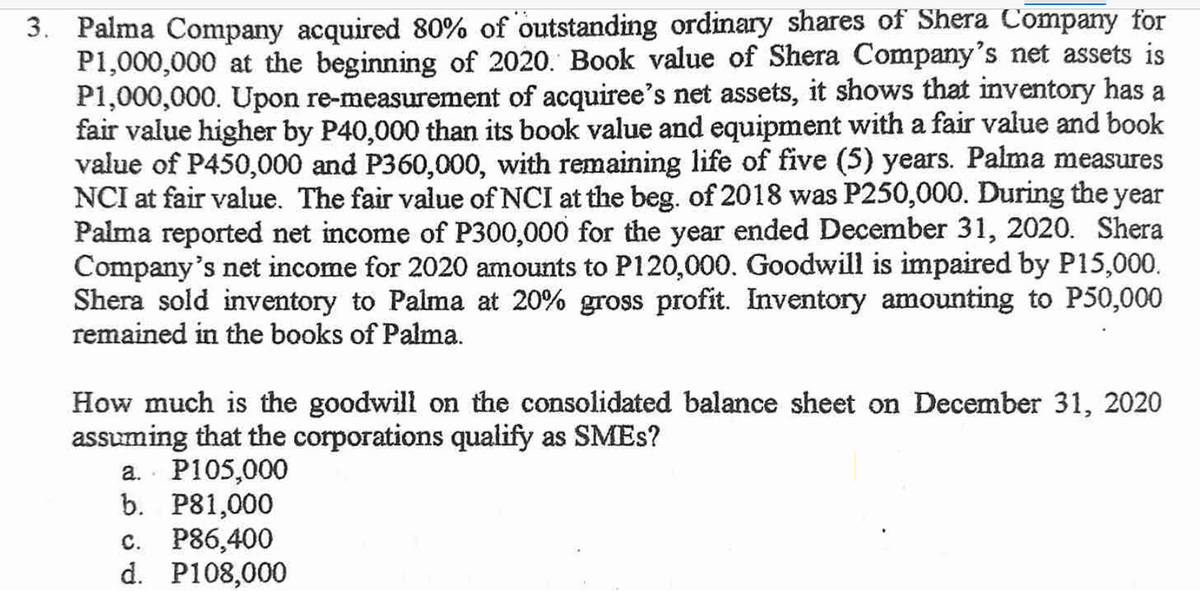

3. Palma Company acquired 80% of outstanding ordinary shares of Shera Company for P1,000,000 at the beginning of 2020. Book value of Shera Company's net assets is P1,000,000. Upon re-measurement of acquiree's net assets, it shows that inventory has a fair value higher by P40,000 than its book value and equipment with a fair value and book value of P450,000 and P360,000, with remaining life of five (5) years. Palma measures NCI at fair value. The fair value of NCI at the beg. of 2018 was P250,000. During the year Palma reported net income of P300,000 for the year ended December 31, 2020. Shera Company's net income for 2020 amounts to P120,000. Goodwill is impaired by P15,000. Shera sold inventory to Palma at 20% gross profit. Inventory amounting to P50,000 remained in the books of Palma. How much is the goodwill on the consolidated balance sheet on December 31, 2020 assuming that the corporations qualify as SMES? a. P105,000 b. P81,000 c. P86,400 P108 000 d

3. Palma Company acquired 80% of outstanding ordinary shares of Shera Company for P1,000,000 at the beginning of 2020. Book value of Shera Company's net assets is P1,000,000. Upon re-measurement of acquiree's net assets, it shows that inventory has a fair value higher by P40,000 than its book value and equipment with a fair value and book value of P450,000 and P360,000, with remaining life of five (5) years. Palma measures NCI at fair value. The fair value of NCI at the beg. of 2018 was P250,000. During the year Palma reported net income of P300,000 for the year ended December 31, 2020. Shera Company's net income for 2020 amounts to P120,000. Goodwill is impaired by P15,000. Shera sold inventory to Palma at 20% gross profit. Inventory amounting to P50,000 remained in the books of Palma. How much is the goodwill on the consolidated balance sheet on December 31, 2020 assuming that the corporations qualify as SMES? a. P105,000 b. P81,000 c. P86,400 P108 000 d

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:3. Palma Company acquired 80% of outstanding ordinary shares of Shera Company for

P1,000,000 at the beginning of 2020. Book value of Shera Company's net assets is

P1,000,000. Upon re-measurement of acquiree's net assets, it shows that inventory has a

fair value higher by P40,000 than its book value and equipment with a fair value and book

value of P450,000 and P360,000, with remaining life of five (5) years. Palma measures

NCI at fair value. The fair value of NCI at the beg. of 2018 was P250,000. During the year

Palma reported net income of P300,000 for the year ended December 31, 2020. Shera

Company's net income for 2020 amounts to P120,000. Goodwill is impaired by P15,000.

Shera sold inventory to Palma at 20% gross profit. Inventory amounting to P50,000

remained in the books of Palma.

How much is the goodwill on the consolidated balance sheet on December 31, 2020

assuming that the corporations qualify as SMES?

a. P105,000

b. P81,000

c. P86,400

d. P108,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning