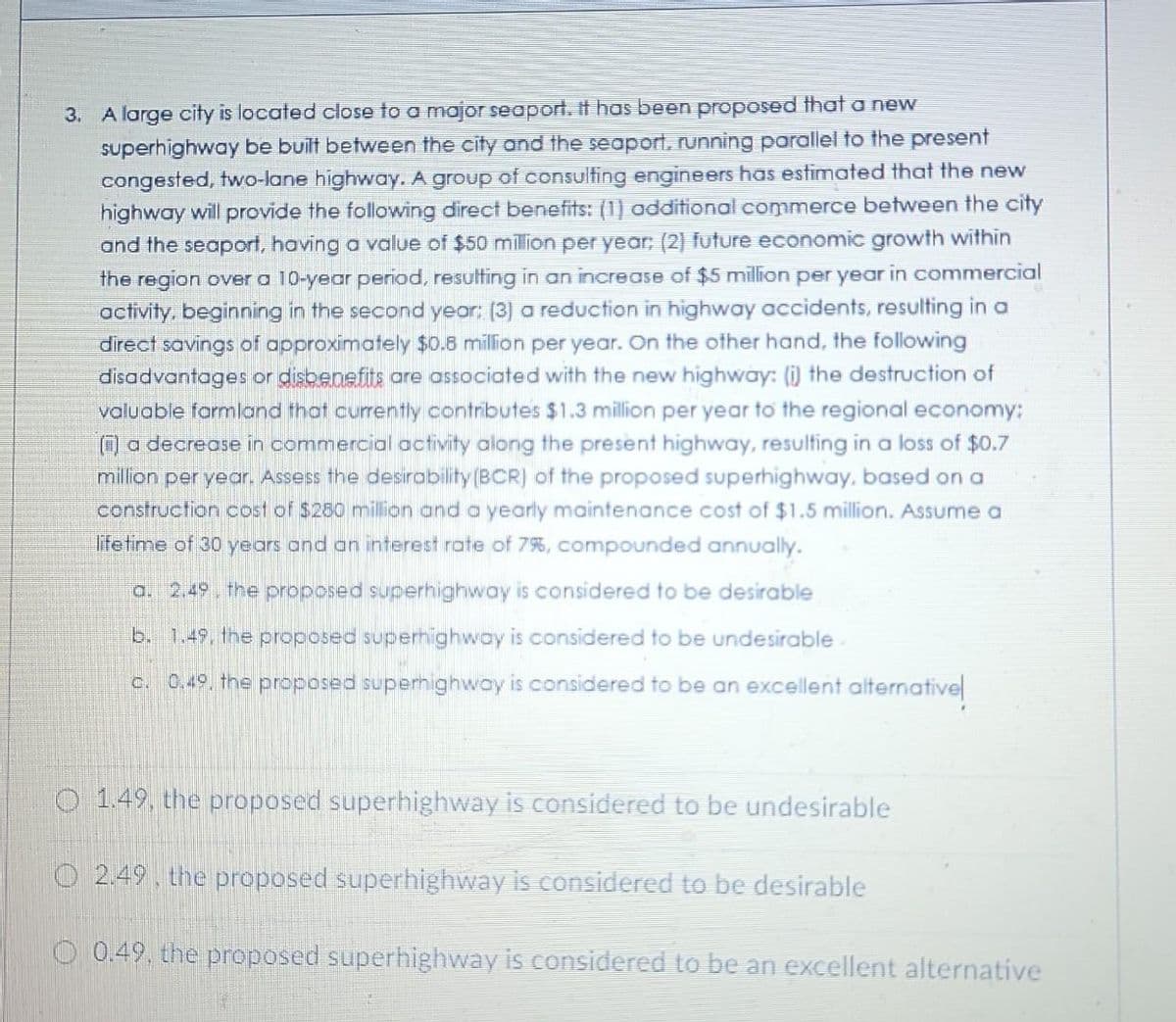

3. A large city is located close to a major seaport. It has been proposed that a new superhighway be built between the city and the seaport, running parallel to the present congested, two-lane highway. A group of consulting engineers has estimated that the new highway will provide the following direct benefits: (1) additional commerce between the city and the seaport, having a value of $50 million per year; (2) future economic growth within the region over a 10-year period, resulting in an increase of $5 million per year in commercial activity, beginning in the second year: (3) a reduction in highway accidents, resulting in a direct savings of approximately $0.8 million per year. On the other hand, the following disadvantages or disbenefits are associated with the new highway: (i) the destruction of valuable farmland that currently contributes $1.3 million per year to the regional economy: (i) a decrease in commercial activity along the present highway, resulting in a loss of $0.7 million per year. Assess the desirability (BCR) of the proposed superhighway, based on a construction cost of $280 million and a yearly maintenance cost of $1.5 million. Assume a life time of 30 years and an interest rate of 7%, compounded annually. a. 2.49, the proposed superhighway is considered to be desirable b. 1.49, the proposed superhighway is considered to be undesirable c. 0.49, the proposed superhighway is considered to be an excellent alternativel

3. A large city is located close to a major seaport. It has been proposed that a new superhighway be built between the city and the seaport, running parallel to the present congested, two-lane highway. A group of consulting engineers has estimated that the new highway will provide the following direct benefits: (1) additional commerce between the city and the seaport, having a value of $50 million per year; (2) future economic growth within the region over a 10-year period, resulting in an increase of $5 million per year in commercial activity, beginning in the second year: (3) a reduction in highway accidents, resulting in a direct savings of approximately $0.8 million per year. On the other hand, the following disadvantages or disbenefits are associated with the new highway: (i) the destruction of valuable farmland that currently contributes $1.3 million per year to the regional economy: (i) a decrease in commercial activity along the present highway, resulting in a loss of $0.7 million per year. Assess the desirability (BCR) of the proposed superhighway, based on a construction cost of $280 million and a yearly maintenance cost of $1.5 million. Assume a life time of 30 years and an interest rate of 7%, compounded annually. a. 2.49, the proposed superhighway is considered to be desirable b. 1.49, the proposed superhighway is considered to be undesirable c. 0.49, the proposed superhighway is considered to be an excellent alternativel

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:3. A large city is located close to a major seaport. It has been proposed that a new

superhighway be built between the city and the seaport, running parallel to the present

congested, two-lane highway. A group of consulting engineers has estimated that the new

highway will provide the following direct benefits: (1) additional commerce between the city

and the seaport, having a value of $50 million per year; (2) future economic growth within

the region over a 10-year period, resulting in an increase of $5 million per year in commercial

activity, beginning in the second year: (3) a reduction in highway accidents, resulting in a

direct savings of approximately $0.8 million per year. On the other hand, the following

disadvantages or disbenefits are associated with the new highway: (i) the destruction of

valuable farmland that currently contributes $1.3 million per year to the regional economy:

(i) a decrease in commercial activity along the present highway, resulting in a loss of $0.7

million per year. Assess the desirability (BCR) of the proposed superhighway, based on a

construction cost of $250 million and a yearly maintenance cost of $1.5 million. Assume a

lifetime of 30 years and an interest rate of 7%, compounded annually.

a. 2.49, the proposed superhighway is considered to be desirable

b. 1.49, the proposed superhighway is considered to be undesirable

c. 0.49, the proposed superhighway is considered to be an excellent alternativel

1.49, the proposed superhighway is considered to be undesirable

2.49, the proposed superhighway is considered to be desirable

0.49, the proposed superhighway is considered to be an excellent alternative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education