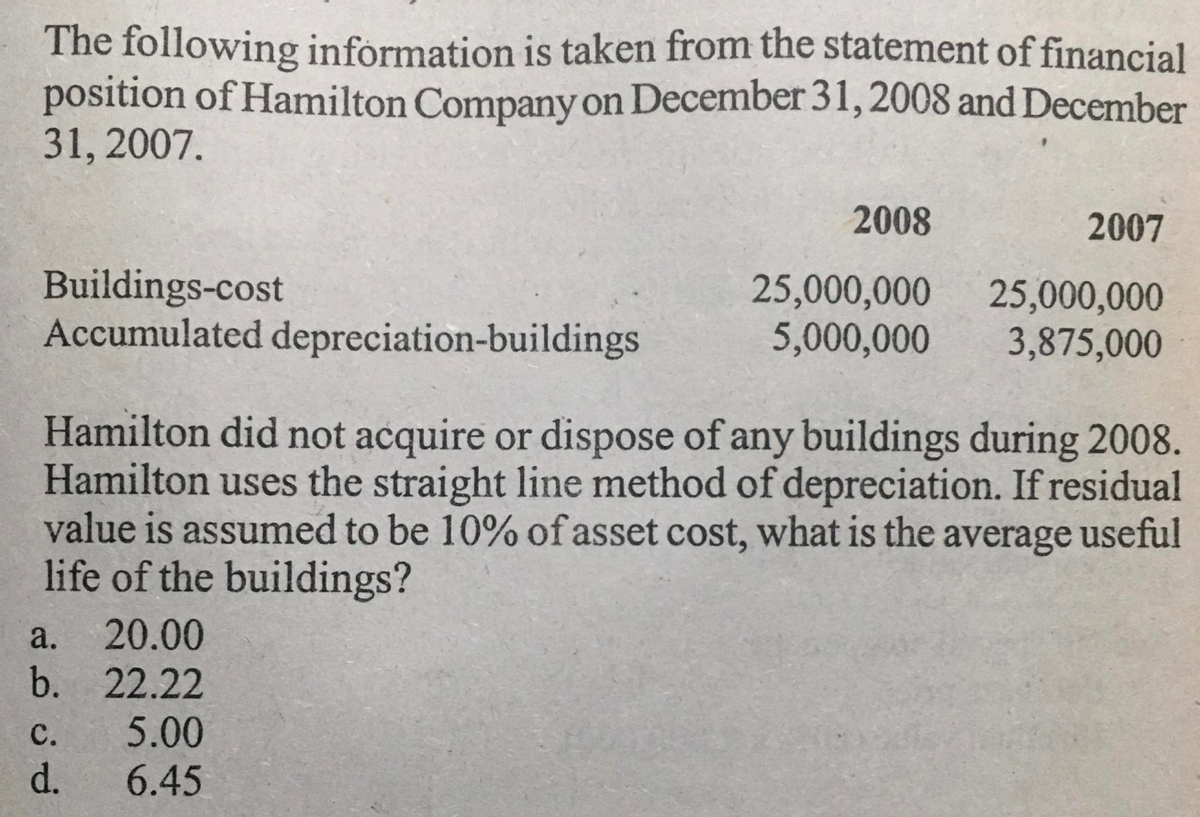

Hamilton did not acquire or dispose of any buildings during 2008. Hamilton uses the straight line method of depreciation. If residual value is assumed to be 10% of asset cost, what is the average useful life of the buildings? a. 20.00 D. 22.22 C. d. 5.00 6.45

Q: Employees that live in a state where the minimum wage is $7.40, their employer will pay them $fill…

A: WAGES PER HOUR Minimum Wages per Hour is computed by Dividing Total Normal Hour in a Day From…

Q: as Walmart’s gross margin decreased in the past 3 years from COVID pandemic?

A: Gross margin is very important and it is measure of the over all operating performance and it show…

Q: Question: Income of certain persons is exempted from tax. Explain the tax policies regarding income…

A: Income tax refers to the tax burden imposed on the earning of person or business by government in…

Q: Question Content Area Standard Actual Variable overhead rate $3.35 Fixed overhead rate $1.80…

A: calculation of variable factory overhead controllable variance are as follows

Q: 4. Which of the following items will appear in the statement of changes in equity? a. Extraordinary…

A: Equity refers to the amount that is left over after payment of all the expenses and debts at the…

Q: Badour Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on…

A: JOB COSTING Industries which manufacture products or render services against specific orders as…

Q: Panamint Systems Corporation is estimating activity costs associated with producing disk drives,…

A: Activity-based costing is used to allocate overhead expenses on the basis of activity. Other than…

Q: Use the average daily balance method to compute the finance charge on the credit card account for…

A:

Q: Required information. Use the following information for the Exercises below. (Algo) [The following…

A: adjusting entry for investment at fair value are as follows

Q: Nickerson Corporation began operations in 2013. There have been no permanent or temporary…

A: Any tax law that permits you to minimize your tax burden is referred to as a tax advantage benefit.…

Q: How much were its total product costs last month? How much were its total period costs last…

A: A total number of three questions has been asked that for the first question solution has been…

Q: Quality Chairs Inc. (QC) manufactures chairs for industrial use. Laura Winters, the Vice President…

A: In the manufacturing or service sectors, direct labor is labor that is assigned to a specific…

Q: Garnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the…

A: The question is based on the concept of Financial Management. Internal rate of return is the rate at…

Q: nderson Publishing has two divisions: Book Publishing and Magazine Publishing. The Magazine division…

A: Business companies compile income statements in order to determine how much net income they generate…

Q: Selling and Administrative expenses Salaries Advertising Insurance Office Depreciation Other fixed…

A: Your answer is below

Q: If other resorts in the area charge $65 per day, what price should Winter Sports charge? The price…

A: Answer for above requirement are as follows

Q: Alpha Corp sponsors a defined benefit pension plan for its employees. On January 1,2012 the…

A: Pension Accounting: Pension accounting may be very difficult, especially when it comes to defined…

Q: could sell its ore at a market price of $265 per tonne, incurring an additional $15 per tonne in…

A:

Q: Bryan sold the following shares of stock of domestic corporations which he bought for investment…

A: The question is asked about the capital gain tax and we need to compute the capital gain tax for…

Q: Beacons Company maintains and repairs warning lights, such as those found on radio towers and…

A: Step 2 in the solution .

Q: What is meant by internal benchmarking in ratio analysis

A: Internal benchmarking is a process in which a company or an organisation looks within its own…

Q: Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated…

A: TANGIBLE ASSETS Tangible are shown under the Non Current Assets in the Asset section of the…

Q: Crane Company markets CDs of numerous performing artists. At the beginning of March, Crane had in…

A: Cost of goods available for sale = Beginning Inventory + Purchases

Q: Ace Leasing acquires equipment and leases it to customers under long-term sales-type leases. Ace…

A: Step 2 in the solution.

Q: (a) Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash…

A: Introduction: A statement of cash flows is a financial statement that describes how much money comes…

Q: Indigo Corporation sells a snowboard, EZslide, that is popular with snowboard enthusiasts. Below is…

A: FIFO: FIFO stands for First-In, First-Out. In this method inventory purchased first will be sell…

Q: A. Shown below is the adjusted balance of Nelson Ricafort, CPA Nelson Ricafort, CPA Adjusted Trial…

A: Reversing Entry: Reversing entries, also known as reversing journal entries, are entries made in a…

Q: Levine Company uses the perpetual inventory system. April 8 Sold merchandise for $3,400 (that had…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Laser World reports net income of $650,000. Depreciation expense is $50,000, accounts receivable…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Powell Company owns an 80% interest in Sauter, Inc. On January 1, 2011, Sauter issued $400,000 of…

A: Solution Bond is a written agreement between an issuer and the holder that requires the issuer to…

Q: Recommendations on how debt-management may be improved

A: Debts Anything owing by one party to another is a debt. Debt may be secured by real estate, cash,…

Q: In 2021, how much taxable income does Hansen recognize from the bank forgiving the home loan to…

A: There are three questions but our guideline is to provide solution to the one question so for the…

Q: On 16 May 2021, Zebra Ltd sold an equipment to its subsidiary Nando Ltd for $100,000, this asset…

A: Inventory: It implies to all the goods, items, merchandise, and materials that are held by the…

Q: Exercise 2-4 Compute the owner's equity for Norman Gonzales on December 31, 20X1 based on the…

A: As per the guidelines we can provide the answer for one question first one ( as the question are…

Q: Problem 12-4A (Static) Calculate risk ratios (LO12-3) The following income statement and balance…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: The Crystal Glass is a trader in chinaware décor . The following information is available at…

A: Gross margin = Sales*Margin Cost of goods sold = Sales - Gross margin Purchases = Cost of goods sold…

Q: Please explain and analyze the effect of major differences between IFRS and U.S. GAAP related to the…

A: A group of accounting standards called International Financial Reporting Standards (IFRS) specify…

Q: Miller Company's contribution form Sales (33,000 units) Variable expenses Contribution margin Fixed…

A: Calculation of net operating income above case are as follows

Q: Discuss Briefly the fundamental principles of Duty of confidentiality An Auditor is required…

A: i) Fundamental principles of Duty of confidentiality 1. It is the duty of auditor that he should…

Q: Required: 1. Calculate each year's absorption costing net operating income. (Enter any losses or…

A: Absorption costing: Absorption costing is a method in which cost of units produced is calculated as…

Q: the average daily balance method to compute the finance charge on the credit card account for the…

A: Average Daily Balance method is a method which is generally used by the credit card company for…

Q: Rex and Dena are married and have two children, Michelle (age seven) and Nancy (age five). During…

A: Answer:- correct option is, C.5,980.

Q: Assume a service company has implemented an activity-based costing system with five activities as…

A: The cost of processing each order is equal to the total cost of operations divided by the total…

Q: Identify a research problem in Accounting and coin topic based on the problem. State the problem for…

A: Effect of Advertisement on Buying Behavior of the Consumers with extraordinary reference to Cosmetic…

Q: Bond Premium, Entries for Bonds Payable Transactions Rodgers Corporation produces and sells football…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Accounts obtained from the books of accounts LMN Trading Company on December 31, 20X1 will enable…

A: Lets understand the basics. Reporting period is a period for which financial statement is prepared…

Q: The net income reported on the income statement for the current year was $122,100. Depreciation…

A: The question is based on the concept of Cash flow statement. Cash flow statement is the statement…

Q: D-F

A: Retained earnings are calculated by adding the net income and opening retained earnings and…

Q: (c) Calculate the gross profit rate for 2020, 2021, and 2022. (Round answers to 1 decimal places,…

A: As you didn't specify which is to be solved and all other questions are answered, I'm solving for…

Q: Chance Enterprises leased equipment from Third Bank Leasing on January Appropriate adjusting entries…

A: Lease - The details of rental agreements for both real estate and personal items are stated in…

Step by step

Solved in 4 steps

- On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.

- Which of the following is not true about the MACRS depreciation system: A salvage value must be determined before depreciation percentages are applied to depreciable real estate. Residential rental buildings are depreciated over 27.5 years straight-line. Commercial real estate buildings are depreciated over 39 years straight-line. No matter when during the month depreciable real estate is purchased, it is considered to have been placed in service at mid-month for MACRS depreciation purposes.SEAT Inc. acquired the following assets in January of 2015. Equipment, estimated service life, 5 years; salvage value, $16,200 $503,700 Building, estimated service life, 30 years; no salvage value $648,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2018, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the journal entry to record depreciation expense for the equipment in 2018. (b) Prepare the journal entry to record depreciation expense for the building in 2018.Maxim Sdn Bhd commenced business as kitchenware manufacturing on 1 January 2013. For the purpose of depreciation, Maxim Sdn Bhd decided the following. Acquisition of a piece of land worth $2,000,000 would not be depreciated. Factory building worth $300,000 would be depreciated by the straight line method to a nil residual value over 30 years. On 1 January 2018, the board of directors decided to revalue its assets after consulted property valuers as following:- Land - $2,500,000Factory building - $450,000 The factory building is estimated still has further 25 years useful life remaining. Calculate the annual charge for depreciation for the first five years of the building's life and the statement of financial position value of the land and building as at the end of each of the first five years. Demonstrate the impact the revaluation will have on the depreciation charge and the statement of financial position value of the land and building.

- The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Skysong, Inc. at the end of 2022 are shown here. Equipment Beg. bal. 60,000 Disposals 16,500 Acquisitions 31,200 End. bal. 74,700 Accum. Depr.—Equipment Disposals 3,825 Beg. bal. 33,375 Depr. exp. 9,000 End. bal. 38,550 In addition, Skysong, Inc.’s income statement reported a loss on the disposal of plant assets of $2,625. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”? (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)CC inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value, $15,700 $486,700 Building estimated service life, 30 years; no salvage value $711k The equipment has been depreciated using the sum-of-the-years'-digits method for the first 3 years for financial reporting purposes. In 2021, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the general journal entry to record depreciation expenses for equipment in 2021. (b) Prepare the journal entry to record depreciation expenses for the building in 2021. (Round answers to 0 decimal places.)Buffalo Cole Inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value, $13,700 $523,700 Building, estimated service life, 30 years; no salvage value $678,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2021, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the general journal entry to record depreciation expense for the equipment in 2021. (b) Prepare the journal entry to record depreciation expense for the building in 2021. (Round answers to 0 decimal places,…

- Whispering Cole Inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value, $16,200 $503,700 Building, estimated service life, 30 years; no salvage value $648,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2021, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the general journal entry to record depreciation expense for the equipment in 2021. (b) Prepare the journal entry to record depreciation expense for the building in 2021.On January 1, 2009, Neal Corporation acquired equipment at a cost of $540,000. Neal adopted the sum-of-the-years’-digits method of depreciation for this equipment and had been recording depreciation over an estimated life of eight years, with no residual value. At the beginning of 2012, a decision was made to change to the straight-line method of depreciation for this equipment. The depreciation expense for 2012 would be Select one: a. $108,000 b. $28,125. c. $67,500 d. $45,000.The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Vaughn Manufacturing at the end of 2022 are shown here. Equipment Beg. bal. 100,000 Disposals 27,500 Acquisitions 52,000 End. bal. 124,500 Accum. Depr.—Equipment Disposals 6,375 Beg. bal. 55,625 Depr. exp. 15,000 End. bal. 64,250 In addition, Vaughn Manufacturing’s income statement reported a loss on the disposal of plant assets of $4,375. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”? (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment $enter cash flow from sale of equipment in dollars