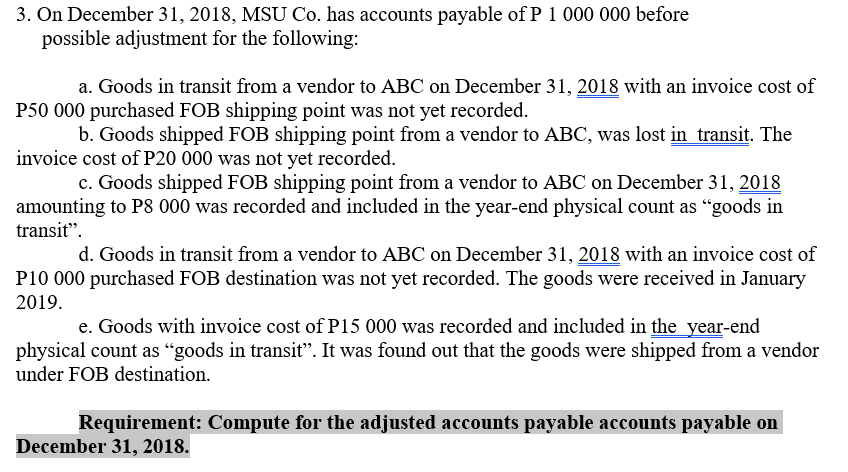

3. On December 31, 2018, MSU Co. has accounts payable of P 1 000 000 before possible adjustment for the following: a. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of P50 000 purchased FOB shipping point was not yet recorded. b. Goods shipped FOB shipping point from a vendor to ABC, was lost in transit. The invoice cost of P20 000 was not yet recorded. c. Goods shipped FOB shipping point from a vendor to ABC on December 31, 2018 amounting to P8 000 was recorded and included in the year-end physical count as "goods in transit". d. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of P10 000 purchased FOB destination was not yet recorded. The goods were received in January 2019. e. Goods with invoice cost of P15 000 was recorded and included in the year-end physical count as “goods in transit". It was found out that the goods were shipped from a vendor under FOB destination. Requirement: Compute for the adjusted accounts payable accounts payable on December 31, 2018.

3. On December 31, 2018, MSU Co. has accounts payable of P 1 000 000 before possible adjustment for the following: a. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of P50 000 purchased FOB shipping point was not yet recorded. b. Goods shipped FOB shipping point from a vendor to ABC, was lost in transit. The invoice cost of P20 000 was not yet recorded. c. Goods shipped FOB shipping point from a vendor to ABC on December 31, 2018 amounting to P8 000 was recorded and included in the year-end physical count as "goods in transit". d. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of P10 000 purchased FOB destination was not yet recorded. The goods were received in January 2019. e. Goods with invoice cost of P15 000 was recorded and included in the year-end physical count as “goods in transit". It was found out that the goods were shipped from a vendor under FOB destination. Requirement: Compute for the adjusted accounts payable accounts payable on December 31, 2018.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 1MC: The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before...

Related questions

Question

Transcribed Image Text:3. On December 31, 2018, MSU Co. has accounts payable of P 1 000 000 before

possible adjustment for the following:

a. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of

P50 000 purchased FOB shipping point was not yet recorded.

b. Goods shipped FOB shipping point from a vendor to ABC, was lost in transit. The

invoice cost of P20 000 was not yet recorded.

c. Goods shipped FOB shipping point from a vendor to ABC on December 31, 2018

amounting to P8 000 was recorded and included in the year-end physical count as "goods in

transit".

d. Goods in transit from a vendor to ABC on December 31, 2018 with an invoice cost of

P10 000 purchased FOB destination was not yet recorded. The goods were received in January

2019.

e. Goods with invoice cost of P15 000 was recorded and included in the_year-end

physical count as "goods in transit". It was found out that the goods were shipped from a vendor

under FOB destination.

Requirement: Compute for the adjusted accounts payable accounts payable on

December 31, 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning