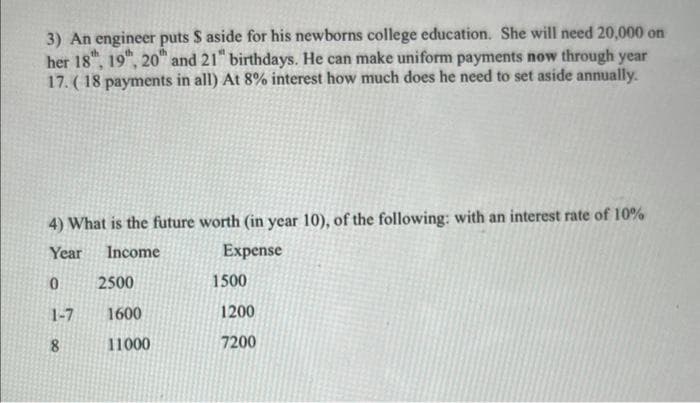

3) An engineer puts $ aside for his newborns college education. She will need 20,000 on her 18, 19, 20 and 21" birthdays. He can make uniform payments now through year 17. (18 payments in all) At 8% interest how much does he need to set aside annually.

3) An engineer puts $ aside for his newborns college education. She will need 20,000 on her 18, 19, 20 and 21" birthdays. He can make uniform payments now through year 17. (18 payments in all) At 8% interest how much does he need to set aside annually.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 14E

Related questions

Question

Solutions sent me all part and typing work only

Transcribed Image Text:3) An engineer puts S aside for his newborns college education. She will need 20,000 on

her 18, 19, 20 and 21" birthdays. He can make uniform payments now through year

17. (18 payments in all) At 8% interest how much does he need to set aside annually.

4) What is the future worth (in year 10), of the following: with an interest rate of 10%

Year

Income

Expense

0

1-7

8

2500

1600

11000

1500

1200

7200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning