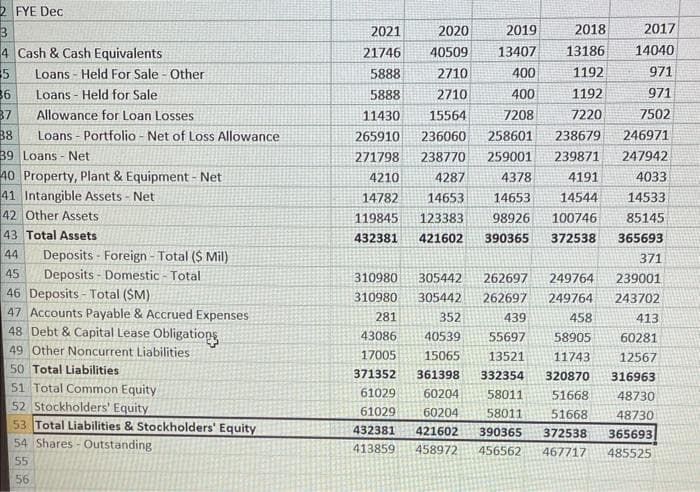

3 FYE Dec Cash & Cash Equivalents 5 Loans Held For Sale - Other 6 Loans Held for Sale Allowance for Loan Losses Loans Portfolio - Net of Loss Allowance 7 8 59 Loans-Net 0 Property, Plant & Equipment - Net 71 Intangible Assets - Net 12 Other Assets 43 Total Assets 44 45 46 Deposits-Total (SM) 47 Accounts Payable & Accrued Expenses 48 Debt & Capital Lease Obligations 49 Other Noncurrent Liabilities Deposits Foreign - Total ($ Mil) Deposits Domestic - Total 50 Total Liabilities 51 Total Common Equity 52 Stockholders' Equity 53 Total Liabilities & Stockholders' Equity 54 Shares-Outstanding 55 56 2021 2020 2019 2018 21746 40509 13407 13186 5888 2710 1192 5888 2710 1192 11430 15564 7220 265910 236060 258601 238679 271798 238770 259001 239871 4210 4287 4378 4191 14782 14653 14653 14544 119845 123383 98926 100746 432381 421602 390365 372538 400 400 7208 310980 310980 305442 262697 249764 305442 262697 249764 281 352 439 458 43086 40539 55697 58905 17005 15065 13521 11743 371352 361398 332354 320870 61029 60204 58011 51668 61029 60204 58011 51668 432381 421602 390365 372538 413859 458972 456562 467717 2017 14040 971 971 7502 246971 247942 4033 14533 85145 365693 371 239001 243702 413 60281 12567 316963 48730 48730 365693 485525

3 FYE Dec Cash & Cash Equivalents 5 Loans Held For Sale - Other 6 Loans Held for Sale Allowance for Loan Losses Loans Portfolio - Net of Loss Allowance 7 8 59 Loans-Net 0 Property, Plant & Equipment - Net 71 Intangible Assets - Net 12 Other Assets 43 Total Assets 44 45 46 Deposits-Total (SM) 47 Accounts Payable & Accrued Expenses 48 Debt & Capital Lease Obligations 49 Other Noncurrent Liabilities Deposits Foreign - Total ($ Mil) Deposits Domestic - Total 50 Total Liabilities 51 Total Common Equity 52 Stockholders' Equity 53 Total Liabilities & Stockholders' Equity 54 Shares-Outstanding 55 56 2021 2020 2019 2018 21746 40509 13407 13186 5888 2710 1192 5888 2710 1192 11430 15564 7220 265910 236060 258601 238679 271798 238770 259001 239871 4210 4287 4378 4191 14782 14653 14653 14544 119845 123383 98926 100746 432381 421602 390365 372538 400 400 7208 310980 310980 305442 262697 249764 305442 262697 249764 281 352 439 458 43086 40539 55697 58905 17005 15065 13521 11743 371352 361398 332354 320870 61029 60204 58011 51668 61029 60204 58011 51668 432381 421602 390365 372538 413859 458972 456562 467717 2017 14040 971 971 7502 246971 247942 4033 14533 85145 365693 371 239001 243702 413 60281 12567 316963 48730 48730 365693 485525

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.24MCE

Related questions

Question

what is total current assets for capital for years 2021 back to 2017?

Transcribed Image Text:2 FYE Dec

4 Cash & Cash Equivalents

5

36

37

Loans Held For Sale - Other

Loans Held for Sale

Allowance for Loan Losses

Loans Portfolio - Net of Loss Allowance

38

39 Loans - Net

40 Property, Plant & Equipment - Net

41 Intangible Assets - Net

42 Other Assets

43 Total Assets

44

45

46 Deposits-Total (SM)

47 Accounts Payable & Accrued Expenses

48 Debt & Capital Lease Obligations

49 Other Noncurrent Liabilities

50 Total Liabilities

51 Total Common Equity

52 Stockholders' Equity

53 Total Liabilities & Stockholders' Equity

54 Shares - Outstanding

55

56

Deposits Foreign - Total ($ Mil)

Deposits Domestic - Total

2020

2019

40509 13407

2710

400

2710

400

11430

15564

7208

265910 236060 258601

271798 238770

4210

4287

14782

14653

119845 123383

432381 421602

2021

21746

5888

5888

2017

14040

971

971

7502

238679

246971

259001 239871

247942

4378

4191

4033

14653

14544

14533

98926 100746 85145

390365

372538

365693

371

239001

243702

413

2018

13186

1192

1192

7220

310980 305442 262697 249764

310980

305442

262697 249764

281

352

439

458

43086

40539

55697

58905

17005

15065

13521

11743

371352

361398 332354 320870

61029

60204

58011

51668

61029

60204

58011 51668

432381 421602 390365 372538

413859 458972

456562 467717

60281

12567

316963

48730

48730

365693

485525

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning