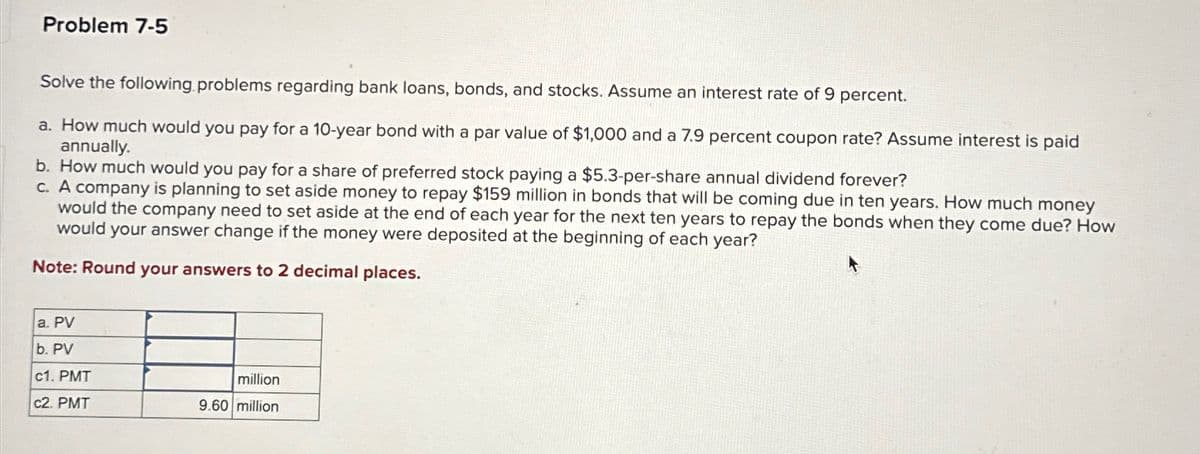

Problem 7-5 Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 9 percent. a. How much would you pay for a 10-year bond with a par value of $1,000 and a 7.9 percent coupon rate? Assume interest is paid annually. b. How much would you pay for a share of preferred stock paying a $5.3-per-share annual dividend forever? c. A company is planning to set aside money to repay $159 million in bonds that will be coming due in ten years. How much money would the company need to set aside at the end of each year for the next ten years to repay the bonds when they come due? How would your answer change if the money were deposited at the beginning of each year? Note: Round your answers to 2 decimal places. a. PV b. PV c1. PMT million c2. PMT 9.60 million

Problem 7-5 Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 9 percent. a. How much would you pay for a 10-year bond with a par value of $1,000 and a 7.9 percent coupon rate? Assume interest is paid annually. b. How much would you pay for a share of preferred stock paying a $5.3-per-share annual dividend forever? c. A company is planning to set aside money to repay $159 million in bonds that will be coming due in ten years. How much money would the company need to set aside at the end of each year for the next ten years to repay the bonds when they come due? How would your answer change if the money were deposited at the beginning of each year? Note: Round your answers to 2 decimal places. a. PV b. PV c1. PMT million c2. PMT 9.60 million

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter9: Stocks And Their Valuation

Section: Chapter Questions

Problem 17P: CONSTANT GROWTH Your broker offers to sell you some shares of Bahnsen Co. common stock that paid a...

Related questions

Question

Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 9 percent. a. How much would you pay for a 10-year bond with a par value of $1,000 and a 7.9 percent coupon rate? Assume interest is paid annually. b. How much would you pay for a share of preferred stock paying a $5.3-per-share annual dividend forever? c. A company is planning to set aside money to repay $159 million in bonds that will be coming due in ten years. How much money would the company need to set aside at the end of each year for the next ten years to repay the bonds when they come due? How would your answer change if the money were deposited at the beginning of each year? Note: Round your answers to 2 decimal places. \table[[a. PV,,],[b. PV,,],[c1. PMT,,million],[c2. PMT,9.60,million]]

Transcribed Image Text:Problem 7-5

Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 9 percent.

a. How much would you pay for a 10-year bond with a par value of $1,000 and a 7.9 percent coupon rate? Assume interest is paid

annually.

b. How much would you pay for a share of preferred stock paying a $5.3-per-share annual dividend forever?

c. A company is planning to set aside money to repay $159 million in bonds that will be coming due in ten years. How much money

would the company need to set aside at the end of each year for the next ten years to repay the bonds when they come due? How

would your answer change if the money were deposited at the beginning of each year?

Note: Round your answers to 2 decimal places.

a. PV

b. PV

c1. PMT

million

c2. PMT

9.60 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning