3. What is the marginal cost of producing the high-quality product? 4. What is the marginal cost of producing the fair-quality product? 5. Given your estimates of the demand for each product, what is the optimal amount of each to produce and what is the optimal price to charge for each? 6. Given your answers to question 5 above, does this strategy make positive, zero, or negative profits (including the fixed costs of development)? 7. To think about: If you just produced one product that was demanded by both sets of customers, what do you think would happen to your profits? Explain your answer.

3. What is the marginal cost of producing the high-quality product? 4. What is the marginal cost of producing the fair-quality product? 5. Given your estimates of the demand for each product, what is the optimal amount of each to produce and what is the optimal price to charge for each? 6. Given your answers to question 5 above, does this strategy make positive, zero, or negative profits (including the fixed costs of development)? 7. To think about: If you just produced one product that was demanded by both sets of customers, what do you think would happen to your profits? Explain your answer.

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.15P

Related questions

Question

1 and 2 done, need the rest

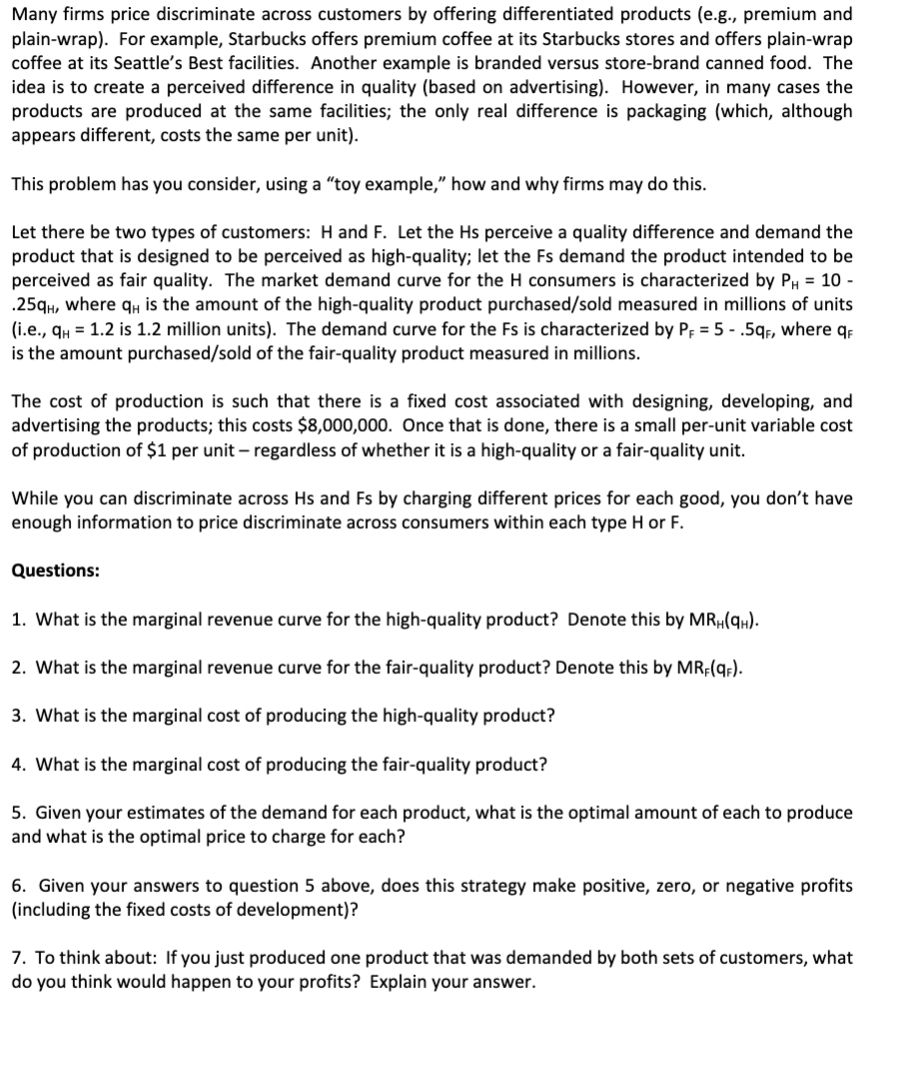

Transcribed Image Text:Many firms price discriminate across customers by offering differentiated products (e.g., premium and

plain-wrap). For example, Starbucks offers premium coffee at its Starbucks stores and offers plain-wrap

coffee at its Seattle's Best facilities. Another example is branded versus store-brand canned food. The

idea is to create a perceived difference in quality (based on advertising). However, in many cases the

products are produced at the same facilities; the only real difference is packaging (which, although

appears different, costs the same per unit).

This problem has you consider, using a "toy example," how and why firms may do this.

Let there be two types of customers: H and F. Let the Hs perceive a quality difference and demand the

product that is designed to be perceived as high-quality; let the Fs demand the product intended to be

perceived as fair quality. The market demand curve for the H consumers is characterized by PH = 10 -

.25qH, where qH is the amount of the high-quality product purchased/sold measured in millions of units

(i.e., qy = 1.2 is 1.2 million units). The demand curve for the Fs is characterized by P; = 5 - .5gr, where q

is the amount purchased/sold of the fair-quality product measured in millions.

The cost of production is such that there is a fixed cost associated with designing, developing, and

advertising the products; this costs $8,000,000. Once that is done, there is a small per-unit variable cost

of production of $1 per unit – regardless of whether it is a high-quality or a fair-quality unit.

While you can discriminate across Hs and Fs by charging different prices for each good, you don't have

enough information to price discriminate across consumers within each type H or F.

Questions:

1. What is the marginal revenue curve for the high-quality product? Denote this by MR„(qH).

2. What is the marginal revenue curve for the fair-quality product? Denote this by MRF(q;).

3. What is the marginal cost of producing the high-quality product?

4. What is the marginal cost of producing the fair-quality product?

5. Given your estimates of the demand for each product, what is the optimal amount of each to produce

and what is the optimal price to charge for each?

6. Given your answers to question 5 above, does this strategy make positive, zero, or negative profits

(including the fixed costs of development)?

7. To think about: If you just produced one product that was demanded by both sets of customers, what

do you think would happen to your profits? Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Recommended textbooks for you