Income ne Fiscal Year come taxes Ended September 30, 2017 et sales ost of products sold oss profit arketing, research, administrative expense epreciation Derating income (loss) terest expense rnings (loss) before income taxes $59,900 18,800 $41,100 18,900 930 $21,270 520 $20,750 6,381

Income ne Fiscal Year come taxes Ended September 30, 2017 et sales ost of products sold oss profit arketing, research, administrative expense epreciation Derating income (loss) terest expense rnings (loss) before income taxes $59,900 18,800 $41,100 18,900 930 $21,270 520 $20,750 6,381

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Question

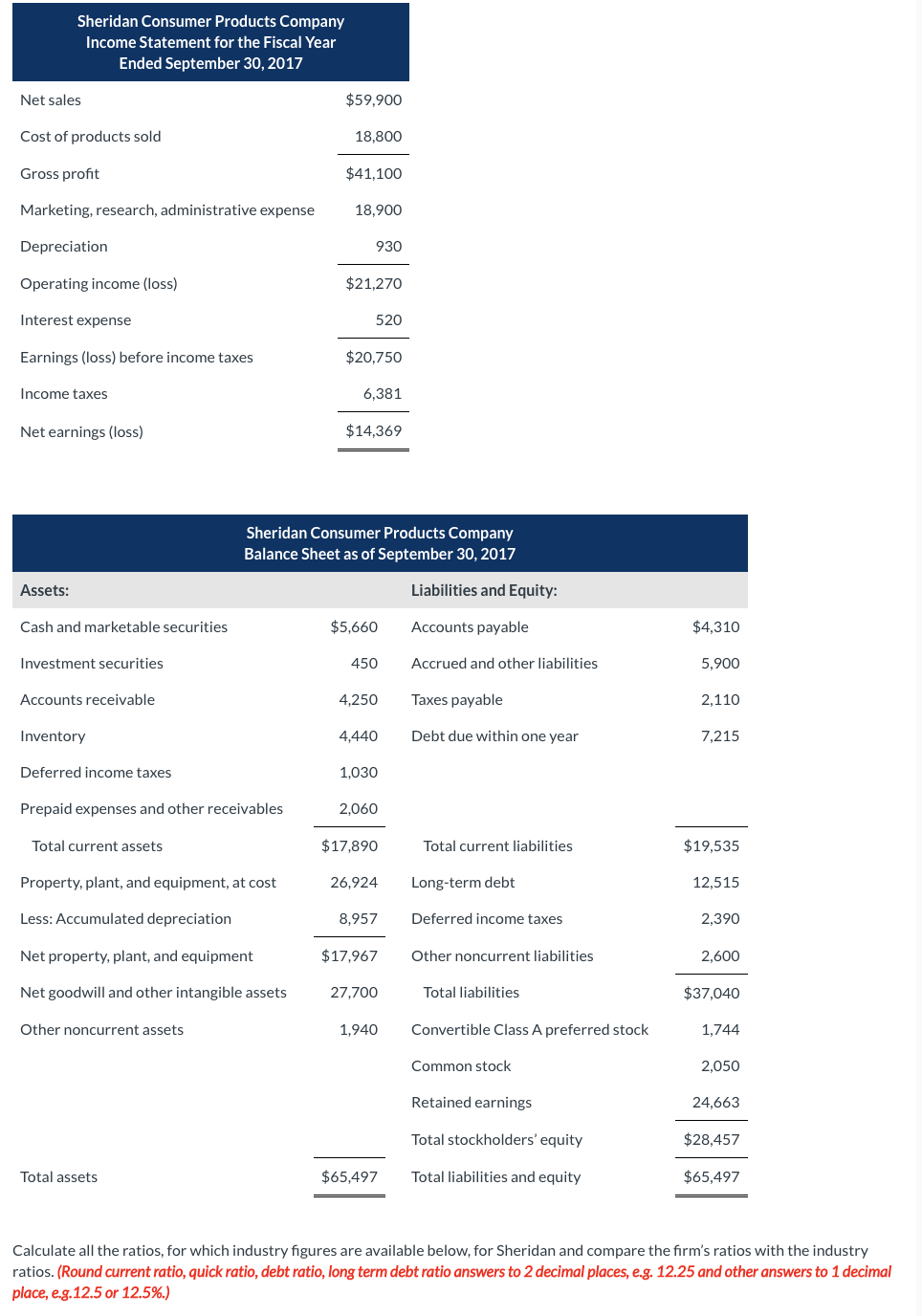

Transcribed Image Text:Sheridan Consumer Products Company

Income Statement for the Fiscal Year

Ended September 30, 2017

Net sales

Cost of products sold

Gross profit

Marketing, research, administrative expense

Depreciation

Operating income (loss)

