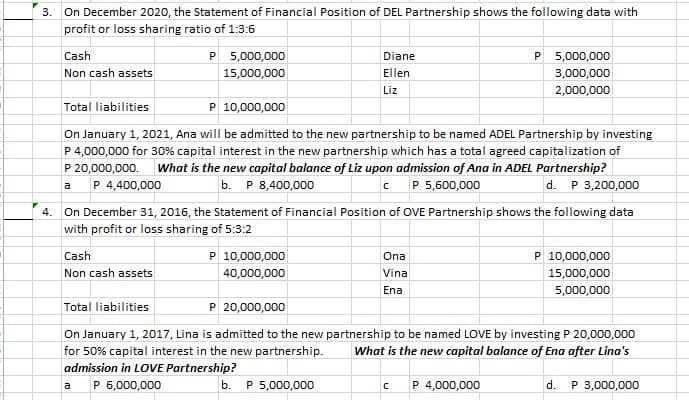

3. On December 2020, the Statement of Financial Position of DEL Partnership shows the following data with profit or loss sharing ratio of 1:3:6 Cash P 5,000,000 P 5,000,000 Diane Non cash assets 15,000,000 Ellen 3,000,000 Liz 2,000,000 Total liabilities P 10,000,000 On January 1, 2021, Ana will be admitted to the new partnership to be named ADEL Partnership by investing P 4,000,000 for 30% capital interest in the new partnership which has a total agreed capitalization of P 20,000,000. What is the new capital balance of Liz upon admission of Ana in ADEL Partnership? a P 4,400,000 b. P 8,400,000 C P 5,600,000 d. P 3,200,000 4. On December 31, 2016, the Statement of Financial Position of OVE Partnership shows the following data with profit or loss sharing of 5:3:2 Cash P 10,000,000 Ona P 10,000,000 Non cash assets 40,000,000 Vina 15,000,000 Ena 5,000,000 Total liabilities P 20,000,000 On January 1, 2017, Lina is admitted to the new partnership to be named LOVE by investing P 20,000,000 for 50% capital interest in the new partnership. admission in LOVE Partnership? What is the new capital balance of Ena after Lina's P 6,000,000 b. P 5,000,000 C P 4,000,000 d. P 3,000,000 a

3. On December 2020, the Statement of Financial Position of DEL Partnership shows the following data with profit or loss sharing ratio of 1:3:6 Cash P 5,000,000 P 5,000,000 Diane Non cash assets 15,000,000 Ellen 3,000,000 Liz 2,000,000 Total liabilities P 10,000,000 On January 1, 2021, Ana will be admitted to the new partnership to be named ADEL Partnership by investing P 4,000,000 for 30% capital interest in the new partnership which has a total agreed capitalization of P 20,000,000. What is the new capital balance of Liz upon admission of Ana in ADEL Partnership? a P 4,400,000 b. P 8,400,000 C P 5,600,000 d. P 3,200,000 4. On December 31, 2016, the Statement of Financial Position of OVE Partnership shows the following data with profit or loss sharing of 5:3:2 Cash P 10,000,000 Ona P 10,000,000 Non cash assets 40,000,000 Vina 15,000,000 Ena 5,000,000 Total liabilities P 20,000,000 On January 1, 2017, Lina is admitted to the new partnership to be named LOVE by investing P 20,000,000 for 50% capital interest in the new partnership. admission in LOVE Partnership? What is the new capital balance of Ena after Lina's P 6,000,000 b. P 5,000,000 C P 4,000,000 d. P 3,000,000 a

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

kindly answer 3 and 4 question. thank you

Transcribed Image Text:3.

On December 2020, the Statement of Financial Position of DEL Partnership shows the following data with

profit or loss sharing ratio of 1:3:6

Cash

P 5,000,000

P 5,000,000

Diane

Non cash assets

15,000,000

Ellen

3,000,000

Liz

2,000,000

Total liabilities

P 10,000,000

On January 1, 2021, Ana will be admitted to the new partnership to be named ADEL Partnership by investing

P 4,000,000 for 30% capital interest in the new partnership which has a total agreed capitalization of

P 20,000,000. what is the new capital balance of Liz upon admission of Ana in ADEL Partnership?

a P 4,400,000

b. P 8,400,000

C P 5,600,000

d. P 3,200,000

4. On December 31, 2016, the Statement of Financial Position of OVE Partnership shows the following data

with profit or loss sharing of 5:3:2

Cash

P 10,000,000

P 10,000,000

Ona

Non cash assets

40,000,000

Vina

15,000,000

Ena

5,000,000

Total liabilities

P 20,000,000

On January 1, 2017, Lina is admitted to the new partnership to be named LOVE by investing P 20,000,000

for 50% capital interest in the new partnership.

admission in LOVE Partnership?

P 6,000,000

What is the new capital balance of Ena after Lina's

b. Р 5,000,000

P 4,000,000

d. P 3,000,000

a

P.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College