Prepare a schedule showing the distribution of net income, assuming net income is $24,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).) Salary allowance Interest allowance Total salaries and interest $ DIVISION OF NET INCOME McGill $ Smyth $ Total

Prepare a schedule showing the distribution of net income, assuming net income is $24,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).) Salary allowance Interest allowance Total salaries and interest $ DIVISION OF NET INCOME McGill $ Smyth $ Total

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 3PA

Related questions

Question

100%

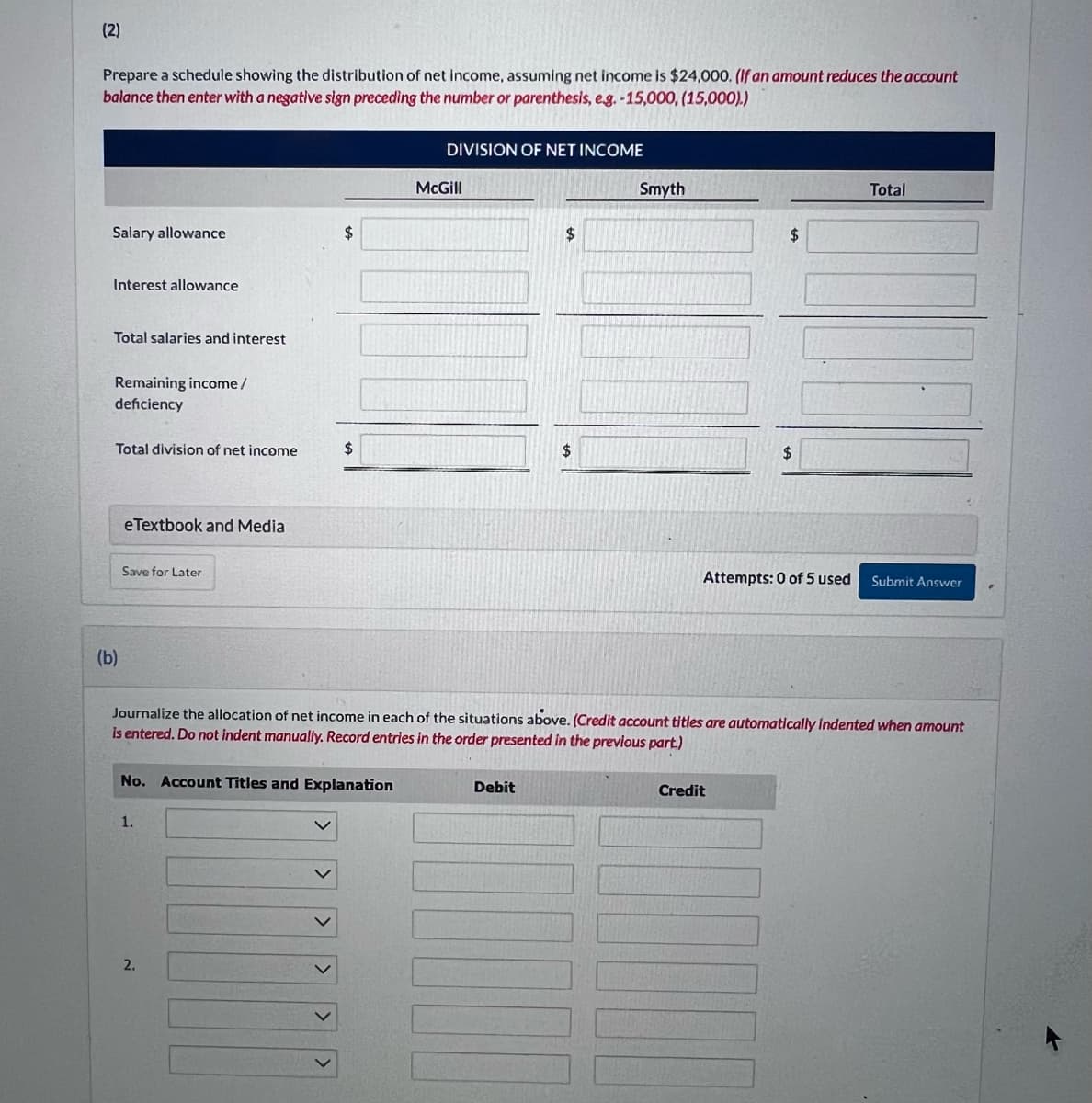

Transcribed Image Text:(2)

Prepare a schedule showing the distribution of net income, assuming net income is $24,000. (If an amount reduces the account

balance then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).)

Salary allowance

Interest allowance

Total salaries and interest

Remaining income/

deficiency

Total division of net income

(b)

eTextbook and Media

Save for Later

1.

$

No. Account Titles and Explanation

2.

$

>

DIVISION OF NET INCOME

McGill

$

Debit

$

Journalize the allocation of net income in each of the situations above. (Credit account titles are automatically indented when amount

is entered. Do not indent manually. Record entries in the order presented in the previous part.)

Smyth

$

Total

Attempts: 0 of 5 used Submit Answer

Credit

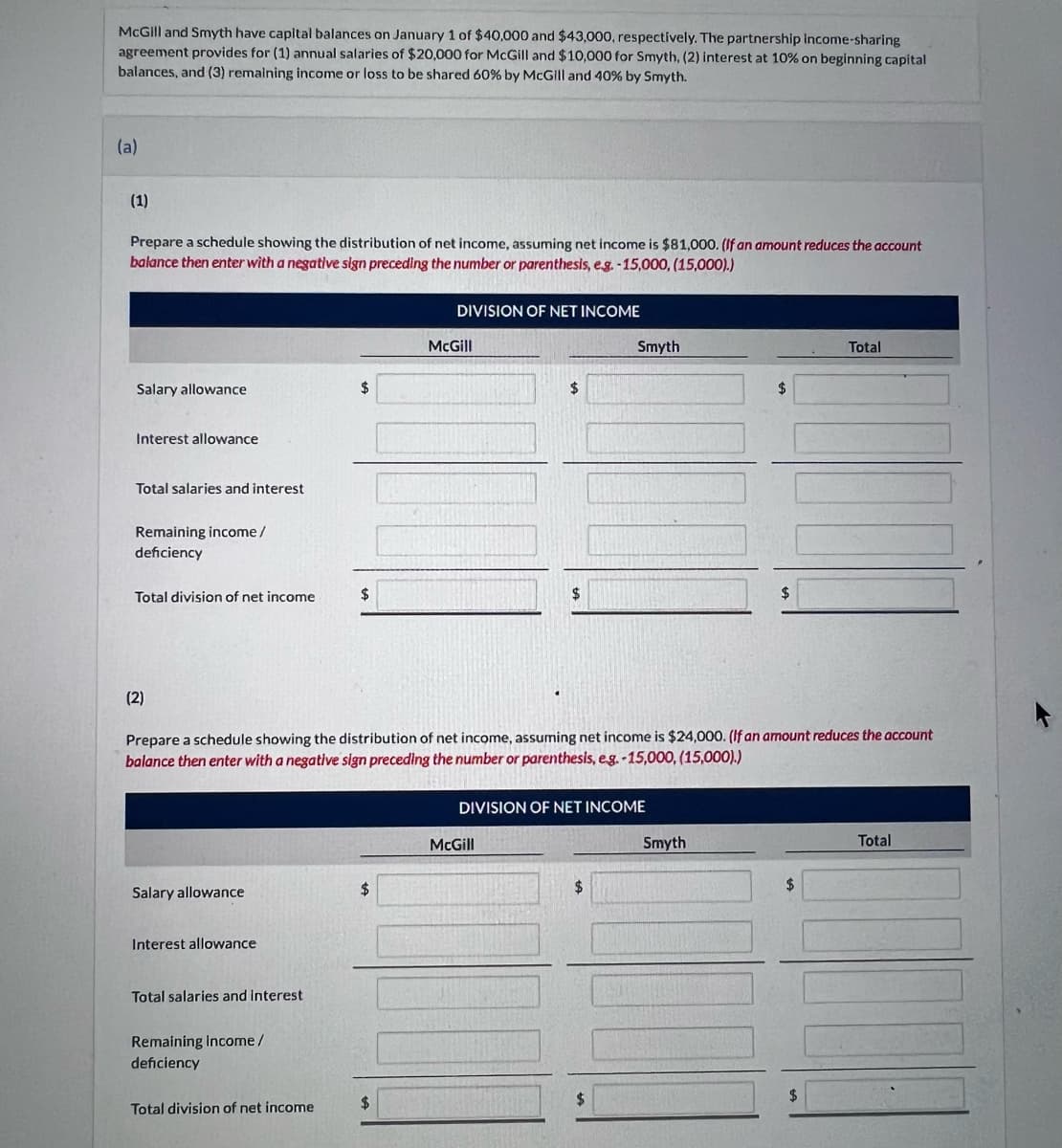

Transcribed Image Text:McGill and Smyth have capital balances on January 1 of $40,000 and $43,000, respectively. The partnership income-sharing

agreement provides for (1) annual salaries of $20,000 for McGill and $10,000 for Smyth, (2) interest at 10% on beginning capital

balances, and (3) remaining income or loss to be shared 60% by McGill and 40% by Smyth.

(a)

(1)

Prepare a schedule showing the distribution of net income, assuming net income is $81,000. (If an amount reduces the account

balance then enter with a negative sign preceding the number or parenthesis, e.g.-15,000, (15,000).)

Salary allowance

Interest allowance

Total salaries and interest

Remaining income/

deficiency

Total division of net income

(2)

Salary allowance

Interest allowance

Total salaries and interest

Remaining Income/

deficiency

$

Total division of net income

$

DIVISION OF NET INCOME

Prepare a schedule showing the distribution of net income, assuming net income is $24,000. (If an amount reduces the account

balance then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).)

$

McGill

$

$

McGill

Smyth

DIVISION OF NET INCOME

$

$

Smyth

Total

$

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,