Oriole Company discovered the following errors made in January 2020. A payment of Salaries and Wages Expense of $820 was debited to Equipment and credited to Cash, both for $820. 1. A collection of $7,700 from a client on account was debited to Cash $770 and 2. credited to Service Revenue $770. The purchase of equipment on account for $170 was debited to Equipment $940 and credited to Accounts Payable $940. 3.

Oriole Company discovered the following errors made in January 2020. A payment of Salaries and Wages Expense of $820 was debited to Equipment and credited to Cash, both for $820. 1. A collection of $7,700 from a client on account was debited to Cash $770 and 2. credited to Service Revenue $770. The purchase of equipment on account for $170 was debited to Equipment $940 and credited to Accounts Payable $940. 3.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 5PA: The Colby Group has the following unadjusted trial balance as of August 31, 2019: The debit and...

Related questions

Question

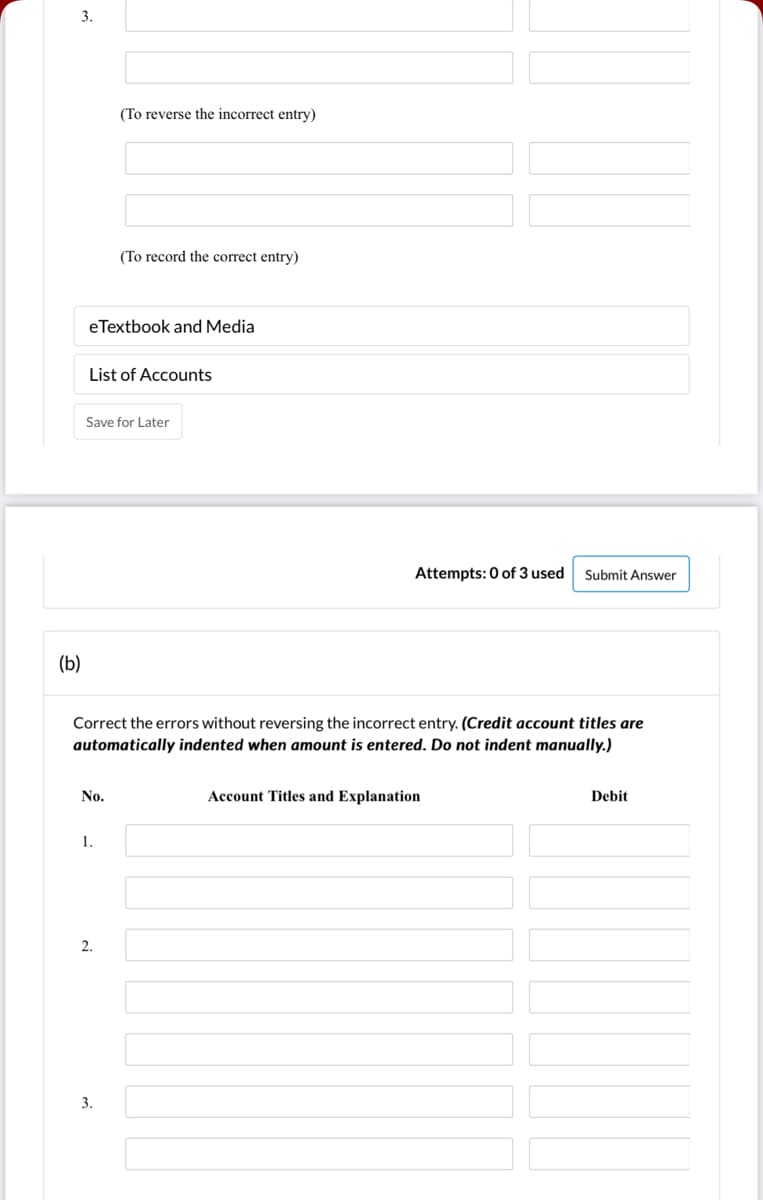

Transcribed Image Text:3.

(To reverse the incorrect entry)

(To record the correct entry)

eTextbook and Media

List of Accounts

Save for Later

Attempts: 0 of 3 used

Submit Answer

(b)

Correct the errors without reversing the incorrect entry. (Credit account titles are

automatically indented when amount is entered. Do not indent manually.)

No.

Account Titles and Explanation

Debit

1.

2.

3.

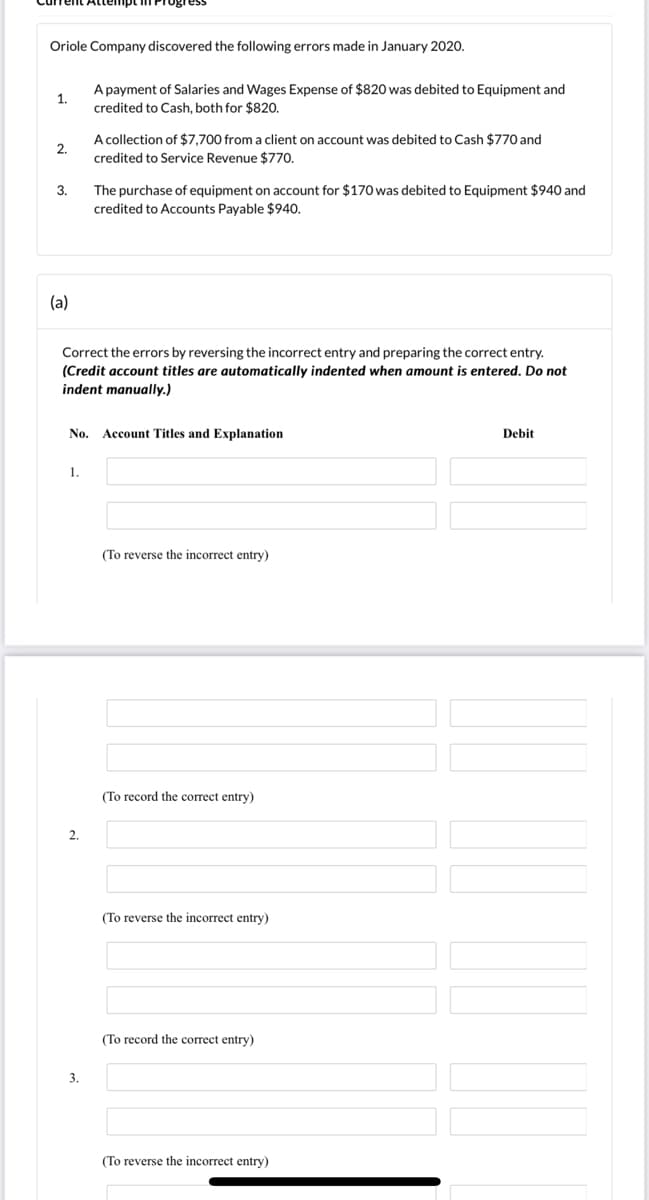

Transcribed Image Text:Oriole Company discovered the following errors made in January 2020.

A payment of Salaries and Wages Expense of $820 was debited to Equipment and

1.

credited to Cash, both for $820.

A collection of $7,700 from a client on account was debited to Cash $770 and

2.

credited to Service Revenue $770.

The purchase of equipment on account for $170 was debited to Equipment $940 and

credited to Accounts Payable $940.

3.

(a)

Correct the errors by reversing the incorrect entry and preparing the correct entry.

(Credit account titles are automatically indented when amount is entered. Do not

indent manually.)

No. Account Titles and Explanation

Debit

1.

(To reverse the incorrect entry)

(To record the correct entry)

2.

(To reverse the incorrect entry)

(To record the correct entry)

3.

(To reverse the incorrect entry)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning