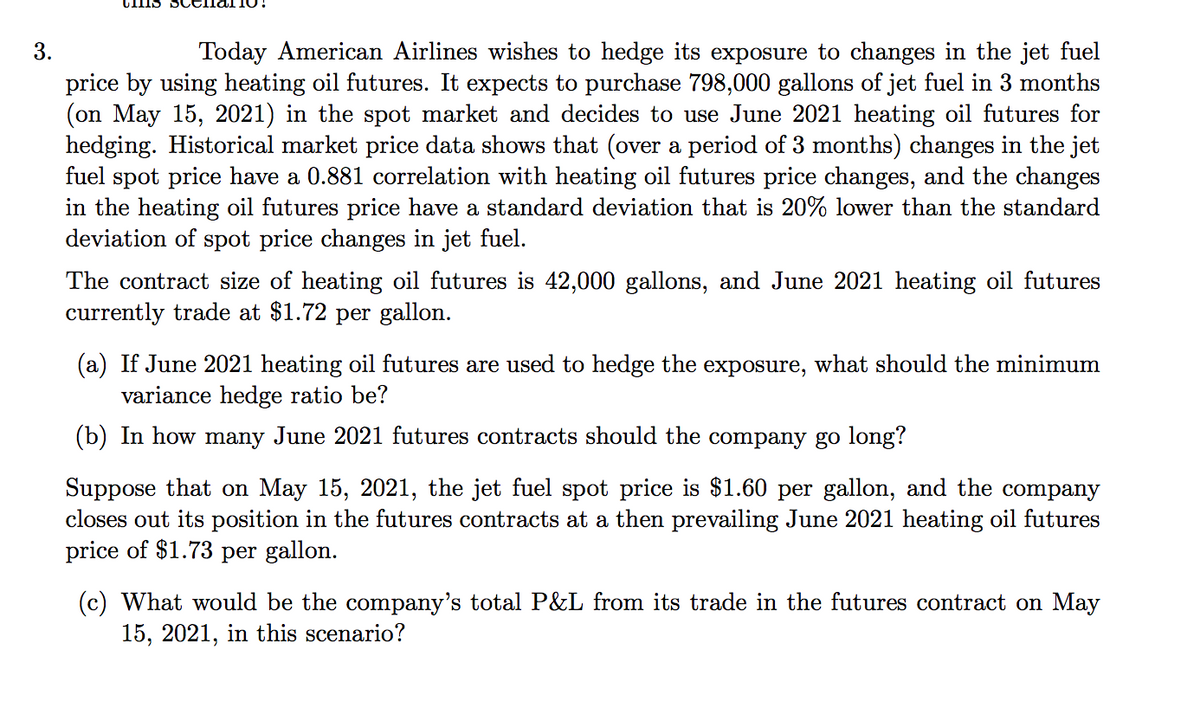

3. Today American Airlines wishes to hedge its exposure to changes in the jet fuel price by using heating oil futures. It expects to purchase 798,000 gallons of jet fuel in 3 months (on May 15, 2021) in the spot market and decides to use June 2021 heating oil futures for hedging. Historical market price data shows that (over a period of 3 months) changes in the jet fuel spot price have a 0.881 correlation with heating oil futures price changes, and the changes in the heating oil futures price have a standard deviation that is 20% lower than the standard deviation of spot price changes in jet fuel. The contract size of heating oil futures is 42,000 gallons, and June 2021 heating oil futures currently trade at $1.72 per gallon. (a) If June 2021 heating oil futures are used to hedge the exposure, what should the minimum variance hedge ratio be? (b) In how many June 2021 futures contracts should the company go long? Suppose that on May 15, 2021, the jet fuel spot price is $1.60 per gallon, and the company closes out its position in the futures contracts at a then prevailing June 2021 heating oil futures

3. Today American Airlines wishes to hedge its exposure to changes in the jet fuel price by using heating oil futures. It expects to purchase 798,000 gallons of jet fuel in 3 months (on May 15, 2021) in the spot market and decides to use June 2021 heating oil futures for hedging. Historical market price data shows that (over a period of 3 months) changes in the jet fuel spot price have a 0.881 correlation with heating oil futures price changes, and the changes in the heating oil futures price have a standard deviation that is 20% lower than the standard deviation of spot price changes in jet fuel. The contract size of heating oil futures is 42,000 gallons, and June 2021 heating oil futures currently trade at $1.72 per gallon. (a) If June 2021 heating oil futures are used to hedge the exposure, what should the minimum variance hedge ratio be? (b) In how many June 2021 futures contracts should the company go long? Suppose that on May 15, 2021, the jet fuel spot price is $1.60 per gallon, and the company closes out its position in the futures contracts at a then prevailing June 2021 heating oil futures

Chapter21: Risk Management

Section: Chapter Questions

Problem 2P

Related questions

Question

Only Part B

Transcribed Image Text:3.

Today American Airlines wishes to hedge its exposure to changes in the jet fuel

price by using heating oil futures. It expects to purchase 798,000 gallons of jet fuel in 3 months

(on May 15, 2021) in the spot market and decides to use June 2021 heating oil futures for

hedging. Historical market price data shows that (over a period of 3 months) changes in the jet

fuel spot price have a 0.881 correlation with heating oil futures price changes, and the changes

in the heating oil futures price have a standard deviation that is 20% lower than the standard

deviation of spot price changes in jet fuel.

The contract size of heating oil futures is 42,000 gallons, and June 2021 heating oil futures

currently trade at $1.72 per gallon.

(a) If June 2021 heating oil futures are used to hedge the exposure, what should the minimum

variance hedge ratio be?

(b) In how many June 2021 futures contracts should the company go long?

Suppose that on May 15, 2021, the jet fuel spot price is $1.60 per gallon, and the company

closes out its position in the futures contracts at a then prevailing June 2021 heating oil futures

price of $1.73 per gallon.

(c) What would be the company's total P&L from its trade in the futures contract on May

15, 2021, in this scenario?

Expert Solution

Step 1

Given:

Standard deviation of spot price = 100%

Standard deviation of future price = 1-20% = 80%

Correlation between the spot price and future price = 0.881

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT