3. (a)What kind of cash flows do investors expect from their investment in gövernime (b)What role does bond indenture plays in a bond investment? (c)Assume that a company listed on the Sunrise Stock Exchange expects to pay dividends amounting to 100 shillings per share next year, shillings 200 in the year that follows and 250 shillings in the following year. After that, dividends are expected to grow at constant 5% per year. If the required rate of return is 10%, what price should investors pay for such shares today?

3. (a)What kind of cash flows do investors expect from their investment in gövernime (b)What role does bond indenture plays in a bond investment? (c)Assume that a company listed on the Sunrise Stock Exchange expects to pay dividends amounting to 100 shillings per share next year, shillings 200 in the year that follows and 250 shillings in the following year. After that, dividends are expected to grow at constant 5% per year. If the required rate of return is 10%, what price should investors pay for such shares today?

Chapter9: The Cost Of Capital

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:three years. What răte UI merEJI TU

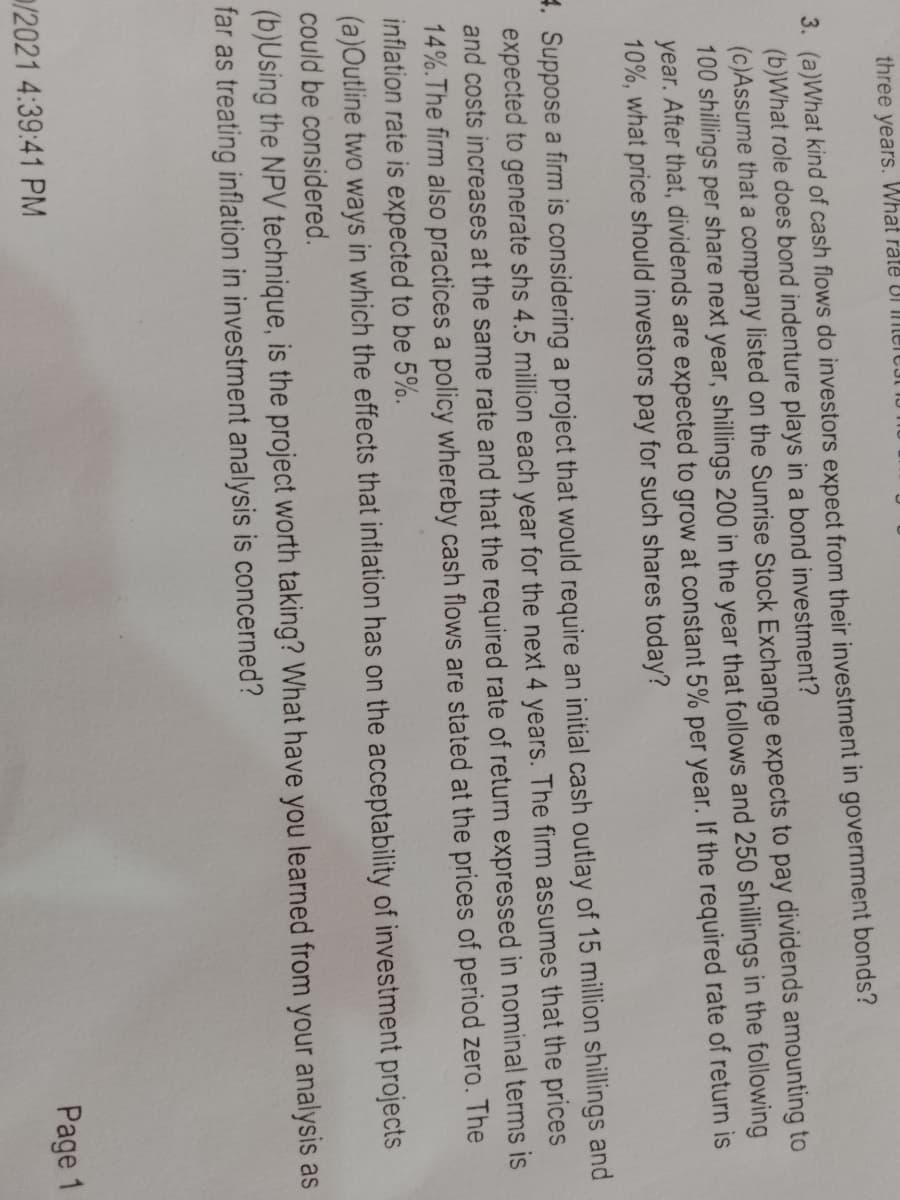

3. (a)What kind of cash flows do investors expect from their investment in government bonds?

(b)What role does bond indenture plays in a bond investment?

(c)Assume that a company listed on the Sunrise Stock Exchange expects to pay dividends amounting to

100 shillings per share next year, shillings 200 in the year that follows and 250 shillings in the following

year. After that, dividends are expected to grow at constant 5% per year. If the required rate of return is

10%, what price should investors pay for such shares today?

4. Suppose a firm is considering a project that would require an initial cash outlay of 15 million shillings and

expected to generate shs 4.5 million each year for the next 4 years. The firm assumes that the prices

and costs increases at the same rate and that the required rate of return expressed in nominal terms is

14%.The firm also practices a policy whereby cash flows are stated at the prices of period zero. The

inflation rate is expected to be 5%.

(a)Outline two ways in which the effects that inflation has on the acceptability of investment projects

could be considered.

(b)Using the NPV technique, is the project worth taking? What have you learned from your analysis as

far as treating inflation in investment analysis is concerned?

/2021 4:39:41 PM

Page 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning