3-2A Adjusting entries ected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the rent year, are as follows: Obj. 2, 3, 4, E Debits Credits Accounts Receivable $ 75,000 Equipment Accumulated Depreciation-Equipment 345,700 $112,500 Prepaid Rent Supplies Wages Payable 9,000 3,350 Unearned Fees 12,000 Fees Earned 660,000 Wages Expense Rent Expense Depreciation Expense Supplies Expense 325,000 - ata needed for year-end adjustments are as follows: Unbilled fees at July 31, $11,150. Supplies on hand at July 31, $900. das Rent expired, $6,000. Depreciation of equipment during year, $8,950. Unearned fees at July 31, $2,000. Wages accrued but not paid at July 31, $4,840. nstructions . Journalize the six adjusting entries required at July 31, based on the data presented. . What would be the effect on the income statement if the adjustments for unbilled fees and accrued wages were omitted at the end of the year? . What would be the effect on the balance sheet if the adjustments for unbilled fees and accrued

3-2A Adjusting entries ected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the rent year, are as follows: Obj. 2, 3, 4, E Debits Credits Accounts Receivable $ 75,000 Equipment Accumulated Depreciation-Equipment 345,700 $112,500 Prepaid Rent Supplies Wages Payable 9,000 3,350 Unearned Fees 12,000 Fees Earned 660,000 Wages Expense Rent Expense Depreciation Expense Supplies Expense 325,000 - ata needed for year-end adjustments are as follows: Unbilled fees at July 31, $11,150. Supplies on hand at July 31, $900. das Rent expired, $6,000. Depreciation of equipment during year, $8,950. Unearned fees at July 31, $2,000. Wages accrued but not paid at July 31, $4,840. nstructions . Journalize the six adjusting entries required at July 31, based on the data presented. . What would be the effect on the income statement if the adjustments for unbilled fees and accrued wages were omitted at the end of the year? . What would be the effect on the balance sheet if the adjustments for unbilled fees and accrued

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 17CE: Cornerstone Exercise 3-17 Accrued Revenue Adjusting Entries Powers Rental Service had the following...

Related questions

Question

100%

Transcribed Image Text:made to correct errors,

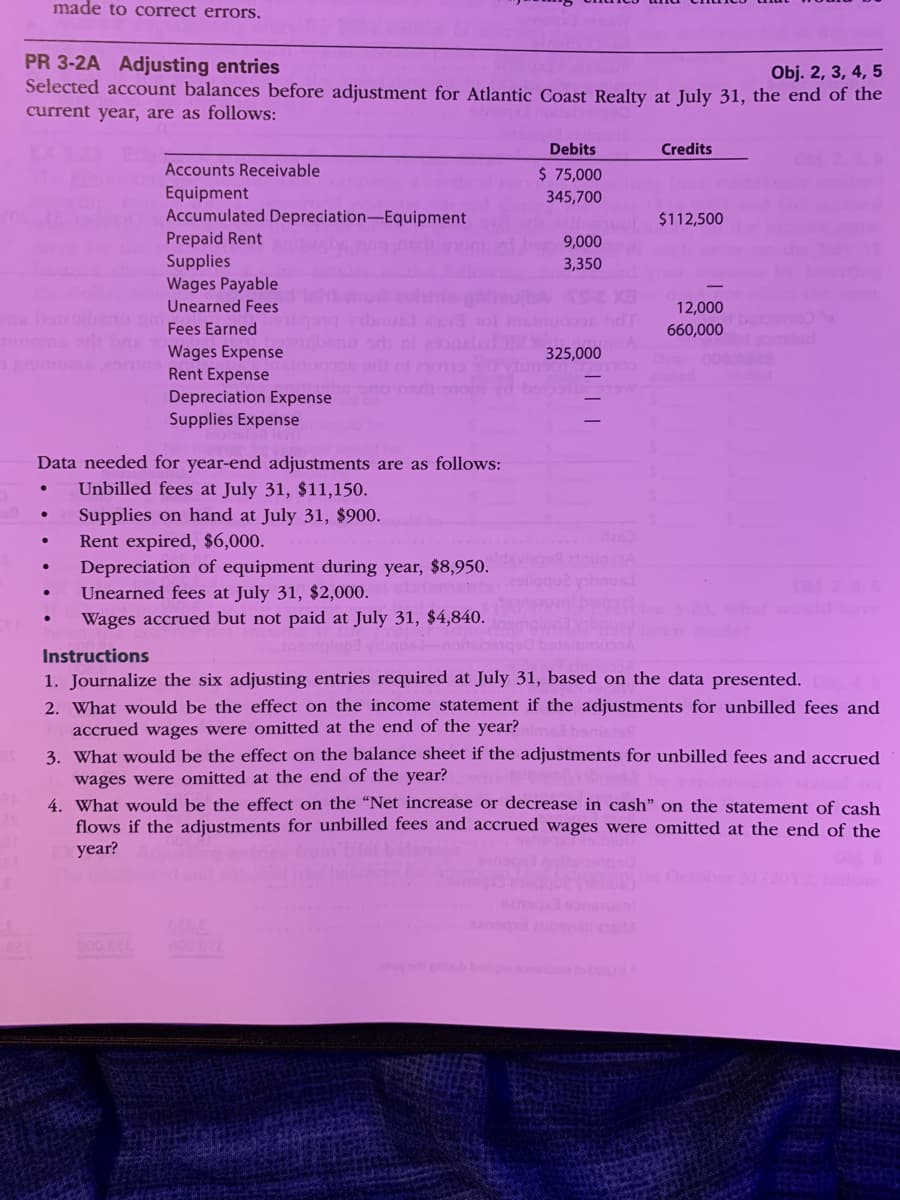

PR 3-2A Adjusting entries

Selected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the

Obj. 2, 3, 4, 5

current year, are as follows:

Debits

Credits

Accounts Receivable

$ 75,000

Equipment

Accumulated Depreciation-Equipment

345,700

$112,500

Prepaid Rent

9,000

3,350

Supplies

Wages Payable

Unearned Fees

ohre

12,000

bers

Fees Earned

660,000

Wages Expense

Rent Expense

325,000

000

TR omd

Depreciation Expense

Supplies Expense

Data needed for year-end adjustments are as follows:

Unbilled fees at July 31, $11,150.

Supplies on hand at July 31, $900.

Rent expired, $6,000.

Depreciation of equipment during year, $8,950.

Unearned fees at July 31, $2,000.

Wages accrued but not paid at July 31, $4,840.

das

devisoRatnugA

ON 26

Instructions

1. Journalize the six adjusting entries required at July 31, based on the data presented.

2. What would be the effect on the income statement if the adjustments for unbilled fees and

accrued wages were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for unbilled fees and accrued

wages were omitted at the end of the year?

4. What would be the effect on the “Net increase or decrease in cash" on the statement of cash

flows if the adjustments for unbilled fees and accrued wages were omitted at the end of the

year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning