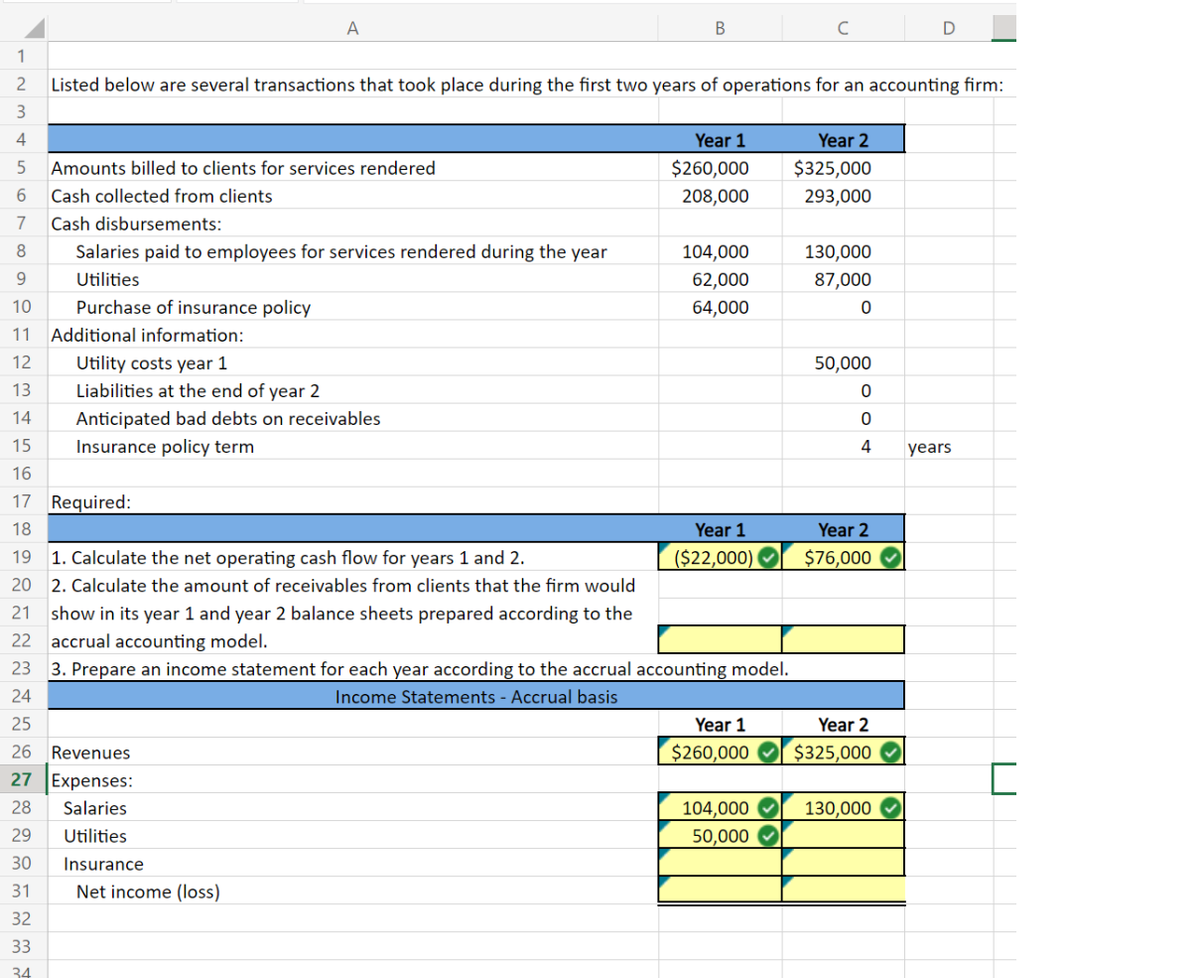

3 9 A Amounts billed to clients for services rendered Cash collected from clients Cash disbursements: Salaries paid to employees for services rendered during the year Utilities Purchase of insurance policy 0 1 Additional information: 2 Utility costs year 1 3 Liabilities at the end of year 2 4 Anticipated bad debts on receivables 5 Insurance policy term 6 7 Required: 8 2 3 4 Listed below are several transactions that took place during the first two years of operations for an accounting firm: 91. Calculate the net operating cash flow for years 1 and 2. 0 2. Calculate the amount of receivables from clients that the firm would 1 show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model. B Insurance Net income (loss) Year 1 $260,000 208,000 104,000 62,000 64,000 2 3 3. Prepare an income statement for each year according to the accrual accounting model. 4 Income Statements - Accrual basis 5 6 Revenues 7 Expenses: 8 Salaries 9 Utilities 0 1 Year 1 ($22,000) Year 2 $325,000 293,000 130,000 87,000 0 50,000 0 0 4 Year 2 $76,000 Year 1 Year 2 $260,000 $325,000 D 104,000✔ 130,000 50,000 years I

3 9 A Amounts billed to clients for services rendered Cash collected from clients Cash disbursements: Salaries paid to employees for services rendered during the year Utilities Purchase of insurance policy 0 1 Additional information: 2 Utility costs year 1 3 Liabilities at the end of year 2 4 Anticipated bad debts on receivables 5 Insurance policy term 6 7 Required: 8 2 3 4 Listed below are several transactions that took place during the first two years of operations for an accounting firm: 91. Calculate the net operating cash flow for years 1 and 2. 0 2. Calculate the amount of receivables from clients that the firm would 1 show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model. B Insurance Net income (loss) Year 1 $260,000 208,000 104,000 62,000 64,000 2 3 3. Prepare an income statement for each year according to the accrual accounting model. 4 Income Statements - Accrual basis 5 6 Revenues 7 Expenses: 8 Salaries 9 Utilities 0 1 Year 1 ($22,000) Year 2 $325,000 293,000 130,000 87,000 0 50,000 0 0 4 Year 2 $76,000 Year 1 Year 2 $260,000 $325,000 D 104,000✔ 130,000 50,000 years I

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PB: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

Transcribed Image Text:1

2

3

4

5

Amounts billed to clients for services rendered

6 Cash collected from clients

7

Cash disbursements:

8

Salaries paid to employees for services rendered during the year

9

Utilities

10

Purchase of insurance policy

11 Additional information:

12

Utility costs year 1

13

Liabilities at the end of year 2

14

Anticipated bad debts on receivables

Insurance policy term

A

1. Calculate the net operating cash flow for years 1 and 2.

2. Calculate the amount of receivables from clients that the firm would

22

23

24

25

26 Revenues

27 Expenses:

28 Salaries

29 Utilities

30

31

32

33

34

B

Listed below are several transactions that took place during the first two years of operations for an accounting firm:

Insurance

Net income (loss)

15

16

17 Required:

18

19

20

21 show in its year 1 and year 2 balance sheets prepared according to the

accrual accounting model.

3. Prepare an income statement for each year according to the accrual accounting model.

Income Statements - Accrual basis

Year 1

$260,000

208,000

104,000

62,000

64,000

Year 1

($22,000)

Year 1

$260,000

C

104,000

50,000

Year 2

$325,000

293,000

130,000

87,000

0

50,000

0

0

4

Year 2

$76,000

Year 2

$325,000

D

130,000

years

[

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning