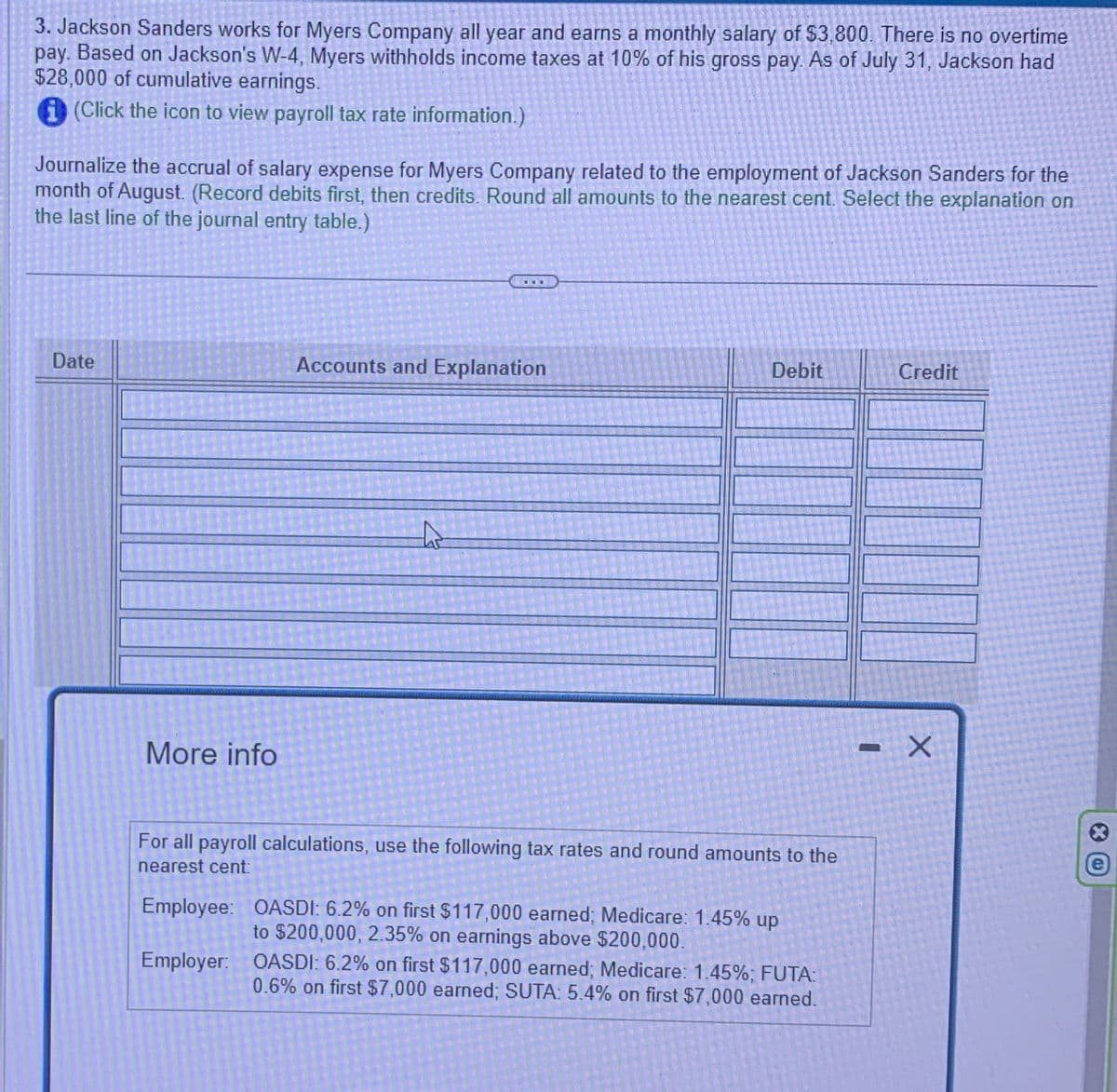

3. Jackson Sanders works for Myers Company all year and earns a monthly salary of $3,800. There is no overtime pay. Based on Jackson's W-4, Myers withholds income taxes at 10% of his gross pay. As of July 31, Jackson had $28,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) Journalize the accrual of salary expense for Myers Company related to the employment of Jackson Sanders for the month of August. (Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit

3. Jackson Sanders works for Myers Company all year and earns a monthly salary of $3,800. There is no overtime pay. Based on Jackson's W-4, Myers withholds income taxes at 10% of his gross pay. As of July 31, Jackson had $28,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) Journalize the accrual of salary expense for Myers Company related to the employment of Jackson Sanders for the month of August. (Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 8PB

Related questions

Question

Transcribed Image Text:3. Jackson Sanders works for Myers Company all year and earns a monthly salary of $3,800. There is no overtime

pay. Based on Jackson's W-4, Myers withholds income taxes at 10% of his gross pay. As of July 31, Jackson had

$28,000 of cumulative earnings.

(Click the icon to view payroll tax rate information.)

Journalize the accrual of salary expense for Myers Company related to the employment of Jackson Sanders for the

month of August. (Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on

the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

More info

For all payroll calculations, use the following tax rates and round amounts to the

nearest cent:

Employee: OASDI: 6.2% on first $117,000 earned; Medicare: 1.45% up

to $200,000, 2.35% on earnings above $200,000.

Employer: OASDI: 6.2% on first $117,000 earned; Medicare: 1.45%; FUTA:

0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned.

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning