College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 5E

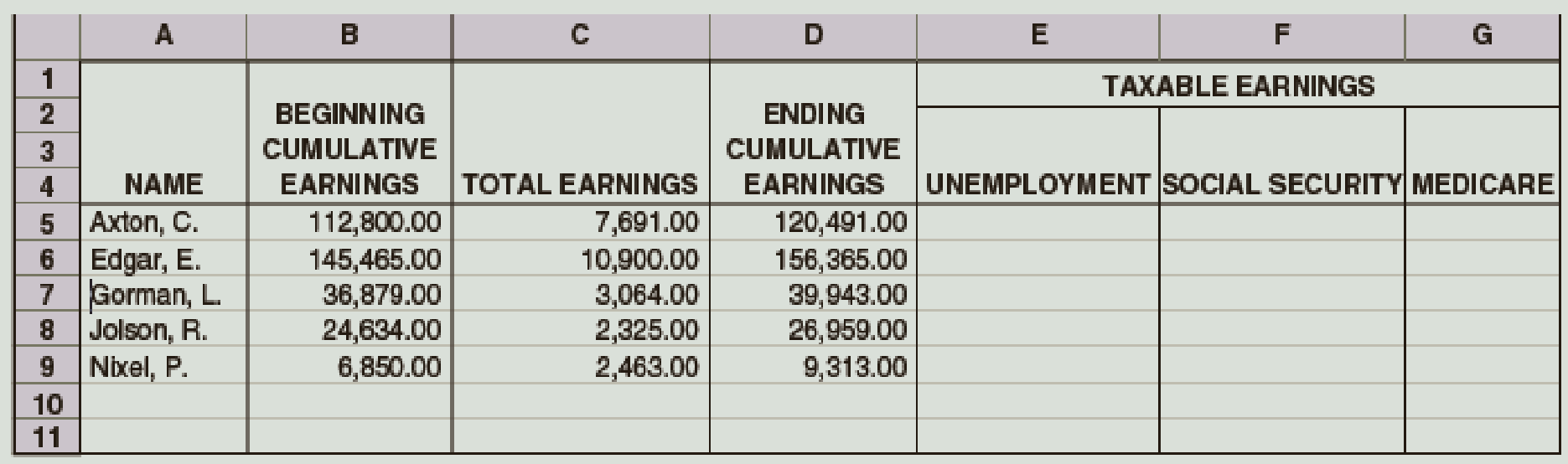

For tax purposes, assume that the maximum taxable earnings are $118,500 for Social Security and $7,000 for the

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 7 Solutions

College Accounting (Book Only): A Career Approach

Ch. 7 - Prob. 1QYCh. 7 - Which of the following taxes are not withheld from...Ch. 7 - Calculate an employees total earnings if the...Ch. 7 - Prob. 4QYCh. 7 - Prob. 5QYCh. 7 - Prob. 6QYCh. 7 - When is the payroll register updated? a. Annually...Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQ

Ch. 7 - Explain the difference between gross earnings and...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Determine the gross pay for each employee listed...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - For tax purposes, assume that the maximum taxable...Ch. 7 - On January 21, the column totals of the payroll...Ch. 7 - Prob. 7ECh. 7 - Assume that the employees in Exercise 77 are paid...Ch. 7 - Prob. 1PACh. 7 - Prob. 2PACh. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - Prob. 5PACh. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - Prob. 5PBCh. 7 - Attracting and retaining the best employees is...Ch. 7 - Southern Company pays its employees weekly by...Ch. 7 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Payrex Co. has six employees. All are paid on a weekly basis. For the payroll period ending January 7, total employee earnings were 12,500, all of which were subject to SUTA, FUTA, Social Security, and Medicare taxes. The SUTA tax rate in Payrexs state is 5.4%, but Payrex qualifies for a rate of 2.0% because of its good record of providing regular employment to its employees. Other employer payroll taxes are at the rates described in the chapter. REQUIRED 1. Calculate Payrexs FUTA, SUTA, Social Security, and Medicare taxes for the week ended January 7. 2. Prepare the journal entry for Payrexs payroll taxes for the week ended January 7. 3. What amount of payroll taxes did Payrex save because of its good employment record?arrow_forwardLemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.arrow_forwardDavis, Inc. paid wages to its employees during the year as follows: a. How much of the total payroll is exempt from the FICA rate of 8%? b. How much of the total payroll is exempt from federal and state unemployment taxes? c. How much of the total payroll is exempt from federal income tax withholding?arrow_forward

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License