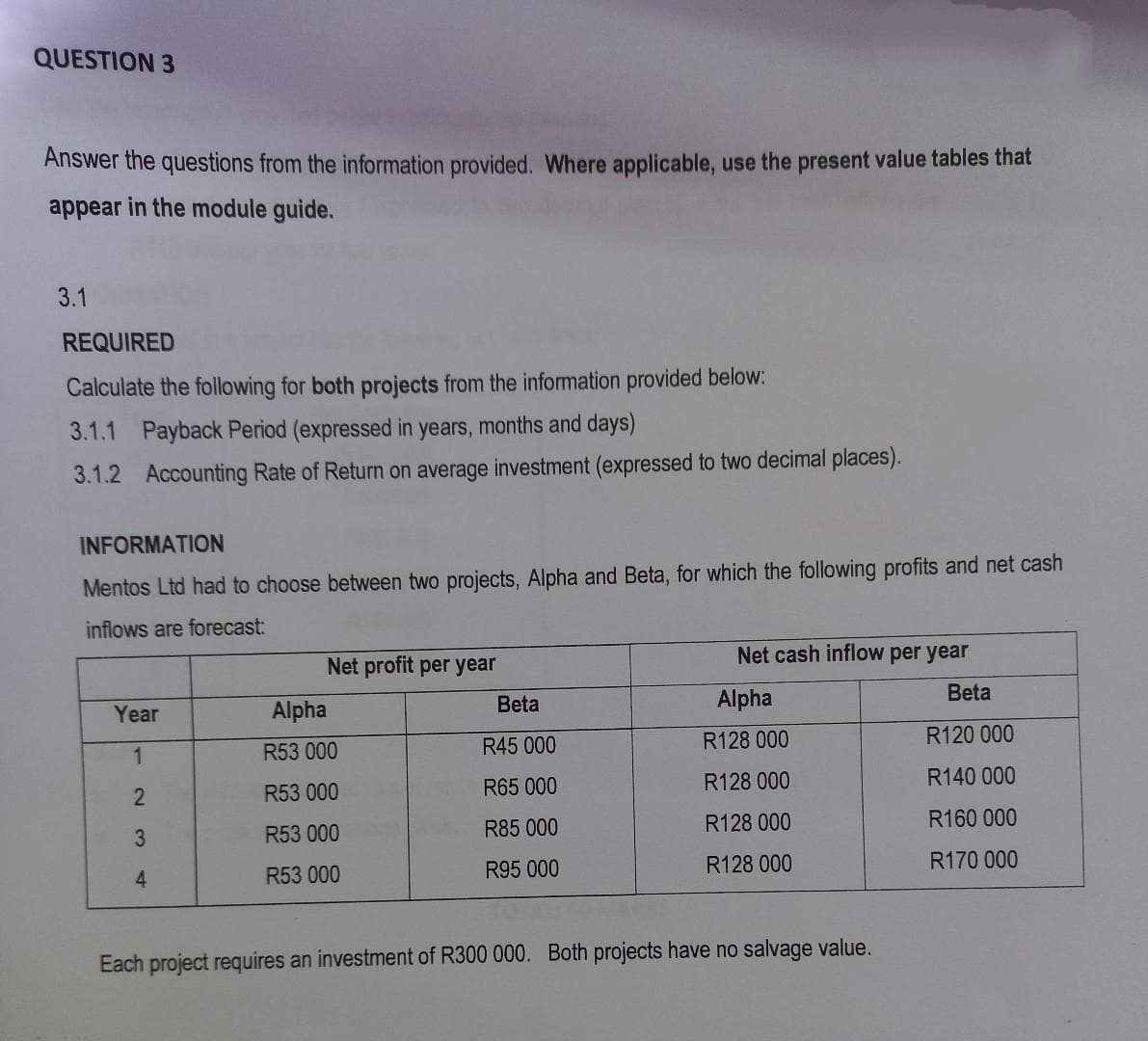

3.1 REQUIRED Calculate the following for both projects from the information provided below: 3.1.1 Payback Period (expressed in years, months and days) 3.1.2 Accounting Rate of Return on average investment (expressed to two decimal places).

Q: Your Aunt Betty has a $120,000 investment portfolio comprising some Government of Canada three-month…

A: Answer 1 long position in the 42-call (i.e., the Suncor call option with strike price of $42)-short…

Q: Consider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –5,300 1,300 1,300…

A: We calculate payback period by dividing the cost of the investment by annual cash flow until the…

Q: Company Q’s current return on equity (ROE) is 12%. It pays out 40 percent of earnings as cash…

A: Given: Particulars Amount Return on equity(ROE) 12% Pay out ratio 40% Book value 59 New…

Q: Question 3 B a) Determine the growth rate. a) Determine the required rate of return. b) Compute the…

A:

Q: Canuck Oil Corporation is a Canadian crude oil producer. Today is July 15. Canuck’s estimated oil…

A: 1. Canuck Oil is producer of oil. If the prices of oil keeps fluctuating then they won't be able to…

Q: what is the value of $100

A: The future value of money is determined by compounding the original amount with interest. It…

Q: The annual deposit amount should equal $ per year. (Round to the nearest dollar.)

A: Information Provided: Interest rate = 2% Withdrawable amount = $3000 Period of annual deposits = 5…

Q: An underlying has a current price of $31. The premia on 3 month European put and call options on…

A: First, we need to check if the there is an arbitrage opportunity using Put - Call Parity.If there is…

Q: If you wish to purchase 50 ANZ Ltd. shares that another individual is selling, this would take place…

A: Market refers to the place where the trading of financial securities and derivatives takes place…

Q: 1) Canuck Oil is also exposed to interest rate risk, as it has issued 2,000 fixed rate coupon bonds…

A: An interest rate swap is a forward contract in which one stream of future interest payments is…

Q: On the news, LinkedIn's market capitalization increased to nearly $26 billion, while Microsoft's…

A: The question requires us to look into the reasons for drop in market capitalization of Microsoft…

Q: roblem 1. Mala Inse Corporation is contemplating to buy P2,000,000 par value bonds at an effective…

A: Price of bond is the present value of coupon payment and present value of bond taken on the yield to…

Q: What does Working Capital Mean?

A: The excess of Current Assets over Current Liabilities is known as Working Capital current assets…

Q: Miguel purchased a hot tub costing $5,010 by taking out an installment loan. He made a down payment…

A: The APR is used for representing the interest rate paid on the outstanding loan balance. It takes…

Q: OPTIMAL CAPITAL STRUCTURE Terrell Trucking Company is in the process of setting its target capital…

A: Optimal capital structure is referred to as that perfect mix of debt and equity that maximizes a…

Q: 1. What is the future worth of a series of equal yearly deposits of Php 100,000 for 8 years in a…

A:

Q: [Det Question 18: The following data are obtained from the records of a factory: Sales 4,000 units @…

A: Please see below attached file

Q: Sue, aged 48 and Paul, aged 49 have two daughters- Leena aged 17 and Reena aged 15. Sue works as a…

A: Expected reurn on the portfolio is the weighted return which investors would receive. It is…

Q: Find the present worth of a future payment of P200,000 to be made in 15 years with an interest of…

A: Future worth of a present value With present worth (PW), effective annual rate (r) and time (n), the…

Q: Find the future value of this loan. $16,916 at 6.8% for 18 months The future value of the loan is $…

A: Principal amount is $16,916 interest rate is 6.8% Time period is 18 months To Find: Future Value of…

Q: Chooanne D' Sexy invested in a four-year project and expect a rate of return of 10%. Information…

A: NPV is calculated as below - NPV = present value of all future cash inflows - present value of all…

Q: s there any portfolio that can be constructed with stocks 1, 2, and risk-free security that will…

A: Portfolio and the purpose of constructing one! An amount intended for investment may be invested in…

Q: Mosaic is evaluating a manufacturing plant that has the potential to generate revenue of $2…

A: Given: Particulars Amount in Millions Stock price $2 Up price % 20.00% Lower price % 25.00%…

Q: Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate…

A: Clifford Clark is a recent retiree Who is interested in investing some Of his savings in corporate…

Q: The risk-free rate is 4% and the expected market return is 10%. A stock with a beta of 0.9 is…

A: The dividend discount model says that fair value or intrinsic value of a stock today is the present…

Q: What does Working Capital Mean?

A: Working capital is the difference between the current asset and current liability of the firm, which…

Q: What is the volatility of your return over this period?

A: Information Provided: Duration = 12 years Yield on bond = 10% Volatility of yield = 0.2%

Q: Dwight Donovan, the president of Stuart Enterprises, is considering two investment opportunities.…

A: Net Present Value: The worth of all future cash flows, both positive and negative, discounted to the…

Q: Could I get the entire answer please? Earnings before taxes, net income and taxes?

A: Information Provided: Sales = $14,800,000 Interest expense = $307,000 COGS (Cost of Goods Sold) =…

Q: Assume that the chance of loss is 3 percent for two different fleets of trucks. Explain how it is…

A: The relative variation of actual loss from expected loss is called objective risk. It is also known…

Q: A businessman wishes to borrow an amount of K4 million for a term of 3 years. The agreed rate of…

A: The loan schedule statement reflects the information related to the principal portion, the interest…

Q: The two main approaches to equity analysis are the relative valuation models and…

A: ANSWER: Option C ;The discounted cash-flow models.

Q: Who performs financial analysis to make operating, financing, and investment decisions of a company?…

A: The company is established to earn profit and achieve financial success. The entity needs to ensure…

Q: In an efficient market, a one-year call option on stock S with K = $25 is traded at $7.06, the…

A: Options: Options come in two varieties: calls and puts. Options of the American variety may be…

Q: What is the forecasting risk when falling decisions based on the nvp rule?

A: Net present value refers to the current value of n asset based on some future date. It shows the…

Q: What are Joint Costs?

A: The entity incurs different types of costs while carrying out its day-to-day operations. When a…

Q: Problem 4. Refer to problem no. 3. Using NPV and IRR method, give your recommendation if the company…

A: This answer is for only Problem no. 4 Here total cost of new equipment would be =417,860+40000…

Q: 1. If assets are 28,000 and owner's equity is 10,000 liabilities are

A: Formula: Oweners equity =all assets - outside liabilities Liabilities= Assets - equity

Q: The following represents the stockholder's equity account of Security Data Company: R Preferred…

A: A stock dividend will keep the total value of the shareholders' equity at the same level but there…

Q: Find the future value of this loan. $13,842 at 5.7% for 13 months

A: Principle value=13,842 Intreast rate =5.7%

Q: Several years ago, the Wall Street Journal reported that the winner of the Massachusetts State…

A: The PV analysis is conducted to find out the actual value of a stream of future payments. It helps…

Q: The profit P, in thousand of dollars, that a manufacturer makes is a function of the number N of…

A: The break-even point is the production level where the costs of production and the revenues from…

Q: Mala Prohibita Inc. is evaluating a proposal to acquire a new equipment. The equipment would equire…

A: Cost of capital(k) will be the yield to maturity(YTM) after tax. Yield to maturity(YTM) is the rate…

Q: If the market is efficient with respect to one information set i.e. either weak, semi-strong or…

A: Market efficiency refers to the reflection of the current prices of all the relevant information…

Q: . [Put-Call Parity Condition] At date t, there is a European call option on the dollar with a strike…

A: Put call parity With call price (c), put price (p), stock price (s), exercise price (k), risk free…

Q: What is the current value of a six-month call option with an exercise price of $20? The six-month…

A: Information Provided: Stock price = $25 Increase in stock price = $40 Decrease in stock price = $15…

Q: A share of Tension-free Economy Ltd. is currently quoted at, a price earning ratio of 2-5 times. The…

A: Steps involved 1)Calculate cost of equity(Part a) 2)market price when there is change(part b and C)…

Q: You invest in a project that will produce real cash flows of -$100 in year zero and then $35, $50,…

A: Net present value(NPV) of a project is calculated using following equation NPV = -CF0 + CF1/(1+d)1…

Q: LinkedIn suffered a large drop in share value following an unexpectedly weak forecast of their…

A: We have to explain why an unexpectedly weak forecast of their future earnings cause investors to…

Q: April, 2012 as follows: Particulars Material control Ale Work-in-progress A/c Finished Goods A/c…

A:

Step by step

Solved in 3 steps with 6 images

- Please help answer From Question 3.1 to 3.5 REQUIREDStudy the information provided below and calculate the following:3.1 Payback Period of Project A (answer expressed in years, months and days). 3.2 Accounting Rate of Return (on average investment) of Project B (answer expressed totwo decimal places).3.3 Net Present Value of both projets (amounts rounded off to the nearest Rand). 3.4 Benefit Cost Ratio of Project A (answer expressed to three decimal places). 3.5 Internal Rate of Return of Project B (answer expressed to two decimal places). INFORMATIONThe following information relates to two possible capital expenditure projects being considered by EdamLtd. Because of capital rationing, only one project can be accepted.Project A Project BInitial cost R800 000 R800 000Expected useful life 5 years 5 yearsAverage annual profit R80 000 R80 000Expected net cash inflows: R RYear 1 240 000 240 000Year 2 260 000 240 000Year 3 280 000 240 000Year 4 220 000 240 000Year 5 200 000 240 000The…Use the information provided to answer the questions.5.1 Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 that appear after QUESTION 5.5.1.1 Calculate the Payback Period of Project A (expressed in years, months and days). 5.1.2Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places). 5.1.3 Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). 5.1.4 Use your answers from question 5.1.3 to recommend the project that should be chosen. Motivateyour choice.Using the below informtion answer: 5.1 Payback Period of Project Tan (expressed in years, months and days). 5.2 Net Present Value of Project Tan.5.3 Accounting Rate of Return on average investment of Project Tan (expressed to two decimal places). INFORMATIONThe management of Mastiff Enterprises has a choice between two projects viz. Project Cos and Project Tan, each ofwhich requires an initial investment of R2 500 000. The following information is presented to you: PROJECT COS PROJECT TANNet Profit Net ProfitYear R1 130 000 80 0002 130 000 180 0003 130 000 120 0004 130 000 220 0005 130 000 50 000A scrap value of R100 000 is expected for Project Tan only. The required rate of return is 15%. Depreciation is calculatedusing the straight-line method.

- Use the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 1. Calculate the Payback Period of Project A (expressed in years, months and days).2. Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).Calculate the Payback Period of Project A (expressed in years, months and days) Calculate the Accounting Rate of Return on average investment of Project A (expressedto two decimal places). Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). Which project should be chosen? Why? Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Youranswer must include two net present value calculations (using consecutiverates/percentages) and interpolation.QUESTION 2 REQUIREDStudy the information given below which was made available by Levis Limited and calculatethe following:2.1 Accounting Rate of Return on average investment of Project A (answerexpressed to two decimal places). 2.2 Net Present Value of Project A (amounts rounded off to the nearest Rand.) 2.3 Internal Rate of Return of Project B (answer expressed to two decimalplaces). INFORMATIONThe following information relates to two capital investment projects, under consideration byLevis Limited for 2021:Project A Project BInitial cost R800 000 R800 000Expected useful life 5 years 5 yearsScrap/Residual value (not included in the figures below) R80 000 0Expected annual profits: R REnd of: Year 1Year 2Year 3Year 4Year 5140 000130 000120 000110 000100 000105 000105 000105 000105 000105 000The company estimates that its cost of capital is 15%. The straight-line method ofdepreciation is used.

- Current Attempt in Progress Find the future value of an investment of $2,800 made today for the following rates and periods: (Do not round intermediate calculations. Round final answer to 2 decimal places, e.g. 2,515.25.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) a. 6.25 percent compounded semiannually for 12 years. Future value $ b. 7.63 percent compounded quarterly for 6 years. Future value $ c. 9.0 percent compounded monthly for 10 years. Future value $ d. 10.95 percent compounded daily for 3 years. Future value $ lli2.1 Calculate the Payback Period of both projects (answers expressed in years, months and days.) Which project would you choose on the basis of payback period? Why?2.2 Calculate the Accounting Rate of Return for both projects (answer expressed to two decimal places).2.3 Calculate the Net Present Value for both projects. (Round off amounts to the nearest Rand.)2.4 Based on your calculations from 2.1 – 2.3, which project should Rothmans Limited choose? Why? .Please solve both (a) and (b) in an Excel Spreadsheet and provide formulas you used. a) Use rate of return (ROR) analysis to determine which of the mutually exclusive projects listed below to select given a MARR of 12% per year. b) Confirm your answer to part (a) using Present Worth analysis.

- Question 3 Given 10% discount rate, what is the profitability index of the investment project described below? 1.00 0.90 0.95 1.03 1.09 Question 4 What is the best method to use when expressing investment profitability as a percentage? Pick from the answers given below. Payback period Discounted payback period NPV AAR IRRQuestion In Management Accounting, there are some investment appraisal methods to analyse the performance of investment projects. The following table lists out the financial data of two projects for London Technology Ltd: Projects/Methods A B Payback Period 2 year and 4 months 2 year and 9 months Accounting Rate of Return 27.6% 15.44% Net Present Value £23,040 £21,798 Required: Which project should company accept? In the discussion, please explain which method can leads to better decision.1. Determine the Net present value of the investment. (use 3 decimal places for the PV factor) 2. Determine the Proposal's internal rate of return 3. Determine the Payback period (3 decimal places)