rent in advance, it debited Cash

and credited Unearned Rent Revenue. The tenant was paying for two years' rent.

d. Salary expense is $5,700 per day-Monday through Friday-and the business pays

employees each Friday. This year, December 31 falls on a Thursday.

e. The unadjusted balance of the Supplies account is $3,100. The total cost of supplies on

hand is $1,200.

f. Equipment was purchased on January 1 of this year at a cost of $140,000. The equipment's useful life is five years. There is

no residual value. Record depreciation for this

year and then determine the equipment's book value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education