3. Assuming Smile Corp., issues a call notice to redeem the debenture bond issuances. This bond has still 4 years life before its maturity at a call price of 110-1/4. Hapi has still six (6) debenture bonds, and is now selling at 106-3/4. If Hapi exercise the call option: a. How much is the total amount she will be receiving? b. Compute for the yield to call. c. What is the capital gains yield?

3. Assuming Smile Corp., issues a call notice to redeem the debenture bond issuances. This bond has still 4 years life before its maturity at a call price of 110-1/4. Hapi has still six (6) debenture bonds, and is now selling at 106-3/4. If Hapi exercise the call option: a. How much is the total amount she will be receiving? b. Compute for the yield to call. c. What is the capital gains yield?

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

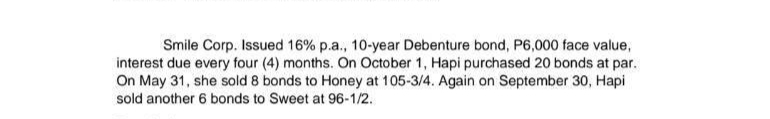

Transcribed Image Text:Smile Corp. Issued 16% p.a., 10-year Debenture bond, P6,000 face value,

interest due every four (4) months. On October 1, Hapi purchased 20 bonds at par.

On May 31, she sold 8 bonds to Honey at 105-3/4. Again on September 30, Hapi

sold another 6 bonds to Sweet at 96-1/2.

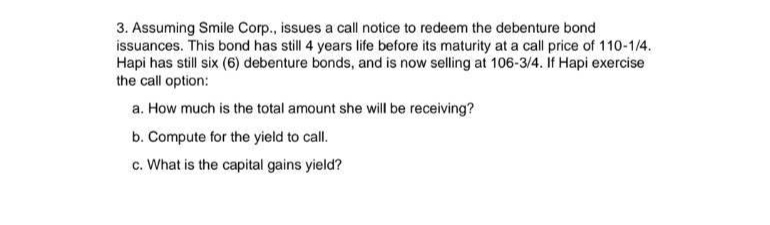

Transcribed Image Text:3. Assuming Smile Corp., issues a call notice to redeem the debenture bond

issuances. This bond has still 4 years life before its maturity at a call price of 110-1/4.

Hapi has still six (6) debenture bonds, and is now selling at 106-3/4. If Hapi exercise

the call option:

a. How much is the total amount she will be receiving?

b. Compute for the yield to call.

c. What is the capital gains yield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,