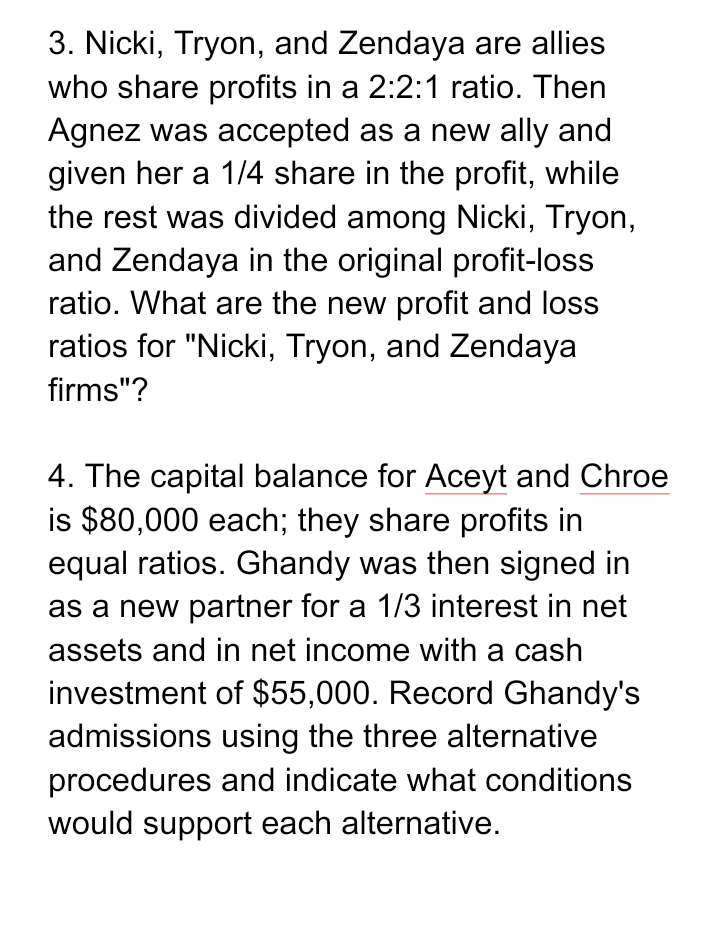

3. Nicki, Tryon, and Zendaya are allies who share profits in a 2:2:1 ratio. Then Agnez was accepted as a new ally and given her a 1/4 share in the profit, while the rest was divided among Nicki, Tryon, and Zendaya in the original profit-loss ratio. What are the new profit and loss ratios for "Nicki, Tryon, and Zendaya firms"?

3. Nicki, Tryon, and Zendaya are allies who share profits in a 2:2:1 ratio. Then Agnez was accepted as a new ally and given her a 1/4 share in the profit, while the rest was divided among Nicki, Tryon, and Zendaya in the original profit-loss ratio. What are the new profit and loss ratios for "Nicki, Tryon, and Zendaya firms"?

Chapter2: The Deduction For qualified Business Income For Pass-through Entities

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:3. Nicki, Tryon, and Zendaya are allies

who share profits in a 2:2:1 ratio. Then

Agnez was accepted as a new ally and

given her a 1/4 share in the profit, while

the rest was divided among Nicki, Tryon,

and Zendaya in the original profit-loss

ratio. What are the new profit and loss

ratios for "Nicki, Tryon, and Zendaya

firms"?

4. The capital balance for Aceyt and Chroe

is $80,000 each; they share profits in

equal ratios. Ghandy was then signed in

as a new partner for a 1/3 interest in net

assets and in net income with a cash

investment of $55,000. Record Ghandy's

admissions using the three alternative

procedures and indicate what conditions

would support each alternative.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College