Interest expense

Earnings (loss) before income taxes

Income taxes

Net earnings (loss)

Assets:

Cash and marketable securities

Investment securities

Accounts receivable

Inventory

Deferred income taxes

Prepaid expenses and other receivables

Total current assets

Property, plant, and equipment, at cost

Less: Accumulated depreciation

Net property, plant, and equipment

Net goodwill and other intangible assets

Other noncurrent assets

Total assets

$59,900

18,800

$41,100

18,900

930

$21,270

520

$20,750

6,381

Sheridan Consumer Products Company

Balance Sheet as of September 30, 2017

$14,369

$5,660

450

4,250

4,440

1,030

2,060

$17,890

26,924

8,957

$17,967

27,700

1,940

$65,497

Liabilities and Equity:

Accounts payable

Accrued and other liabilities

Taxes payable

Debt due within one year

Total current liabilities

Long-term debt

Deferred income taxes

Other noncurrent liabilities

Total liabilities

Convertible Class A preferred stock

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and equity

$4,310

5,900

2,110

7,215

$19,535

12,515

2,390

2,600

$37,040

1,744

2.050

24,663

$28,457

$65,497

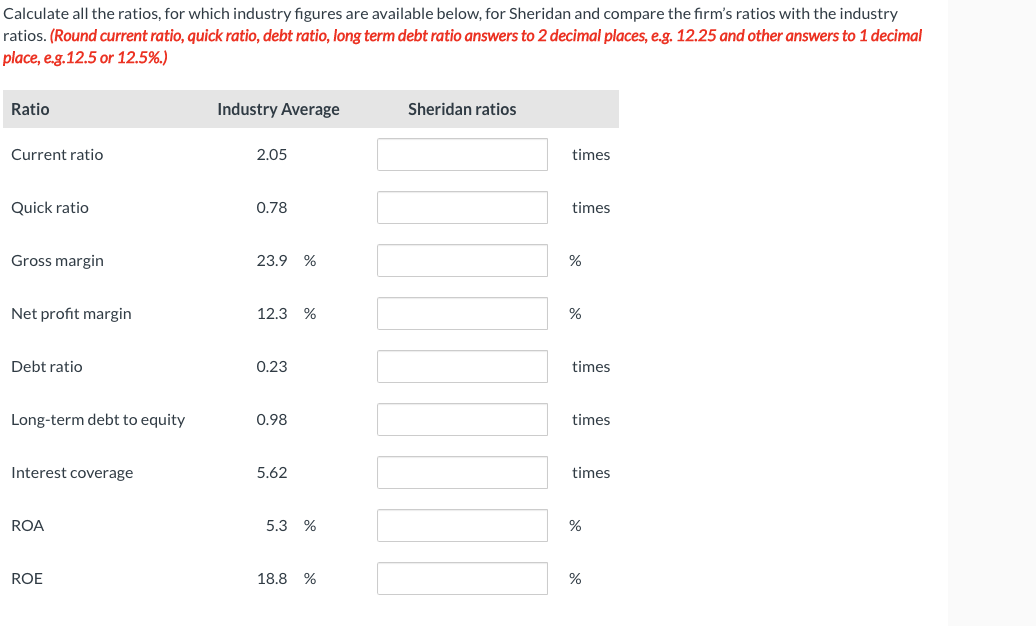

Calculate all the ratios, for which industry figures are available below, for Sheridan and compare the firm's ratios with the industry

ratios. (Round current ratio, quick ratio, debt ratio, long term debt ratio answers to 2 decimal places, e.g. 12.25 and other answers to 1 decimal

place, e.g.12.5 or 12.5%.)

Transcribed Image Text:Calculate all the ratios, for which industry figures are available below, for Sheridan and compare the firm's ratios with the industry

ratios. (Round current ratio, quick ratio, debt ratio, long term debt ratio answers to 2 decimal places, e.g. 12.25 and other answers to 1 decimal

place, e.g.12.5 or 12.5%.)

Ratio

Current ratio

Quick ratio

Gross margin

Net profit margin

Debt ratio

Long-term debt to equity

Interest coverage

ROA

ROE

Industry Average

2.05

0.78

23.9 %

12.3 %

0.23

0.98

5.62

5.3 %

18.8 %

Sheridan ratios

times

times

%

%

times

times

times

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT