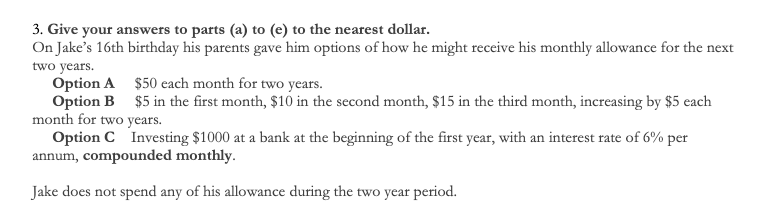

3. Give your answers to parts (a) to (e) to the nearest dollar. On Jake's 16th birthday his parents gave him options of how he might receive his monthly allowance for the next two years. Option A $50 each month for two years. Option B $5 in the first month, $10 in the second month, $15 in the third month, increasing by $5 each month for two years. Option C Investing $1000 at a bank at the beginning of the first year, with an interest rate of 6% per annum, compounded monthly. Jake does not spend any of his allowance during the two year period.

3. Give your answers to parts (a) to (e) to the nearest dollar. On Jake's 16th birthday his parents gave him options of how he might receive his monthly allowance for the next two years. Option A $50 each month for two years. Option B $5 in the first month, $10 in the second month, $15 in the third month, increasing by $5 each month for two years. Option C Investing $1000 at a bank at the beginning of the first year, with an interest rate of 6% per annum, compounded monthly. Jake does not spend any of his allowance during the two year period.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:3. Give your answers to parts (a) to (e) to the nearest dollar.

On Jake's 16th birthday his parents gave him options of how he might receive his monthly allowance for the next

two years.

Option A $50 each month for two years.

Option B $5 in the first month, $10 in the second month, $15 in the third month, increasing by $5 each

month for two years.

Option C Investing $1000 at a bank at the beginning of the first year, with an interest rate of 6% per

annum, compounded monthly.

Jake does not spend any of his allowance during the two year period.

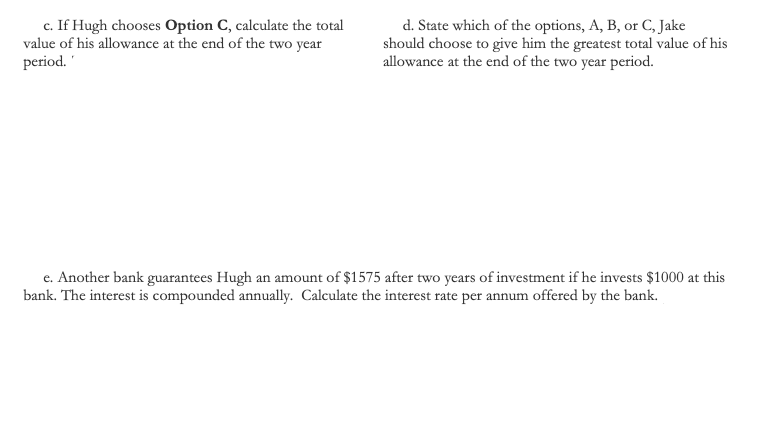

Transcribed Image Text:c. If Hugh chooses Option C, calculate the total

value of his allowance at the end of the two year

period.

d. State which of the options, A, B, or C, Jake

should choose to give him the greatest total value of his

allowance at the end of the two year period.

e. Another bank guarantees Hugh an amount of $1575 after two years of investment if he invests $1000 at this

bank. The interest is compounded annually. Calculate the interest rate per annum offered by the bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning