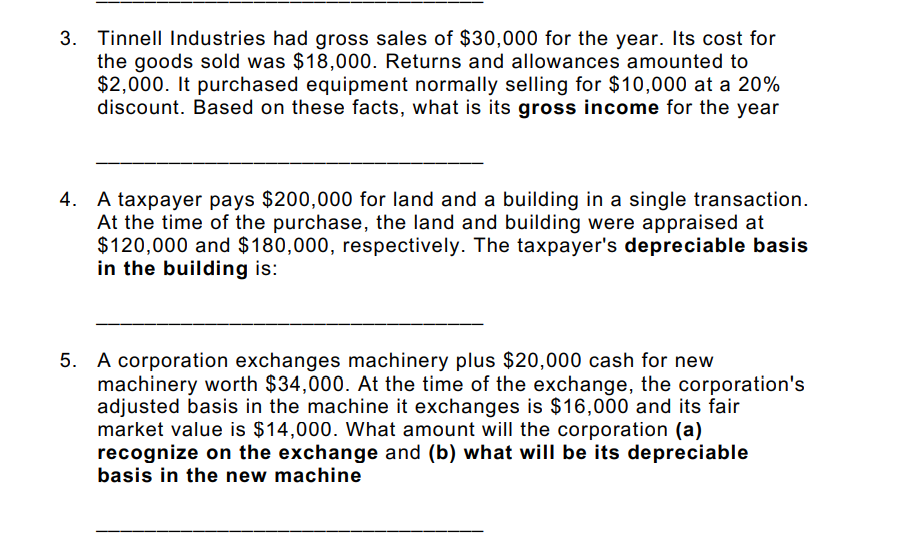

3. Tinnell Industries had gross sales of $30,000 for the year. Its cost for the goods sold was $18,000. Returns and allowances amounted to $2,000. It purchased equipment normally selling for $10,000 at a 20% discount. Based on these facts, what is its gross income for the year 4. A taxpayer pays $200,000 for land and a building in a single transaction. At the time of the purchase, the land and building were appraised at $120,000 and $180,000, respectively. The taxpayer's depreciable basis in the building is: 5. A corporation exchanges machinery plus $20,000 cash for new machinery worth $34,000. At the time of the exchange, the corporation's adjusted basis in the machine it exchanges is $16,000 and its fair market value is $14,000. What amount will the corporation (a) recognize on the exchange and (b) what will be its depreciable basis in the new machine

3. Tinnell Industries had gross sales of $30,000 for the year. Its cost for the goods sold was $18,000. Returns and allowances amounted to $2,000. It purchased equipment normally selling for $10,000 at a 20% discount. Based on these facts, what is its gross income for the year 4. A taxpayer pays $200,000 for land and a building in a single transaction. At the time of the purchase, the land and building were appraised at $120,000 and $180,000, respectively. The taxpayer's depreciable basis in the building is: 5. A corporation exchanges machinery plus $20,000 cash for new machinery worth $34,000. At the time of the exchange, the corporation's adjusted basis in the machine it exchanges is $16,000 and its fair market value is $14,000. What amount will the corporation (a) recognize on the exchange and (b) what will be its depreciable basis in the new machine

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:3. Tinnell Industries had gross sales of $30,000 for the year. Its cost for

the goods sold was $18,000. Returns and allowances amounted to

$2,000. It purchased equipment normally selling for $10,000 at a 20%

discount. Based on these facts, what is its gross income for the year

4. A taxpayer pays $200,000 for land and a building in a single transaction.

At the time of the purchase, the land and building were appraised at

$120,000 and $180,000, respectively. The taxpayer's depreciable basis

in the building is:

5. A corporation exchanges machinery plus $20,000 cash for new

machinery worth $34,000. At the time of the exchange, the corporation's

adjusted basis in the machine it exchanges is $16,000 and its fair

market value is $14,000. What amount will the corporation (a)

recognize on the exchange and (b) what will be its depreciable

basis in the new machine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT