3. An individual makes 6 annual deposits of P2,000 in a savings account that pays interest rate of 4% compounded annually. Two years after making the last deposit, the interest rate changes to 7% compounded annually. Ten years after the last deposit, the accumulated money is withdrawn from the account. How much is withdrawn?

3. An individual makes 6 annual deposits of P2,000 in a savings account that pays interest rate of 4% compounded annually. Two years after making the last deposit, the interest rate changes to 7% compounded annually. Ten years after the last deposit, the accumulated money is withdrawn from the account. How much is withdrawn?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

Answer number 3

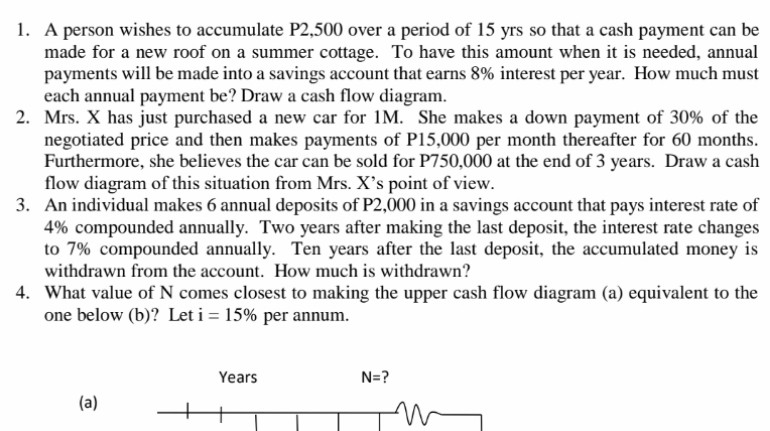

Transcribed Image Text:1. A person wishes to accumulate P2,500 over a period of 15 yrs so that a cash payment can be

made for a new roof on a summer cottage. To have this amount when it is needed, annual

payments will be made into a savings account that earns 8% interest per year. How much must

each annual payment be? Draw a cash flow diagram.

2. Mrs. X has just purchased a new car for 1M. She makes a down payment of 30% of the

negotiated price and then makes payments of P15,000 per month thereafter for 60 months.

Furthermore, she believes the car can be sold for P750,000 at the end of 3 years. Draw a cash

flow diagram of this situation from Mrs. X's point of view.

3. An individual makes 6 annual deposits of P2,000 in a savings account that pays interest rate of

4% compounded annually. Two years after making the last deposit, the interest rate changes

to 7% compounded annually. Ten years after the last deposit, the accumulated money is

withdrawn from the account. How much is withdrawn?

4. What value of N comes closest to making the upper cash flow diagram (a) equivalent to the

one below (b)? Let i = 15% per annum.

Years

N=?

(a)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning