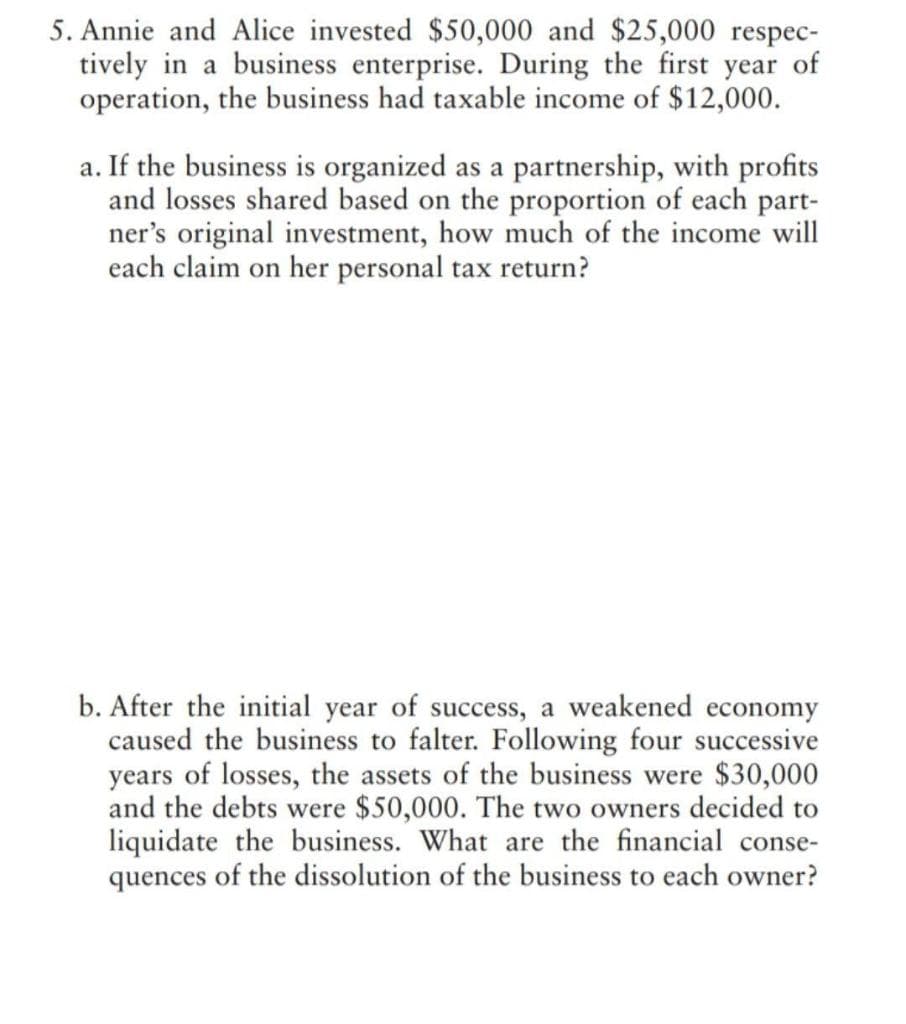

5. Annie and Alice invested $50,000 and $25,000 respec- tively in a business enterprise. During the first year of operation, the business had taxable income of $12,000. a. If the business is organized as a partnership, with profits and losses shared based on the proportion of each part- ner's original investment, how much of the income will each claim on her personal tax return? b. After the initial year of success, a weakened economy caused the business to falter. Following four successive years of losses, the assets of the business were $30,000 and the debts were $50,000. The two owners decided to liquidate the business. What are the financial conse- quences of the dissolution of the business to each owner?

5. Annie and Alice invested $50,000 and $25,000 respec- tively in a business enterprise. During the first year of operation, the business had taxable income of $12,000. a. If the business is organized as a partnership, with profits and losses shared based on the proportion of each part- ner's original investment, how much of the income will each claim on her personal tax return? b. After the initial year of success, a weakened economy caused the business to falter. Following four successive years of losses, the assets of the business were $30,000 and the debts were $50,000. The two owners decided to liquidate the business. What are the financial conse- quences of the dissolution of the business to each owner?

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 20P

Related questions

Question

ASAP

Transcribed Image Text:5. Annie and Alice invested $50,000 and $25,000 respec-

tively in a business enterprise. During the first year of

operation, the business had taxable income of $12,000.

a. If the business is organized as a partnership, with profits

and losses shared based on the proportion of each part-

ner's original investment, how much of the income will

each claim on her personal tax return?

b. After the initial year of success, a weakened economy

caused the business to falter. Following four successive

years of losses, the assets of the business were $30,000

and the debts were $50,000. The two owners decided to

liquidate the business. What are the financial conse-

quences of the dissolution of the business to each owner?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you